How Elections Affect the Market

Business Record Staff Mar 23, 2020 | 6:06 pm

4 min read time

898 wordsBusiness Insights Blog, FinanceBY KENT KRAMER, CFP®, AIF®, Chief Investment Officer, Foster Group

The morning of February 12, 2020, the day after the Democratic Party’s 2020 New Hampshire Presidential Primary, I typed, “What does the Presidential election mean for markets?” into my Google browser window. In 0.69 seconds, I had links to more than 141 million related articles and sources. I’d like to say, I read them all but at a reading rate of 10,000 sources per day, every day, I’d be writing this in time for the 2058 election cycle.

Obviously, there is a lot of interest and plenty of opinions about what the 2020 US Presidential election might mean for investment markets and investors!

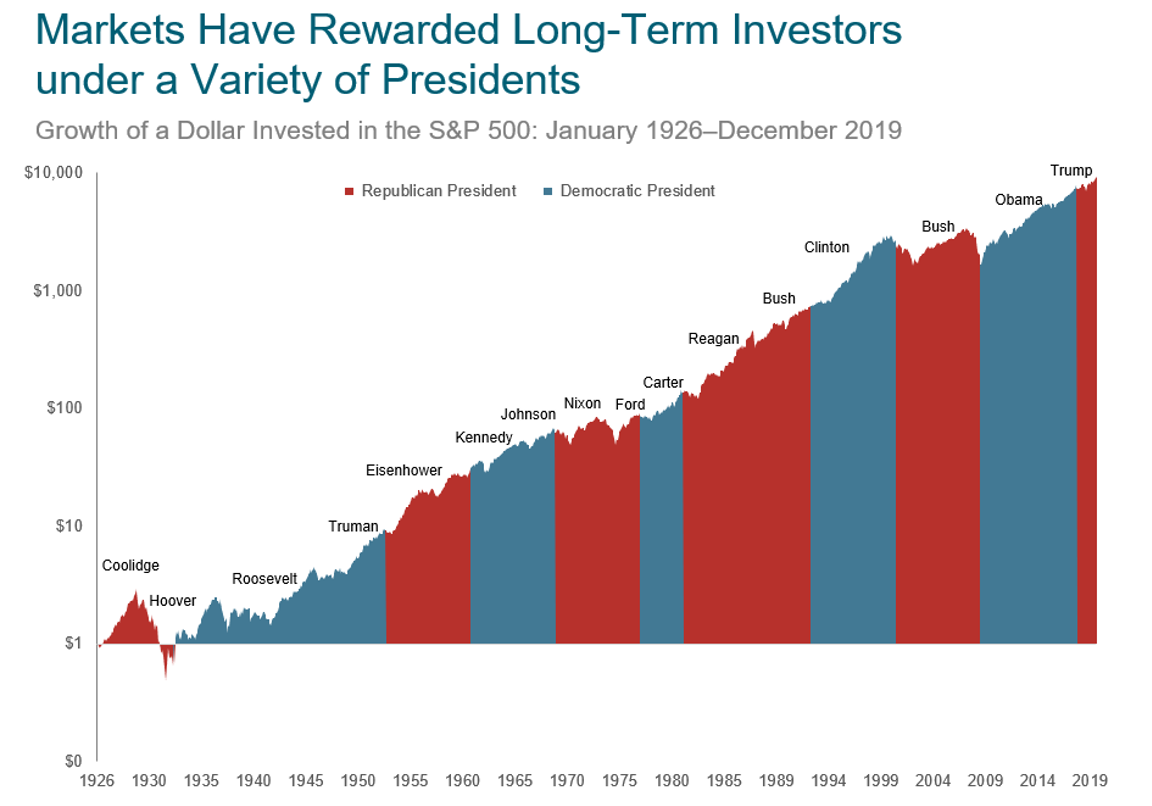

A bit of history helps bring some perspective to trying to read too much into the influence of elections on stock markets. In 83% of election years since 1928, the S&P 500 stock market index has risen. The average gain has been around 11.3% regardless of which party held control leading up to the election. This is in line with US stock market performance in any year since the S&P 500 has risen in 72% of all years beginning in 1928, with an average return of 11.82%.

Of course, at this stage in the electoral process, many investors are asking which candidate would be better for investors, or more generally which political party.

