1,400 apartments proposed in downtown Des Moines

Nearly 1,400 apartment units are expected to be added in downtown Des Moines by mid-2026, increasing the number of people who live in the central business district and the need for both service and recreational amenities.

Currently five projects with a total of 452 units are under construction in the downtown area. Six other projects are proposed to begin either yet this year or in 2025, adding 944 more units to the area. And, if a proposed 33-story project at 515 Walnut St. moves forward, another 390 units could be added.

“We saw a pretty big slowdown in construction starts during and post-pandemic that has delayed delivery of new units,” said Carrie Kruse, an economic development coordinator for the city of Des Moines. “Because we are not delivering new units at the same pace that we were before the pandemic, demand is continuing to grow. …

“Supply and demand [for apartment] units haven’t quite balanced out yet coming out of the pandemic. Demand remains high and supply and vacancies remain low.”

In 2023, two projects with a total of 246 units were completed: Hubbell Realty Co.’s five-story Level multifamily project at 220 Maple St., and Sherman Associates’ four-story Slate at Gray’s Landing at 400 S.W. 11th St. Slate is aimed at active, older adults.

In 2022, downtown recorded no new deliveries of apartment units, the first time that had occurred since 2012, according to a CBRE Inc. report. Eighty-seven new units were added to downtown in 2021 and 650 were added in 2020.

In 2023, about 5.2% of downtown’s more than 4,800 apartment units were vacant, according to CBRE Inc.’s multifamily market report. The vacancy rate in the downtown core was 6.2%; in East Village, the vacancy rate was 5%.

(The downtown area is roughly bordered by Interstate Highway 235 on the north; East 12th Street on the east; the Raccoon River on the south; and 19th Street on the west.)

Demand for downtown residential units remains high, said Derek Haugen, vice president of Indigo Living, an apartment management company that is a division of Hubbell Realty. Level, which opened in October 2023, is 85% occupied. This summer, after the spring college graduates begin to lease units, the new development’s occupancy is expected to be well over 90%, he said.

“We are in a healthy position right now and we’re in a position where the market can add and absorb more units,” Haugen said.

People are attracted to downtown living because of the wide array of year-round activities that occur, Haugen said, citing the Farmers Market, Winefest, plays and concerts at the Des Moines Civic Center, and events at Wells Fargo Arena.

Prior to the pandemic, many people wanted to live near where they worked, Haugen said. “I think that is secondary to lifestyle now. … Commuting has become less of a factor. Now people want to live near where things are going on.”

The absorption of new units downtown has impressed Andrew Juiris, president of Chicago-based Double Eagle Development.

“That was a really good proving point on whether the city could handle a lot of supply at once,” said Juiris, whose company has proposed a 202-unit, seven-level apartment project valued at $62 million at 1435 Mulberry St.

Double Eagle Development’s parent company – St. Louis, Mo.-based Balke Brown Transwestern – acquired Flux Apartments and Onyx Office Suites at 1400 Walnut St. in January 2022. The seven-level, 202-unit apartment project called Falcon is just south of Flux Apartments.

Des Moines’ central business district is poised for additional growth, Juiris said.

“We love the economic drivers of Des Moines,” Juiris said. “When we look at Midwest markets, we are going to focus on the ones with the best growth history and projections. Des Moines falls into that category.”

Between 2010 and 2020, the number of people living downtown grew over 80% to 8,371 from 4,497, U.S. Census data shows. In the preceding decade, just 397 people were added to downtown’s population.

Kruse, of the city, estimates downtown’s current population at around 12,000 people.

“More rooftops help to attract more amenities,” Kruse said. “Retaining [the Hy-Vee] grocery store and making sure residents have access to a pharmacy downtown helps attract households. So do quality-of-life amenities like the water trails project.”

Growth in multifamily units downtown is occurring not only from new developments but also from redevelopment of office and other existing spaces. Since 2010, more than 1,300 residential units have been added downtown through the redevelopment of at least 19 properties to become multifamily, a review of data supplied by CBRE Inc. shows.

Two others redevelopment projects are planned:

- 200 apartments are planned at the 14-story Two Ruan Center, 601 Locust St., which will be converted from office to multifamily. Block Real Estate Services and Foutch Brothers, both located in the Kansas City, Mo.-area, have formed a joint venture with Ruan Inc. to redevelop the mostly vacant Two Ruan Center.

- Up to 198 apartments are planned on the lower 15 floors of the Financial Center, 606 Walnut St. This spring, Lawmark Capital, which owns the Financial Center property, revealed plans for the multifamily project.

Mark Buleziuk, CEO and managing partner of Lawmark Capital, said watching other downtown projects be successful in converting commercial and office space to multifamily helped spur his company’s plans.

