Time to fuel up

Scott Cirksena knows that the words “raise” and “taxes” aren’t usually met with wholehearted agreement when they appear together.

But people also need workable roadways and bridges, and upkeep has to be paid for somehow. Cirksena and others have recommended a raise in the state’s fuel tax to bridge a gap of critical funding for the state’s infrastructure.

“People need to understand how complex this issue is,” said Cirksena, the mayor of Clive and a member of Gov. Terry Branstad’s Transportation 2020 Citizen Advisory Committee (CAC). “The gas tax affects everybody.”

A bipartisan proposal released by two state legislators last week calls for a phased-in 8 cent per gallon increase in the state fuel tax by 2014, which, combined with a increased fee for new registration of vehicles, could bring the state an additional $234 million per year in road funding. Advocates say the increase is a long time coming and represents the most feasible way to keep up with critical needs for the state’s infrastructure.

The issue

The Iowa Department of Transportation (DOT) has identified a critical funding shortfall of $215 million per year for the next 20 years.

That shortfall was identified by looking at an increasing number of bridge repairs and emergency road repairs.

That was the most immediate and pressing challenge of the governor’s CAC, which went around the state to get ideas from citizens and drafted a 52-page report for Branstad and legislators, detailing ways to not only make up the critical funding shortfall, but to provide sustainable revenues for future projects that aren’t classified as critical. The most immediate issue, though, is to fund the critical needs.

How did we get to this point? Part of it is due to the fact that Iowa ranks fifth nationally in the number of bridges and 13th in miles of roadway, the report said. Another large factor is age; much of the system was built or modernized in the 1940s, ’50s and ’60s.

That couples with the fact that since the fuel tax last increased in 1989, construction costs have gone up, and vehicles’ fuel mileage has improved.

The recommendations and legislation

The CAC report laid out six recommendations to make up the shortfall and have money left over to help fund some non-critical needs. The quickest way identified to make up the shortfall is increasing the fuel tax by eight to 10 cents per gallon.

Using those recommendations, Iowa Democratic Sen. Tom Rielly and Republican Rep. David Tjepkes, who were both on the committee, unveiled a proposal to bring in more revenue to address the funding needs. The bulk of that added revenue would come from raising the tax by 4 cents in 2013 and another 4 cents in 2014.

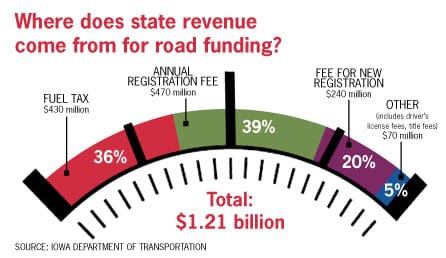

The current state fuel tax, not including a 1 cent per gallon fee for underground storage tanks, is 21 cents per gallon for gasoline, 22.5 cents per gallon on diesel and 19 cents per gallon on ethanol-blended fuels. It makes up about 36 percent of state funding, which equated to an estimated $430 million in fiscal year 2011, according to the DOT.

Each penny raises approximately $23 million, meaning that an 8-cent increase would raise an estimated $184 million per year.

“That moves the needle the quickest,” Cirksena said.

State Sen. Matt McCoy, a Des Moines Democrat who serves as the co-chair of the Legislature’s joint Transportation, Infrastructure and Capitals Appropriations Subcommittee, said now is the time to have the tough conversations. Nobody likes raising taxes, he said, but the issue has been put off long enough.

McCoy is passionate enough about it that he insists he’d be OK with doing the right thing even if it is an unpopular decision politically. But he gets the sense that not only will it be a hot-button issue this legislative session, but raising the fuel tax will have a lot of support.

The bipartisan legislation recommendation is a good sign, he said, and indications are that if Iowa’s Senate and House get a bill to Branstad’s desk, the governor will sign it into law. A number of groups have also indicated they would back the legislation, including the Iowa Motor Truck Association, the Iowa Farm Bureau Federation and the Iowa Corn Growers Association.

“I would say we are at the point, the critical point, where it’s not really a luxury to wait any longer on this gas tax,” McCoy said. “We’ve got to go forward with it, in my opinion, at this point, or we’re going to do some real, long-term damage to the quality of our state, to the economic development of our state.”

David Scott, executive director of the Iowa Good Roads Association, said that it’s not a matter of if the fuel tax has to be raised, but when. Waiting longer could turn drastically more expensive. He cited a statistic from the Association of State Highway Transportation Officials that says every dollar spent to maintain a road today reduces future repair costs anywhere from $6 to $14.

Cirksena said the governor’s CAC looked at a number of avenues to close the revenue gap and found the fuel tax increase to be the one that made the most sense. Money gained from raising the fuel tax is constitutionally protected to be used for infrastructure; money raised from other sources could ultimately be used elsewhere.

Toll roads, for example, wouldn’t be a viable option due to federal law that prohibits imposing tolls on existing interstates. On the same note, the governor has asked the DOT this year to identify $50 million in efficiency savings, but saving money in the DOT’s budget can only go so far, Scott said.

“The gas tax is the only way to raise a significant amount of revenue,” Scott said. “It’s the most fair way in that those people who use the roads are the ones who pay it. It’s also the only way we have of collecting a fee from people outside of Iowa that are using our roads. … And it’s the most consistent.”

What others are saying:

What would be the consequence of not raising the state’s fuel tax?

Stuart Anderson

planning, programming and modal division director,

Iowa Department of Transportation:

“Certainly if the revenue drops or doesn’t grow, there are going to be continued project needs that aren’t funded. That could mean critical infrastructure will continue to deteriorate, and it also would likely impact some broader project needs, whether it’s corridor improvements or interstate modernization improvements.”

Todd Ashby

executive director,

Des Moines Area Metropolitan Planning Organization:

“It just slows things down. It takes a lot longer to do projects. Nobody likes to see taxes go up … but people are also using roads for travel and commerce, creating wear and tear on them, so there’s a need to recapture some of that. It’s funding back so you can rehab roads or build some new facilities.”