Are You Advancing Your Portfolio with Science?

Business Record Staff Nov 29, 2018 | 6:00 am

3 min read time

828 wordsBusiness Insights Blog, FinanceBY KENT KRAMER, CFP®, AIF®, Chief Investment Officer, Foster Group

“Science is the pursuit and application of knowledge and understanding of the natural and social world following a systematic methodology based on evidence.”

Science Council, www.sciencecouncil.org

Consider the following two questions:

Question 1: If you had symptoms of a potentially serious health problem, would you:

- consult a physician, possibly more than one, undergo testing, and choose the doctor and treatment option that, through careful clinical trials, was shown to have the highest probability of good outcomes, or

- talk with a friend who had a health problem with symptoms like yours a decade ago and try whatever he or she did?

Question 2: If you are planning to retire and want to achieve other financial goals, would you:

- consult an investment professional, possibly more than one, go through a diagnostic of your current situation and goals, and choose the investment approach that academic research had shown to have a higher probability of successful outcomes, or

- talk with a friend who invests, seems to have been successful, and try whatever he or she did?

When it comes to our physical health (Question 1), most of us seek out the best clinical approach available. We understand that medical science is constantly advancing and that new treatment options are being developed that increase the probability of better patient outcomes. These advances are occurring in everything from cancer treatments and orthopedic surgical procedures to the delivery of premature babies.

However, when it comes to how we invest (Question 2), many people either don’t know or don’t choose to seek out investment approaches that are developed with a similar scientific and academic rigor when compared to the best health care options.

As you think about your current portfolio and investments, consider these important scientific advancements that could raise your probability of achieving a better outcome.

Broad Diversification: A Quantifiable Free Lunch

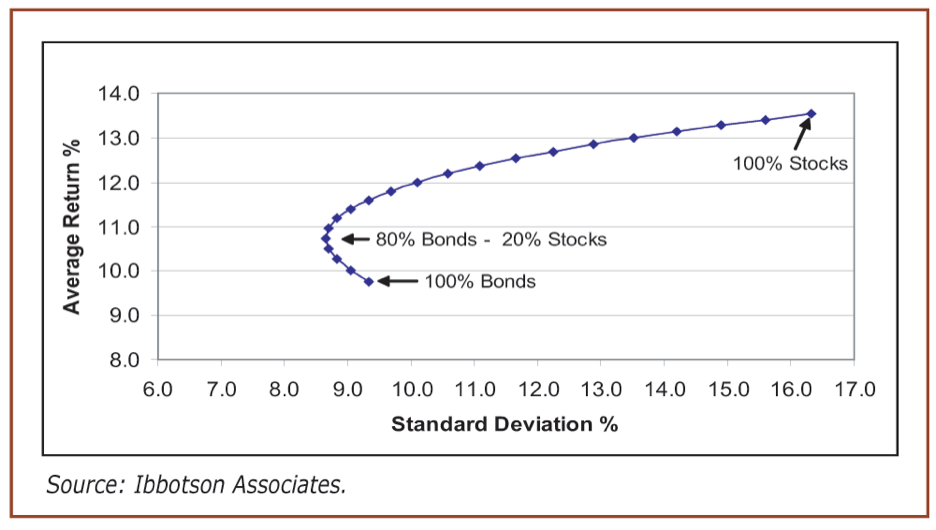

Up until the 1950s, investors thought the least risky portfolio to own was 100% U.S. government bonds and that the riskiest portfolio was 100% stocks. Generally accepted wisdom also said you only needed to own about 50 stocks to have a well-diversified portfolio. This was before Nobel laureate Professor Harry Markowitz explained the statistical science behind diversification, which revealed that the 100% bond portfolio was not always the least risky portfolio and that adding not only more stocks, but also more exposure to entirely new asset classes (e.g., foreign stocks, real estate), could yield higher returns with less risk. Markowitz’s Mean Variance Optimization equations revealed that a diversified portfolio with 10% to 30% or more in stocks, had a high probability of being lower in risk (in terms of price volatility) while providing superior returns.

Source: https://www.aaii.com/journal/article/the-benefits-of-modern-portfolio-theory.touch

Mixing in other asset classes improved the results even more. He referred to this finding of increased return with lower volatility as “free economic return,” basically a little bit of free lunch for investors. Now, 60 years later, this accepted science is used as a basic building block by successful investors around the world.

Factors: How Securities are Priced for Expected Return

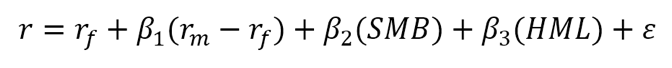

Nobel Prize winner William Sharpe’s work explained the relationship between the returns of risky assets like stocks to the returns an investor could achieve from holding a practically risk-free investment like U.S. Treasury bills. The higher expected return of stocks was explainable as the reward for bearing stock market risk. “Beta” became the name for this single market factor and revealed that much of a portfolio’s return was simply due to investing in stocks generally rather than skill in individual stock selection. Professors Gene Fama, another Nobel winner, and Ken French built on Sharpe’s work, creating the three-factor model:

Return of Portfolio = Risk Free Rate + Market Factor + Size Factor + “Value” Factor + other

This model explains that investors can increase their expected return by not only emphasizing stocks in their portfolio (market factor), but also by emphasizing small-cap companies (the size factor) and companies with high book-to-market ratios (the value or relative price factor). Academics following up on Fama and French’s work have uncovered other factors that can be used to enhance expected return or manage risk in both stock and bond portfolios.

Academically researched scientific approaches to diversification and factors are just two of many ways investors can advance with science today as they pursue their financial goals.

Whether you are answering Question 1 about your health or Question 2 about your investment portfolio, the answer with the higher probability of success is to advance with science.

PLEASE NOTE LIMITATIONS: Please see Important Disclosure Information and the limitations of any ranking/recognitions, at www.fostergrp.com/info-disclosure. The above discussion should be viewed in its entirety. The use of any portion thereof without reference to the remainder could result in a loss of context. Foster Group cannot be responsible for any resulting discrepancy. A copy of our current written disclosure statement as set forth on Part 2A of Form ADV is available at www.adviserinfo.sec.gov.

|

Kent Kramer View Bio |