The Jobs Issue – 2016 outlook

Metros ‘booming,’ pay rising, but ag economy mutes growth

PERRY BEEMAN Nov 13, 2015 | 12:00 pm

12 min read time

2,745 wordsBusiness Record Insider, HR and LeadershipGreater Des Moines’ economy will see solid growth in 2016, but continued recovery will be muted by the widespread economic drag of low grain prices, labor shortages, and other factors, economists and other observers agreed.

Iowa State University economist David Swenson said there should be more confidence in Greater Des Moines and other larger Iowa cities next year.

“Metros are for the most part booming,” Swenson said.

Statewide, the economy is looking better, with even rural areas now seeing numbers return to pre-recession levels. “It’s been a strong and geographically broad-based recovery,” Swenson said. “Some of that has been the agriculture sector. Some has been in wind energy. There is a lot of commercial, and, in metro areas, residential development.”

“We have had a well-rebounded construction sector, which is employing more people than it did prior to the recession,” for example, Swenson said.

Overall, manufacturing has rebounded, too. “Manufacturer employment is not growing, but capacity is. That is reflected in construction,” including two large fertilizer plants in the state, Swenson said.

Many employers plan to add positions in 2016, which employment agency managers and economists alike see as another year of measured growth. No boom, but no weakening, either.

“The outlook for hiring is really good,” said Karen Miller, executive vice president of Manpower Inc. locally. “We are struggling to find the candidates to fill the vacancies that

we have.”

David Leto, executive vice president of Palmer Group, a West Des Moines-based staffing agency, expects another healthy year of modest gains, with experienced tech workers in particular enjoying high demand. “People are cautiously optimistic now,” he said. “They aren’t going to put the brakes on anything, but they aren’t going hog wild, either. They are taking time to make good decisions.”

In a six-month outlook survey released Sept. 1, Iowa Business Council members showed they expect a good Iowa economy into the beginning of 2016, but they aren’t as excited as they were the past few quarters.

“The reach of global economic concerns may finally be extending, to a degree, into our local industry segments,” Mike Wells, president and CEO of Wells Enterprises Inc. in Le Mars and the business council’s chairman, said in a statement. “However, reasonable levels of optimism remain in sales, capital spending and employment to possibly sustain some measure of the fairly robust outcomes experienced by many Iowa companies so far this year.”

Among the reasons to be bullish on 2016:

— Robert Half’s survey of 200 chief financial officers at Central Iowa employers with 20 or more employees found that 92 percent were confident that their business will grow through spring — the end of the six-month period covered by the poll.

— Palmer Group’s work with its clients finds that most plan to hire and to expand, within reason. Next year won’t be a boom, but it should see modest gains tempered somewhat by an agriculture economy still hurting from low grain prices, Leto said.

— The Iowa Business Council’s periodic survey found

that nearly half of respondents, 48 percent, expect to increase hiring in coming months, while 43 percent

expect no change.

ISU’s Swenson also expects growth, especially in the metropolitan areas, with some challenges tempering the curve.

“The big picture from my point of view is the agriculture economy is soft,” said Swenson said. “Low commodity prices

will constrain ag spending. When you slow down that spending, you slow down their suppliers, like those that make hoses

and cylinders.”

“We can see that in (agricultural) manufacturing numbers,” Swenson said. “They are soft and declining, and there is no suggestion they are going to increase.”

Part of the challenge is the trend toward bumper crops, even amid low grain prices, Swenson said. “We have increasingly large supplies,” he said. “Farmers will turn around and decide between beans and corn and plant every acre they can.”

Forecasts are for somewhat better corn prices in 2016, with soybeans lagging due to competition from Brazil and elsewhere, Swenson said.

In general, the economy continued to grow as 2016 approached, with some statistics topping 2008 levels for the

first time.

Here’s a look at segments of the economy:

Jobs

The Robert Half survey of 200 chief financial officers in Central Iowa found that 12 percent said they would add staff in the six months ending in February 2016, down three percentage points from the previous six months. The same survey found that a slightly higher percentage — 10 percent versus 6 percent — plan to leave vacant positions open and won’t create new ones. More than three-fourths, 76 percent, said they planned to only fill vacated positions, down one percentage point.

With the tight labor market in some fields, many employers will have to go into a hurry-up offense in hiring, said Mike Gremmer, regional vice president for Robert Half. Perks in the offer won’t hurt. The Robert Half survey found that 53 percent of the CFOs surveyed find it somewhat or very challenging to find skilled candidates for professional positions.

“Six or nine months ago, we were educating clients about the market. ‘It’s tight. You have to move quickly.’ Now, clients are telling us that. They say, ‘We’re having a hard time finding talent,’ “ Gremmer said.

Now, candidates often are entertaining multiple offers, especially in technical jobs. “We tell people you have to move quickly,” Gremmer said. “For example, we are seeing an extreme shortage of internal audit people.” Information technology workers and Web developers are tough to hire too, “because they have a lot of options,” he said.

“Generally speaking, the candidate is in charge today,” he said. “I don’t think anyone can deny that right now.”

Workers also are much more prone to leave their company.

