Eastern Iowa industrial portfolio sells for $54 million

BUSINESS RECORD STAFF Jun 29, 2021 | 11:18 pm

2 min read time

399 wordsAll Latest News, Real Estate and DevelopmentThe recent $54 million sale of a 1.4 million-square-foot industrial portfolio in eastern Iowa is among the largest sales in the sector in the state in both size and value, according to a recent release by JLL, a professional services firm that specializes in real estate and investment management.

JLL, headquartered in Chicago, has an office in Des Moines.

JLL marketed the Eastern Iowa Class B industrial portfolio on behalf of the seller, 2570 Independence LLC, an entity based in North Liberty, Iowa.

The five properties — three in Iowa City and two in Cedar Rapids — were sold to Hollingsworth Capital Partners-Iowa LLC, managed by the Hollingsworth Cos., based in Clinton, Tenn. The company has more than 19 million square feet in its industrial portfolio, according to its website. A large percentage of the company’s holdings are in the southeast part of the United States, including Alabama, Georgia, Mississippi, North Carolina, South Carolina, Tennessee and Virginia.

The three Iowa City buildings were sold for a total of $37.2 million, according to the Johnson County recorder. The buildings at 2561, 2570 and 2610 Independence Road in Iowa City have a total of 992,250 square feet and are located on nearly 49 acres.

The two Cedar Rapids buildings that were sold are located at 5404 and 5507 Ely Road, According to a JLL release, the buildings have a total of 410,000 square feet and are located on 21.2 acres. Those buildings were sold for $16.8 million, according to the release.

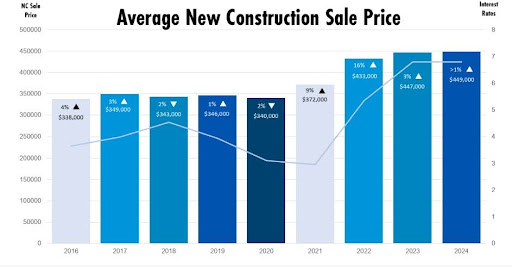

“Based on the locations, sizes and growing need for warehouse space throughout the region, we knew we had an opportunity to position this portfolio as a desirable option for a variety of users,” JLL Vice President Michael Minard said in a prepared statement. “With construction costs increasing and the market experiencing a gap between second-generation and new space, owners of high-quality Class B properties have an opportunity to capitalize on adjusted rent increases to keep up with new construction.”

JLL’s managing directors Marcus Pitts and Justin Lossner, and vice presidents Michael Minard and Austin Hedstrom took over leasing the five buildings in August and closed on the sale less than a year later.

The Des Moines JLL team was selected by the new ownership to continue the leasing agreement and JLL anticipates the portfolio will be fully occupied by the end of 2021. The properties are currently 80% leased.