10 trends in the trades

Compiled by Emily Barske Wood

A little over a year ago, the completion of six industrial projects in the Greater Des Moines area added over 2 million square feet of warehouse and flex space to the market, increasing vacancy rates in the sector, reports from CBRE Inc. and JLL showed. Where does that space stand now? How is the cost of materials and labor affecting the market? What other challenges is the commercial real estate industry facing?

We asked several local leaders: What’s one trend in your trade that could affect the commercial real estate market?

Here’s what they said.

Focus on talent in the industrial market

Jon Sargent, president and CEO, Todd & Sargent Inc.

While questions swirl regarding how much steam the economy has left — driven in significant part by the highest interest rates we’ve seen in more than 20 years — construction demand in the food, ag and industrial processing space remains strong, with clients looking to put capital to use toward facility expansion. As Iowa companies look to create more value out of existing commodities, infrastructure needs to continue to grow. At the end of the day, every business is driven by the success of its people, so our biggest focus right now is ensuring we have a talented team in place to serve these growing markets. To that end, we’re making a major push to develop both the technical skills and leadership ability of our people — both office and field — to help them achieve their career goals while supporting an expanding industrial market.

Cost of raw materials

Derrick Walker, co-chair of welding, DMACC Ankeny campus

One of the trends that could affect the real estate market would be the cost of raw materials. The real estate market is always trying to be competitive in building good quality homes at affordable prices for clients. When prices of raw materials increase it affects the prices of housing and makes the market prices rise to cover costs for materials to build homes. During COVID-19, in the welding industry, the cost of raw materials tripled from normal market prices. This affected our welding program because the institution did not want to raise the cost of tuition to accommodate rising prices of raw materials. This is the most common issue in my trade that affects the bottom line. When prices go up, sales go down due to prices rising for materials to build new products.

Demand for second-generation space

Chris Pendroy, senior vice president, CBRE

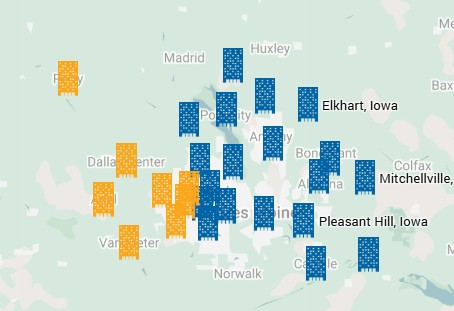

Des Moines is experiencing a healthy oversupply of newly constructed warehouse product after developers rushed to deliver new inventory following several years of increasing demand, low vacancy and flight to quality post-COVID. Occupiers (tenants and buyers) finally have some breathing room and options when considering their space requirements. New construction deliveries have outpaced absorption, and developers have been quick to commence construction of new, large speculative warehouses.

Removing new construction from consideration and focusing on second-generation inventory (space that has been previously occupied), the market remains near full occupancy. Demand for this second-generation space is strong because historically less expensive rent makes it desirable to occupiers who are willing to consider aging, sometimes functional obsolete buildings with often inadequate loading and lower clear heights. Occupiers who go to the market in search of space for their growing business are often faced with “sticker shock” compared to leases that were negotiated five to 10 years ago. Today’s occupier will almost definitively experience higher rents, whether they renew or relocate. The good news is there exists a healthy inventory of new construction options to consider, and there will be opportunities for prospective tenants to benefit from landlords more willing to offer concessions on lease terms as there will be mounting pressure to fill unoccupied warehouses.

Data center builds

Naomi Lawson, journeyman inside wireman and chair of the women’s committee, International Brotherhood of Electrical Workers Local Union 347

A big trend in the commercial real estate market is data center construction. I am currently working at a data center project. They have multiple sites throughout the metro and are consistently purchasing land for more sites. The union contractor I work for currently under IBEW Local Union 347 has the building automation and fire alarm systems contracts for five of these current projects. These corporations and contractors seek out diversity on these projects as much as possible. This affects me in that I am a minority, female and veteran-skilled tradeswoman who can find steady work at a good wage with good benefits currently and in the foreseeable future. It affects our market as union electricians as profits continue to come in and employment will remain steady.