”If you delve into what is prompting a candidate to leave a company or to be pulled to another, one of the things we are seeing is that candidates have more confidence in leaving today because they have more confidence in the market that there is more opportunity out there,” Gremmer said.

It’s not just about pay and benefits. “We have seen candidates leave because they seek a different culture in the workplace,” Gremmer said. “They might be looking for work-life balance. Some might want to work from home a day or two a week. Or it might just be the environment over an organization.”

“When you have a low unemployment rate, and a high demand, there are a lot of jobs there,” he said. “Recruiting has to be the emphasis for companies today.”

“Companies are going to have to compete and they are going to have to stand out. They are going to have to sell themselves,” by offering a quality cafeteria of benefits, more paid time off, work-from-home policies and other perks, Gremmer added.

Swenson, the ISU economist, said the tight labor market goes far beyond IT. “Our labor force’s ability to provide labor is starting to get constrained,” he said. “Wages and migration are the only things that would affect that.” He added that he sees neither evidence of significantly higher salaries nor hordes of people moving to Iowa.

“These things are potentially going to inhibit job growth through the rest of the decade,” especially in rural areas, he said.

In the Iowa Business Council survey, nearly half of respondents, 48 percent, expect to increase hiring in coming months, while 43 percent expect no change.

Leto of Palmer Group expects solid hiring in 2016. “I don’t think it will be off the charts, but there will be hiring,” he said. “Companies have done a nice job of marketing themselves and keeping capital to protect themselves. Nobody wants to go back to 2008. They won’t go overboard on demand.”

Swenson said a shortage of skilled construction workers will become a growing problem. Many potential journeymen chose other careers during the recession, and now candidates may be skipping the union halls for the air-conditioned, dust-free offices of companies willing to hire them to do computer work or other tasks.

“It is difficult to get labor,” Swenson said. “They aren’t bidding up prices, but they are shifting schedules.”

“Well, we’ll just have to wait a bit longer to get projects done,” he added. “In a bigger economy, you bid up wages. In an economy like Iowa’s, the probability of people moving in for short-term projects isn’t as high.”

“The state of Iowa can’t grow faster than the national economy,” Swenson said. “Everything we can produce, someone else has to buy. We are only as healthy as they are.”

Manpower’s survey of Midwestern companies found that 21 percent expected to increase staff levels at the end of 2015; the projections for early next year come out in December. Another 6 percent expect to cut staff. On a seasonally adjusted basis, the fourth quarter of this year is relatively stable compared with last quarter, with the outlook a bit stronger than last year.

Manpower found the market particularly strong for leisure and hospitality workers, and for nondurable goods manufacturing. Hiring is expected to be slightly higher in construction, financial activities and professional and business services, Miller said.

Employers in three industry sectors expect the hiring pace to decrease slightly: education and health services, government and durable goods manufacturing. Wholesale manufacturing and retail trade hiring are expected to see a moderate decrease, Miller added.

Salaries and perks

Robert Half’s survey of 200 Greater Des Moines CFOs of companies with 20 or more employees found that 35 percent plan to make adjustments to salaries.

“We’re seeing companies add 15 percent base raises,” Gremmer said. “In the last couple of months, we’ve seen companies raise (compensation) 30 percent. That is unusual. With very particular skill sets — companies have needs — they recognize that they have to do extra things to get the talent through the door.”

Companies are adding vacation days and considering other perks like the flexibility to work at home. “Companies are moving to offering what the candidate wants,” said Gremmer, whose company specializes in the high-demand tech fields. “Three weeks (of vacation) is kind of standard now. But if their normal package is two weeks, many times we can get that candidate three weeks” from the start, he added.

Robert Half’s survey found salaries for public accountants, financial analysts, controllers and bookkeepers are expected to rise nearly 5 percent. Bookkeepers can expect salaries between $39,750 and $49,500, while a controller in a company with revenues of $50 million to $100 million could see pay between $95,000 and $129,250, the survey found.

For the truly technical jobs, like business system analysts or big data engineers, quality assurance engineers, Web designers and Web developers, employees will see salaries increase by 3.2 to 8.9 percent.

In the bottom of that range are Web designers, looking at pay of $67,000 to $112,250. Business system analysts are in the middle at $84,000 to $122,000. And at the high end of the hot job list are the big data engineers, with salaries expected to range from $129,500 to $183,500.

Robert Half’s salary survey noted that financial institutions are boosting salaries and offering bonuses, including some at the time of hiring. Current employees are seeing higher salaries too as companies try to keep their employees.

Clive-based David P. Lind Benchmark surveyed 1,000 Iowa employers. The majority had 10 to 250 employees.

That survey found that 78.4 percent of the respondents increased their health insurance premiums, with an average boost of 10.9 percent. Lind reported Iowa Workforce Development records showing that while health insurance rate increases have ranged from 7 percent to 18.7 percent since 2001, pay raises in that period have ranged from 0.6 percent to 4.4 percent.

Not everyone is expecting modest to aggressive raises. ISU’s Swenson said with inflation not likely to top 2 percent, “I have no expectation of wage growth in Iowa.”