“I initially had some concerns that apartments weren’t the best fit for the Financial Center, but [transforming office space to multifamily] is becoming more and more common,” Buleziuk said. Other projects “have gone through some uncharted territory to pave the way for residential downtown.”

Most downtown class A office buildings that could be converted to multifamily have been Kruse said. “A lot of the obvious buildings have been converted, or will be like the Financial Center and Ruan Two.”

Others, like the office buildings Wells Fargo has for sale downtown, are more difficult to convert, Kruse said. “In my mind, those are not obvious housing conversions.”

Still, property is available downtown for new construction, Kruse said. Some land along Martin Luther King Jr. Parkway that had been used for surface parking is available for redevelopment, she said. Interest in developing multifamily projects in the Market District, just east of the Des Moines River and north of MLK, is also growing, she said.

The city is getting inquiries from out-of-state developers interested in mixed-use projects that include residential and commercial components, Kruse said.

“There continues to be demand for downtown living,” said Cody Christensen, Des Moines’ development services director. “We think that will continue as we see more amenities like the MidAmerican Energy [Co.’s] Riverfront Park and the water trails get completed.

“As we see areas like the Market District develop, we’ll see more and more amenities come online that will be more attractive to a more diverse downtown population.”

What’s new with the tower project?

A 33-story, mixed-use office tower that would include 390 apartment units continues to move forward, albeit slowly, Joe Teeling, the project’s developer, told the Business Record. “It’s going to happen. … We’ve got a lot of time and money put in this and we’re not going anywhere.” The project, which in early 2023 was estimated to cost about $140 million, is planned on the former site of Kaleidoscope at the Hub, a once lively center with an indoor mall, food court and office spaces. The three-story structure at 515 Walnut St. has been demolished. The project will move forward when interest rates drop to a level that makes financing feasible, Teeling said.

– Kathy A. Bolten

Central business district apartment projects

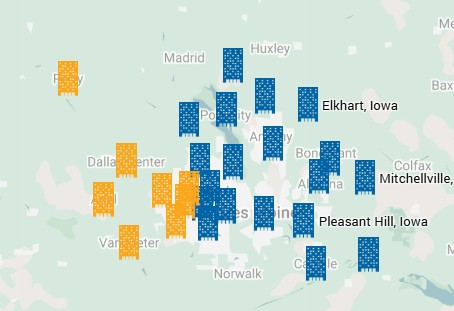

Twelve apartment projects are either proposed or under construction in Des Moines’ central business district, which includes the East Village. If all of the projects are completed, nearly 2,000 units would be added to the area over the next two to three years. The map shows where the projects are proposed and description boxes below include information about the projects.

ADDRESS: 1619 High St.

ESTIMATED PROJECT VALUE: $11,170,000

PROJECT DESCRIPTION: Four-level structure that includes 31 partially underground parking stalls.

NUMBER OF UNITS: 44

PROJECT STATUS: Proposed; has received final design approval from Urban Design Review Board

EXPECTED COMPLETION: Late 2025

BUILDER/DEVELOPER: Wade Investments, Coralville

ARCHITECT/DESIGNER: Streamline Architects & Artisans, East Moline, Ill.

PROJECT NAME: High Street Lofts I

ADDRESS: 610 16th St.

ESTIMATED PROJECT VALUE: $10,500,000

PROJECT DESCRIPTION: Four-level structure that includes partially underground parking stalls.

NUMBER OF UNITS: 47

PROJECT STATUS: Under construction

EXPECTED COMPLETION: Mid-2024

BUILDER/DEVELOPER: Wade Investments, Coralville

ARCHITECT/DESIGNER: Streamline Architects & Artisans, East Moline, Ill.

PROJECT NAME: The Falcon

ADDRESS: 1435 Mulberry St.

ESTIMATED PROJECT VALUE: $62,000,000

PROJECT DESCRIPTION: Seven-story structure proposed on a 1.3-acre site previously occupied by Des Moines Area Religious Council’s food pantry.

NUMBER OF UNITS: 202

PROJECT STATUS: Under review by city staff

EXPECTED COMPLETION: Spring 2026

BUILDER/DEVELOPER: Double Eagle Development, Chicago

ARCHITECT/DESIGNER: Ask Studio, Des Moines

PROJECT NAME: The Deco

ADDRESS: 1301 Mulberry St.

ESTIMATED PROJECT VALUE: $17,250,000

PROJECT DESCRIPTION: Five-story, mixed-use structure with underground parking and nearly 10,000 square feet of commercial space.

