Public Companies: West Bancorporation Inc.

Headquarters: West Des Moines

Website: www.westbankstrong.com

Ticker symbol: WTBA

Employees: 185

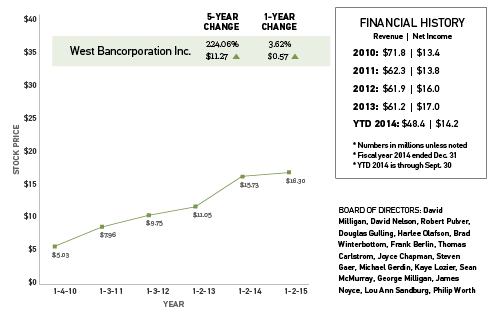

If you judge it solely on stock price, West Bancorporaton Inc. is one of the top performing companies in the state. Over the past five years, the West Des Moines-based parent of West Bank has watched its stock price gain 224 percent. It is topped by just three other Iowa-based public companies in that category.

But banks are judged by more than just their stock performance. For his part, West Bank President and CEO Dave Nelson said he finds the increase in stock numbers interesting, but stock price isn’t his main focus

These days, the bank is receiving national kudos for its performance, its ability to return some value in the face of low interest rates, tough competition for customers and stiff regulatory oversight that many bankers believe is taking away their ability to do their jobs.

Also during Nelson’s tenure, West Bank has opened a branch in Rochester, Minn., where he spent a good part of his career with Wells Fargo & Co., and it is completing a new branch in the Iowa City area.

Nelson’s goals are simple: figure out what customers like about West Bank, keep providing those services and find areas of improvement. That’s it in a nut shell.

There’s no point in asking Nelson about a five-year plan for West Bank, because there isn’t one. He doesn’t believe in them.

A six-month strategy, on the other hand, now that’s something Nelson, president and CEO of the West Des Moines bank and its parent company, can get excited about.

“We conduct strategic planning sessions every six months and select our priorities,” Nelson said. “If we did a two-year or five-year plan, it would quickly become worthless. I think it’s kind of a waste of time. We specifically plan our activities, and then we work on those things. We pick the most important things.”

Q & A with Dave Nelson, president and CEO, West Bancorporation Inc.

Age: 53

Education: Hoover High School; bachelor’s degree and MBA from Drake University

Hometown: Urbandale

Family: Wife, Kathie; teenage son and daughter

You must be pleased with the bank’s growth over the last several years?

In general we are very pleased with our direction and our performance and it’s all based on the fact that people are choosing to do business with us. But it is complicated. Why do they keep doing business with us and what can we do to improve on that? There’s nothing we do that we can’t get better at. We’re constantly asking the question what does it mean to be a community bank? Why do people choose to do business with us? When we find out what is most important to our customers, we try to give that to them; We do try to keep it that simple.

What have been some keys to your growth?

We have expanded into a new marketplace as a way to continue to grow. We may look at doing something similar to what we did in Rochester somewhere else. We are the beneficiary of an improving local economy, but we were also growing at a time when the economy was not. We want to do more business with existing (customers) and get more customers. We are not all things to all people. The growth rates and the performance that we have been able to achieve has been good and we’re optimistic with the position the bank is in.

Low interest rates, the threat of a rapid rise in interest rates and more regulation are obvious challenges. What are some others?

One of the big risks is the way the interest rates are being kept artificially low. When we stop buying our own debt and fiscal policy returns to some normalcy, most people would expect interest rates could rise drastically and dramatically. That’s something that could impact all of us, not just West Bank or the banking industry. With interest rates so low, an investor or depositor is not getting much of a return, and deposits are very important to us.

Our loans are growing at a rate faster than our deposits. One of the best parts is that the bad parts are getting smaller and smaller and the good parts are growing. When you reduce the level of problems, you get to where you don’t have anything left to address. That’s great news, but therein lies a challenge. If your apartment building is 100 percent occupied, I don’t know how you can improve it that much. You might raise rents, but then you might lose tenants.

One of the extreme examples of the unintended consequences of banking regulations was that former Federal Reserve Chairman Ben Bernanke could not refinance his house because he was out of a job.

That’s part of what it means to be a community bank, we can go ahead and make a loan to someone we want to. There’s a lot of logic to it, but there are unintended consequences for people they were meant to help. If we knew (Bernanke) had a job and he was our customer, we would go ahead and do that. We have the ability to do that, as do all community banks. But again, that’s an example of the regulatory burden. When they publish 6,600 pages of new regulations, just trying to read and digest what they mean is a burden. It’s an industry, the regulatory burden, it’s just an industry. There are bills being considered or in various stages of the legislative process all the time and they are all centered on consumer banking, most specifically home loans.

That’s just something the whole industry has had to deal with. That line of business is not our identity. About half of our deposits comes from retail households, but over 90 percent of our loans are for a business purpose. We are hurt less by legislation on the home mortgage market, but that piece with rates so low, no one is refinancing. That’s been a challenge for all institutions that provide those loans.

What is your focus right now?

The simple stuff. We’re completing construction on an eastern Iowa headquarters building. We’re going to start plans for a new headquarters building in Rochester. We have the site, bought the land. Heck we haven’t designed what we are going to build yet. More important than the building is our overall strategy, what we’re going to be doing on purpose to serve the community and grow the bank. We’re already bigger than two or three of the Rochester banks in loans outstanding. Of course everything in Rochester is new. We started with nothing, but we’ve had great growth in Des Moines and eastern Iowa. Sioux Falls (South Dakota) would be a good one, but Des Moines, Iowa City and Rochester are all three healthy economies positioned for the future. We have relationships established to help make things happen in those communities.

How does the future look?

We’re looking at another good year, but we are very focused on every six months. We do not have a goal on being a certain size by a certain time that is critical to our performance, to our strategies. Anybody can make a bank grow. Any group of knuckleheads can make a bank grow real fast. No matter what the question is, the answer is yes. If you have a goal to be a certain size by a certain time, then they’ll achieve that. We want to outperform our peer group and others.

I never really compare us to anything other than other banks. We don’t even talk about the stock price; we base our success on our financial performance metrics: Return on assets, return on equity, credit quality, efficiency ratios, what does it cost to generate a dollar of revenue? That’s what we compare ourselves to. You add that up and it ought to drive the stock price, but we don’t have any goals around stock price.

I have to figure that if the bank is healthier and stronger and performing stronger, that ought to make the stock price go up. Nevertheless, it is fun to hear you say we have done better over the last five years than about anybody else. But for a banking comparison, not everybody is publicly traded, so I just focus on their performance metrics.