Manpower’s Miller, who deals with the full range of job classifications, said: “Salaries are absolutely creeping up. And employers who can’t pay well will have to offer some great benefits or perks.”

Raises

Gabe Gulick, regional manager of QPS Employment Group, said he’s expecting to see a lot of 3 percent raises. Some employers may need to throw in free lunch, free pop, flex time, work at home and better vacation to beat the competition.

“We are in a really interesting time,” Gulick said. “We have a strong economy and low unemployment. Companies are working as best they can to be an employer of choice. They are going to continue to have to do the things to attract candidates. I don’t think it is going to get any easier in 2016.”

Gulick has this last piece of advice: “Answer the question ‘Why would I want to work here?’ If you like the answer, applicants will probably have the answer too.”

Some national reports also suggest an average raise of 3 percent. “We’re seeing more than that,” said Robert Half’s Gremmer. “We are seeing upwards of 5 or 10 percent for some skill sets.”

“Roles that are impacting the company’s bottom line or are very specialized are probably going to get more,” he added.

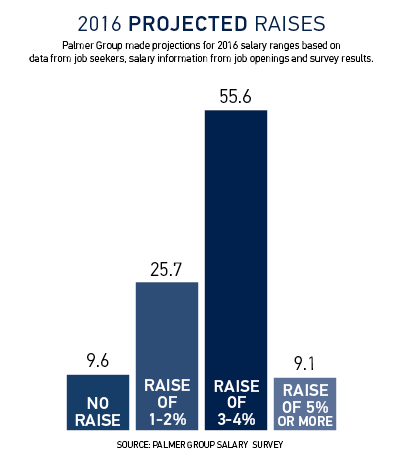

Palmer Group’s survey of Central Iowa employers found that the majority, 55.6 percent, expected to dole out raises of 3 to 4 percent, down from 62 percent this year. But the percentage giving raises of 5 percent or more is expected to grow to 9.1 percent from this year’s 4.1 percent.

Palmer reports that 9.6 percent of employers won’t give raises. That’s up from 8.3 percent this year.

Another 25.7 percent plan to give raises of 1 to 2 percent, little changed from this year’s 25.6 percent.

“I see steady improvement in wages,” Leto said.

Unemployment

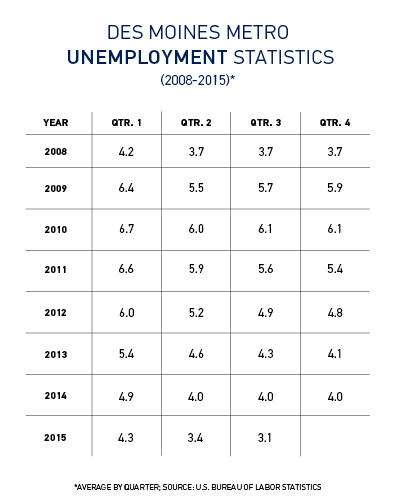

The Greater Des Moines unemployment rate is expected to stay under 4 percent.

ISU’s Swenson expects the unemployment rate to fall modestly: “Unemployment will go down a little bit more. We have the problem with the labor force. But is the rate going down because the labor force is shrinking, or are they giving up on the job search?”

Federal statistics don’t count people who have decided to stop looking for a job as unemployed, even though they are.

Leto said unemployment will remain well below 4 percent, basically meaning the Greater Des Moines market is at full employment.

In the tech fields particularly, that has companies bidding up pay and benefits, Leto added. “Employers have to work harder to keep their employees,” he said. “Part of it is money, and a 5 to 10 percent increase is pretty significant. But also, how do you treat them? Do you offer flexibility on work schedule? Work-life balance is a big deal. You don’t want to give people a reason to leave.”

He’s not just talking about tech jobs. “It’s that way in the market in general,” Leto said. For example, “customer service and processors are in demand right now. “

Leto said more aggressive first offers are likely: “It’s pretty rare when a candidate doesn’t have more than one offer.”

Gremmer said the low unemployment rate feeds that phenomenon.

“It’s very low,” he said. “One could argue we have full employment (in Polk and Dallas counties). I would venture that it will at least stay stable, if not decrease, in 2016.”

Things could get tougher for employers. “Baby boomers are a large percentage of the workforce,” Gremmer said. “They are feeling more comfortable with retirement and may leave the workforce. It is going to be tougher to get talent.”

“What we found in our survey, which is pretty consistent in what we are hearing in recruiting, is that 35 percent of CFOs say their companies are making adjustments to their compensation packages,” he said. “It’s just a really tight market.”

Miller, the Manpower executive, said a survey of 160 Greater Des Moines employers found that 27 percent plan to hire more workers in the last quarter of 2015, but they will have a tougher time filling the positions.

“(The workforce) is not growing and (baby) boomers are retiring and the Gen Z’s aren’t growing up fast enough to replace them,” Miller added. That is leaving a hole in the market.

Sales

Of the CEOs surveyed by the Iowa Business Council, 43 percent expect higher sales over the next six months.

Capital spending

Fully one-third of the Iowa Business Council survey respondents expect higher capital spending, and another 5 percent predict substantially higher spending. More than half, 52 percent, expect no change through early 2016.