NUMBER OF UNITS: 82

PROJECT STATUS: Building permit issued in January

EXPECTED COMPLETION: Mid-2025

BUILDER/DEVELOPER: Green Acre Development, Sioux Falls, S.D.

ARCHITECT/DESIGNER: Schemmer, Omaha, Neb. headquarters

PROJECT NAME: Financial Center

ADDRESS: 606 Walnut St.

ESTIMATED PROJECT VALUE: Not known

PROJECT DESCRIPTION: Conversion of floors one through 15 to multifamily.

NUMBER OF UNITS: 198

PROJECT STATUS: Proposed. Property owner has applied for historic tax credits for the project

EXPECTED COMPLETION: Mid-2026

BUILDER/DEVELOPER: Landmark Capital

ARCHITECT/DESIGNER: Slingshot Architecture

PROJECT NAME: Two Ruan Center

ADDRESS: 601 Locust St.

ESTIMATED PROJECT VALUE: Not known

PROJECT DESCRIPTION: Conversion of 14-story office building into market-rate apartments.

NUMBER OF UNITS: 200

PROJECT STATUS: Proposed

EXPECTED COMPLETION: Not known

BUILDER/DEVELOPER: Block Real Estate Services, Kansas City, Mo., and Ruan Center Corp., Des Moines

ARCHITECT/DESIGNER: Foutch Brothers, Parkville, Mo.

PROJECT NAME: Not decided

ADDRESS: 515 Walnut St.

ESTIMATED PROJECT VALUE: $140,000,000

PROJECT DESCRIPTION: 33-story residential tower that would include a mix of market-rate and affordably priced units. The project would be built on the former Kaleidoscope at the Hub site.

NUMBER OF UNITS: 390

PROJECT STATUS: Proposed

EXPECTED COMPLETION: Not known

BUILDER/DEVELOPER: St. Joseph Group, Des Moines

ARCHITECT/DESIGNER: Neumann Monson Architects

PROJECT NAME: Meridian at Gray’s Landing

ADDRESS: 425 S.W. 11th St.

ESTIMATED PROJECT VALUE: $39,100,000

PROJECT DESCRIPTION: Five-story structure that will include a swimming pool and dog park, as well as 82 underground parking spaces and 78 surface parking spaces.

NUMBER OF UNITS: 169

PROJECT STATUS: Under construction

EXPECTED COMPLETION: 2024

BUILDER/DEVELOPER: Sherman Associates

ARCHITECT/DESIGNER: Simonson & Associates LLC

PROJECT NAME: Union at River’s Edge

ADDRESS: 214 Jackson Ave.

ESTIMATED PROJECT VALUE: $56,100,000

PROJECT DESCRIPTION: Two buildings: six-story building with 192 apartment units and three-story building with 24 apartment units.

NUMBER OF UNITS: 216

PROJECT STATUS: Building permits issued

EXPECTED COMPLETION: Late 2025

BUILDER/DEVELOPER: The Annex Group, Indianapolis

ARCHITECT/DESIGNER: Ask Studio, Des Moines

PROJECT NAME: Not decided

ADDRESS: 418 E. Grand Ave.

ESTIMATED PROJECT VALUE: $18,382,000

PROJECT DESCRIPTION: Five-story, mixed-use building with street-level retail.

NUMBER OF UNITS: 132

PROJECT STATUS: Building permit has been issued

EXPECTED COMPLETION: Not known

BUILDER/DEVELOPER: Nelson Construction & Development, Des Moines

ARCHITECT/DESIGNER: BNIM, Des Moines

PROJECT NAME: The Aston

ADDRESS: 603 E. Sixth St.

ESTIMATED PROJECT VALUE: $44,000,000

PROJECT DESCRIPTION: Seven- and eight-story C-shaped apartment building proposed where the American College of Hairstyling had been located.

NUMBER OF UNITS: 186

PROJECT STATUS: Proposed; has received final design approval from Urban Design Review Board

EXPECTED COMPLETION: Late 2025

BUILDER/DEVELOPER: Heart of America Group

ARCHITECT/DESIGNER: Heart of America Group

PROJECT NAME: The Tempo

ADDRESS: 317 E. Sixth St.

ESTIMATED PROJECT VALUE: $22,000,000

PROJECT DESCRIPTION: Seven-story building with street-level retail.

NUMBER OF UNITS: 110

PROJECT STATUS: Under construction

EXPECTED COMPLETION: 2024

BUILDER/DEVELOPER: Heart of America Group

ARCHITECT/DESIGNER: Heart of America Group

Kathy A. Bolten

Kathy A. Bolten is a senior staff writer at Business Record. She covers real estate and development, workforce development, education, banking and finance, and housing.