Cost per square foot

Ben Hammes, vice president of association affairs and member engagement, Master Builders of Iowa

As the cost per square footage continues to get more and more expensive, business owners are left facing crucial decisions about the future of their workspaces. We believe the trend will continue where business owners place an increased emphasis on environments that promote employee well-being, enhance the daily work experience and support flexible work arrangements.

The food and beverage subsector

Brad Schoenfelder, Midwest region president, Ryan Cos.

One word – stabilization. It’s providing more predictability and momentum for our developments and construction projects. Construction costs, lead times and interest rates appear to have peaked or are decreasing, and we are optimistic they will improve after a few challenging years. On a national basis, everyone’s seeing a significant amount of land development for, and construction of, data centers. What’s not as obvious is the upward trend in the food and beverage subsector within industrial. They are investing significant capital for the shift from large format food service production to individual serving sizes or physically providing food prep closer to the consumer. There’s also a large appetite for adding automation to enhance consistency and production. This demand is creating opportunities for both speculative facilities and build-to-suit projects.

Meeting demand via industrial parks

Jenna Kimberley, CEO, Kimberley Development Corp.

With roughly 20% growth in industrial property valuations recently, rising land cost in Central Iowa continues to be a major trend affecting development of commercial real estate. Not only land, but also labor and materials, coupled with stricter regulations, pose challenges for developers. To meet demand and maintain feasibility, we are increasingly looking to industrial parks on the outskirts of the metro. These areas offer lower land costs, more availability and potentially less stringent regulations, making both development and rental rates viable. Tenants from hobbyists looking for flex space to e-commerce micro-fulfillment centers locating closer to the customers they serve all drive this demand.

Technological efficiencies

Mike Tousley, executive vice president, the Weitz Co.

Utilization of technology in the field by our craftworkers is having a positive impact on productivity. We are utilizing construction management software on mobile devices to access construction documents and change documents on the fly in the field. We are also seeing positive results in documenting quality-control inspections/observations, as well as safety observations, eliminating the need to manually write up these observations. Photo documentation to support our quality-control and safety programs can be easily uploaded to this software in the field and tagged to certain scopes of work and/or subcontractors. This technology is making our craftworkers much more productive having all of this information accessible to them in the field.

Labor, material cost factors

Sid Juwarker, vice president and general manager – Central Iowa Division, Graham Construction Co.

The construction industries’ labor crunch shows no signs of stopping in 2024. Even with the slowdown of construction spending as markets soften, the construction industry is showing some of the lowest unemployment rates on record. The industry will still need to add a larger than usual number of workers to meet demand. Factors contributing to this are more experienced workers retiring out of the profession, fewer younger workers entering the skilled construction trades, and mega projects in private and public segments. Based on this, labor costs may increase as wages increase to stay competitive and construction companies focus on retention in a competitive market. The good news is material prices seem to have stabilized and brought more predictability and certainty to clients’ projects and pricing. In fact, steel pricing has dropped significantly since the highs we experienced just a couple years ago. The recent signaling of the [Federal Reserve] to reduce interest rates in 2024 will have a positive impact on projects and real estate development. We are encouraging clients that are “thinking” about doing something to move quickly and lock in on volatile commodities like steel.

Absorption of existing inventory

Matt Weller, vice president of development, Hubbell Realty Co.

We are keeping a very close eye on inventory and rates, specifically in the industrial and multifamily sectors. When talking speculative industrial development, there are two to three years of inventory currently sitting vacant or under construction. This is going to keep lease rates flat when, ideally, we’d like to see them increase to support the higher cost of construction that everyone is experiencing. We need to see some healthy absorption of this existing inventory in 2024. With the current elevated interest rates, the carry cost on a newly constructed vacant building quickly becomes burdensome. In regard to multifamily, certain submarkets have a surge in supply, so we will be watching absorption and rental rates in those markets. But overall, new construction inventory appears to be at a healthy level, and rates continue to grow moderately.

Emily Barske Wood

Emily Wood is special projects editor at Business Record. She covers nonprofits and philanthropy, HR and leadership, and diversity, equity and inclusion.