2021 Leaders’ Survey responses on affordable housing

BUSINESS RECORD STAFF Dec 28, 2021 | 11:53 pm

3 min read time

664 wordsAll Latest News, Economic Development, Housing, Real Estate and Development

The Business Record began releasing results from the 2021 Leaders’ Survey in its Nov. 26 print edition. The annual survey asks business leaders to share what they feel are some of the top issues affecting businesses in Central Iowa, and in particular, the Greater Des Moines region.

The following is a selection of responses from leaders who opted to leave comments on the questions related to affordable housing.

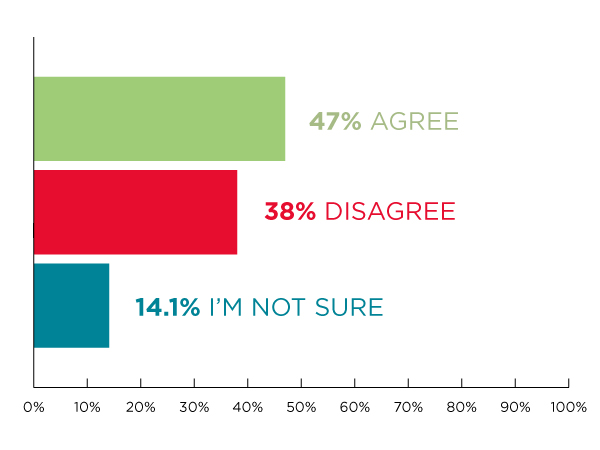

Agree or disagree: Developers should be required to have an affordable housing component to receive public tax incentives.

Comments from guest editor Jake Christensen, a local developer: The responses to this question were nearly split. This points to the complexity of the issue and may also reflect a lack of understanding of the challenges to creating affordable housing. The most successful neighborhoods include multiple types of housing and multiple income levels within the neighborhood.

The development of any housing unit comes with fixed costs associated with the development. The most cost-efficient way to add affordable units is to average them within market-rate projects. The fixed cost per unit is spread over all units, reducing the financial gap to create the affordable unit. When municipalities assist projects through tax incentives, the municipality should be able to require developers to meet design standards and neighborhood goals as part of the development agreement.

Agree:

“All income levels inherently pay property taxes. The entire housing supply market at multiple price points needs to be incentivized, but cities can’t do that across multiple projects from different owners, so it’s left to being only within a single project. Unless somehow incentive funds can be put into a common pool for a separate project.”

– Todd Kielkopf, president, Kielkopf Advisory Services

“Developers get my money (taxes), they should not increase the adverse effects of gentrification that may ultimately affect some other problems that are going to be asking for my money (taxes).”

– Bryan Myers, senior vice president, Neumann Brothers

“Currently there are not enough government and philanthropic resources to provide every Central Iowan with safe, stable and affordable housing. Adding the private sector as an additional funding source can help fill that funding gap.”

– Eric Burmeister, executive director, Polk County Housing Trust Fund

Disagree:

“This definitely feels like the wrong question. This type of approach is at least partially responsible for the housing crisis we are facing, so following the same path isn’t going to produce any different results. To affect the affordability and availability of housing, we have to think and act differently. We have to decrease the level of unnecessary regulation, end the weaponization of the zoning codes and stop treating those who work with their hands as second-class citizens.”

– Dan Knoup, executive officer, Home Builders Association of Greater Des Moines

“Every project should take into account thearea median income of the workforce and strive to provide housing that fits all demographics.”

– Wade Hiner, president, sales and marketing, Destiny Homes

“Public tax incentives should be available for affordable housing. If private and public funding would facilitate an economic return to the developer, then workforce housing will be built.”

– Mike Zuendel, founder/CEO, Legacy Bridge Private Family Offices

“Before an affordability component should be required, it is important to know what is really missing in our community. We need to define affordability. Most [low-income housing tax credit] projects are for 60% of median income and below. I believe that is too narrow a group. I believe the group that is missing out is the area above this, up to 150% of median income, but we really do not know. That would be the first step.”

– Rick Tollakson, CEO, Hubbell Realty Co.

“Developers have a singular responsibility to look after their own income/expense profile. They should not be receiving public tax incentives, therefore they should not be providing an affordable housing component.”

– Kenneth Stinson, principal, Northwestern Investments

Related: WATCH the most recent Project515 virtual discussion in which six local experts talk about affordable housing.