Got capital gains? Zone them out.

Business Record Staff Sep 12, 2019 | 6:00 am

4 min read time

854 wordsBusiness Insights Blog, FinanceBY JOE KRISTAN, CPA, Partner, Eide Bailly

Everybody likes investment gains. Nobody likes to pay taxes on investment gains.

There’s one sure-fire way to avoid capital gain taxes: don’t cash out the gains. That’s a big reason why “buy and hold” is such a popular investment strategy. The U.S. tax system doesn’t tax most investments until they are sold. The longer you wait to sale, the longer the gains build up for you, rather than for the tax man.

Sometimes life doesn’t let you buy and hold. Sometimes you get an offer for your business that you can’t refuse—maybe a stock you have been holding has been acquired by another company—and you have no choice but to cash out. Taxpayers without loss investments to sell to offset the gain have looked in vain for on opportunity to delay the day of tax reckoning.

Now, they have such an opportunity: “Opportunity Zones,” a new tax creature created in the 2017 tax reforms. Taxpayers who make qualifying investments in Opportunity Zone property can kick their taxes on their capital gains as far down the road as 2026. If the Opportunity zone investment increases in value, some of that additional gain may be tax-free forever.

How Opportunity Zones Work

A taxpayer who incurs a capital gain and who invests an amount equal to that gain in a “Qualified Opportunity Fund” (QOF) within 180 days can elect to defer the tax on that gain. The gain will be deferred until the QOF investment is cashed out, or until December 2026, if earlier.

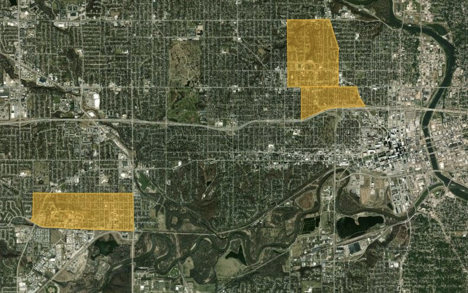

A QOF is an investment vehicle set up to fund businesses in “Opportunity Zones”—designated “economically distressed” census tracts. There are Opportunity Zones all over the United States, and many such zones in Iowa, including portions of Des Moines.

Source: Iowaeconomicdevelopment.com

While rolling gains into a QOF may look superficially like the “Section 1031” like-kind exchanges traditionally used for real estate, the QOF is much more flexible:

- Section 1031 is only available for real estate under current law. A QOF, by contrast, can invest in a wide variety of business assets.

- You only need to invest the net capital gain to defer it via a QOF. In a Section 1031 swap, you must reinvest the entire gross proceeds of the property to defer the whole gain.

- While Section 1031 deals often require escrows or intermediaries, QOF investments don’t need them.

QOF investments have two other features that like-kind exchanges can’t match:

- If you hold your investment at least five years, you permanently avoid tax on 10% of the original deferred gain; holding on for another two years avoids tax on an additional 5% of the original deferred gain.

- What’s more, if you hold a QOF investment for at least ten years, you don’t have to pay tax on any appreciation that occurs in the QOF investment (though you do have to pay tax on the remaining 85% of the original gain).

Some Numbers

Suppose a taxpayer has a $200,000 2019 capital gain. The taxpayer invests $200,000 in a Qualified Opportunity Fund in 2019 within 180 days of realizing the gain.

- If the taxpayer holds the property for five years, 10% of the gain ($20,000) is never recognized.

- If the taxpayer holds on an additional two years, an additional $10,000 of gain is permanently avoided, if the required two year holding period does not go past December 2026.

Now assume the value of the $200,000 QOF investment increases to $500,000 and the taxpayer sells out in 2030. The deferred gain from the original selling transaction will be recognized in December 2026, and tax will be paid for the year 2026 on 85% of the $200,000 realized in 2019. Then, in 2030, the gain on the sale of the QOF investment will be recognized. Because the taxpayer held on for ten years, the $300,000 gain that accrued on the original 2019 $200,000 QOF investment in 2019 is never taxed. That’s a great tax savings benefit.

What’s the Catch?

There’s always a catch. With a QOF, one catch is that you live and die with the success of the fund. The QOF must invest in business assets, and that involves risk. Finding the right fund during your 180-day reinvestment window can be a challenge.

Another catch is the 2026 mandatory recognition of gain once you invest in the fund. While there is always a chance a future Congress will extend that date, counting on that requires reckless courage.

Finally, there are detailed and sometimes uncertain rules on what investments qualify. Professional tax advice is a must, and that isn’t free.

Not Right for Everyone, but May Be Right for You.

The Opportunity Zone deferral can a great opportunity for the right investor who can find the right investment. It’s hard to beat gain deferral combined with partial permanent gain avoidance. If you don’t mind keeping your funds in play in a business investment for years and you are comfortable with the risk that comes with it, a QOF provides tax benefits you can’t find anywhere else.

|

Joe Kristan View Bio |