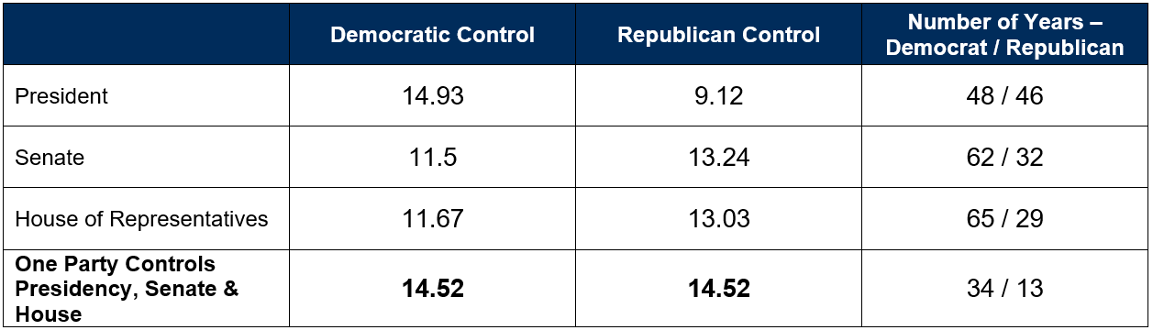

Historically the results are fun to look at but hardly conclusive. Here’s a sampling of different ways to parse calendar year average annual US stock market data from 1926 through 2018:

Depending on which political party you favor, you will likely find something in these numbers to like and or dislike. Democratic Presidents have experienced better average market returns than Republican Presidents. However, the average performance when Republicans controlled either Senate or House chambers in Congress was better than under Democratic Party control.

For this time period though, the most surprising result may be the identical market performance when either party controlled all three sources of power!

Statisticians look at data sets like these and use terms like “correlation without causation,” or “coincidental” because the data set is relatively small (Only 16 Presidents since 1926) and because so many other market influencing variables are excluded from the analysis. The Great Depression, Wars, Oil embargoes, the dot.com market bubble, 9/11 Terrorist attacks, The Great Financial Crisis of 2007-2009 are just a few major economic and geo-political events that Presidents and Congress have had to address without regard to which party inherited or experienced the crisis while in office.

So, what does an election year mean for investors?

If 2020 is like other recent election years, investors should prepare for increased market volatility as the November election approaches. A recent Wall Street Journal article noted that,

“…markets tend to grow rockier around the presidential elections. Since its inception, the VIX (a measure of stock market volatility) has risen in the month leading up to an election, according to Credit Suisse Group AG. The gauge records an average increase of 3½ points, according to the firm.”2

Investors should expect that changes in market direction may become more pronounced and frequent as candidates announce legislative agendas and as media sources report on daily polls showing shifts in voter sentiment. This is not new, but campaign advertising, media commentators, and news organizations will make everything seem highly dramatic to get votes and attention.

One of the most important lessons of stock market history is that diversified long-term investors have been rewarded with very positive returns when they remained invested regardless of which party held sway in Washington, DC. Investors are well served by having a portfolio strategy that combines relatively lower risk, liquid assets to cover near term spending and liabilities, with more aggressive investments associated with higher long-term expected returns.

Elections and the political process are important and influential in various areas of public policy. As a former elected office holder, I encourage citizens to become informed, participate, and vote for candidates who share your perspectives and values. At the same time, be very cautious about allowing political sentiment to have undue influence over the structure of your investment portfolio. Our portfolios should be positioned to provide the expected returns we need while managing risk for the rest of our lives and not just the next four years.

1. S&P 500 calendar year returns supplied by Dimensional Fund Advisors

2. https://www.wsj.com/articles/options-markets-brace-for-election-volatility; January 22, 2020

Market returns do not represent the performance of the Foster Group or any of its advisory clients. All investment strategies have the potential for profit or loss. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses.

PLEASE NOTE LIMITATIONS: Please see Important Disclosure Information and the limitations of any ranking/recognitions, at www.fostergrp.com/info-disclosure. A copy of our current written disclosure statement as set forth on Part 2A of Form ADV is available at www.adviserinfo.sec.gov. ©2020 Foster Group, Inc. All Rights Reserved.

|

Kent Kramer View Bio |