A clearer picture for 401(k) fees?

The next few months promise to be eye-opening for employers and workers alike, as new federal rules designed to make retirement savings statements more transparent take effect.

A majority of Americans are in the dark about how fees are assessed on their 401(k) accounts, which are the prevalent retirement tool offered by employers. Of the more than 800 401(k) participants surveyed in late 2010 by AARP, 71 percent said they believed that they did not pay fees on their accounts.

Yes, Virginia, there are fees, and even the companies that offer the plans to their workers aren’t always clear on who pays them. According to a study released in April by the Government Accountability Office, half of 1,000 plan sponsors surveyed didn’t know whether they or their plans’ participants paid investment management fees, or incorrectly believed the fees were waived by their service providers.

Effective July 1, companies that administer 401(k) plans are required to provide plan sponsors – companies that offer 401(k) plans to their employees – more detailed information about all fees and costs associated with running the retirement accounts. On the heels of that, new regulations kick in this fall that govern how plan sponsors must communicate retirement plan information to their employees.

Employers may want to tread carefully as they disclose fees, or risk facing a backlash from workers who might think they’re suddenly being assessed new fees on their accounts, experts say. On a broader basis, the new rules shine a brighter spotlight on a company’s fiduciary duty to find the best deals for its employees.

“I look at this as an opportunity for everyone to take their game up to the next level, for people in the retirement plan space to really improve their processes,” said Jean Duffy, a senior vice president and investment adviser with CAPTRUST Financial Advisors in West Des Moines. The Raleigh, N.C.-based advisory firm entered the Greater Des Moines market in 2010 with the acquisition of the financial services arm of Holmes Murphy and Associates Inc.

‘Don’t run away from it’

The ultimate responsibility for communicating the retirement plan’s details lies with the plan sponsor, Duffy said. “They don’t necessarily have to create all the pieces, but they have to assure that it’s sent out to their participants,” she said.

If not communicated properly, the new disclosures could send up red flags to employees who may think, “Oh, great, now they’re requiring me to pay these fees,” when actually they have been paying the fees all along, Duffy said. It’s not much better if an employer goes to a lot of work to follow the new disclosures if they aren’t going to be read by anyone, she noted.

The best practice for companies in explaining 401(k) fees to employees is to always act in the employees’ best interests, she said.

“What we’re suggesting to our employers is, don’t run away from it,” Duffy said. “Address it head-on, before (employees) start seeing (the new disclosures) on their statement. (Employers) have a requirement to act as a prudent expert. We think it’s really important that if plan sponsors don’t have that help, that they secure the help that they need.”

The Department of Labor estimates that the new disclosure rules will cost companies $425 million this year, based on the time spent in ensuring legal compliance, consolidating information for participants, creating and updating websites and preparing and distributing annual and quarterly reports. However, the department also said the new rules should save plan participants nearly 54 million hours they would otherwise have spent in collecting and organizing information so they can compare key information, a time savings it values at $2 billion this year.

Principal Financial Group Inc., one of the largest 401(k) plan administrators in the country, has been working to provide information to clients at both the plan sponsor and participant level ever since the rules were first released two years ago, said Joni Tibbetts, vice president of retirement and investor services for the Des Moines-based company.

“We think the Department of Labor really got it right” with the new rules, Tibbetts said. “What we did was go one step further. We created a (Web) landing page that plan sponsors can go to to see all the services that Principal provides to plan sponsors.”

Consider more than cost

Though many of its online 401(k) tools are accessible only to its clients, Principal has also made a few documents available to any business owner to peruse, among them tips on assessing retirement plan value.

“We put that (on the Principal website) because we think it’s so important for people to consider more than just the cost,” Tibbetts said. “Understanding all these details will help (plan sponsors) evaluate whether the fees are reasonable.”

Principal routinely evaluates the fees that it passes along, she said. “As a retirement leader, you need to continually look at the prices you’re charging and most importantly the services that you’re providing,” she said. “I think what sometimes gets missed is that people just focus on that number. It may be based on a real bare-bones service offering, or one that offers really comprehensive education services. So they really need to look at the services as well as the fees themselves.”

The potential for lawsuits is always in the back of employers’ minds. In a recent court case, Tussy v. ABB Inc., a federal judge in Missouri held that ABB was liable for $35 million in damages for failing to meet its fiduciary responsibilities to its plan. The court found that the company had never calculated the amount of record-keeping fees paid to Fidelity Management Trust Co. via a revenue-sharing arrangement it had with the plan’s investments, and that ABB had not investigated the market price for similar record-keeping services or benchmark the cost of record-keeping fees prior to entering into the revenue-sharing agreement with Fidelity.

Duffy said she believes that the high-dollar judgment is likely to set a new standard for plan sponsors and advisers in evaluating their own fiduciary responsibilities.

So how ready are companies now that the new rules are in place?

“The ones who are working with an adviser probably have their arms pretty much around it,” Duffy said. “Advisers have seen this coming a long time and have been working on it for a long time. For plan sponsors that are trying to do this on their own, hopefully they will see that now is a good time to look at this and make sure that everyone is clear on their responsibilities.

“As they’re doing this, it may be a good time for plan sponsors to look at their whole process – do we have a committee; are we documenting what we’re acting on – that they have a good process in place. And if you haven’t benchmarked your plan in three to five years, now would be a good time to do it. We’re finding the marketplace to be real competitive right now.”

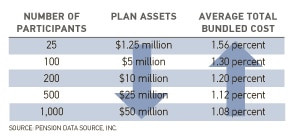

Average 401(k) costs

Average 401(k) plan costs tend to decrease as fixed costs are spread across a larger number of participants.

Here’s a snapshot of average costs as compiled in the “401k Averages Book,” (www.401ksource.com) which Pension Data Source Inc. derives from a database of 187 plans from 68 plan providers.