Employers expect to slow pay hikes in 2024, continue to add positions

Palmer Group releases results of annual Salary Guide

Employers plan to increase hiring and continue to offer pay increases in 2024, although those increases will be tempered, according to the Palmer Group’s 2024 Salary Guide, which was released Nov. 1.

The guide is designed to give companies a pulse on what the market will be and to share that information to make both employers and prospective job candidates more informed about the future of employment, said David Leto, CEO of the employment agency.

The survey, done in collaboration with the Greater Des Moines Partnership, was launched Oct. 4 and collected responses through Oct. 13. The number of recipients and the number of responses were not released.

What initially began about a decade ago as a survey asking employers about salaries has evolved into a survey that measures the overall employment climate.

The questions in this year’s survey included plans for compensation increases, hiring plans for 2024, what a company’s main focus for 2024 will be, and work options that will be offered. A new question for this year’s survey asked whether a company was looking at direct hires to fill positions or if they would be open to hiring contract and temporary workers.

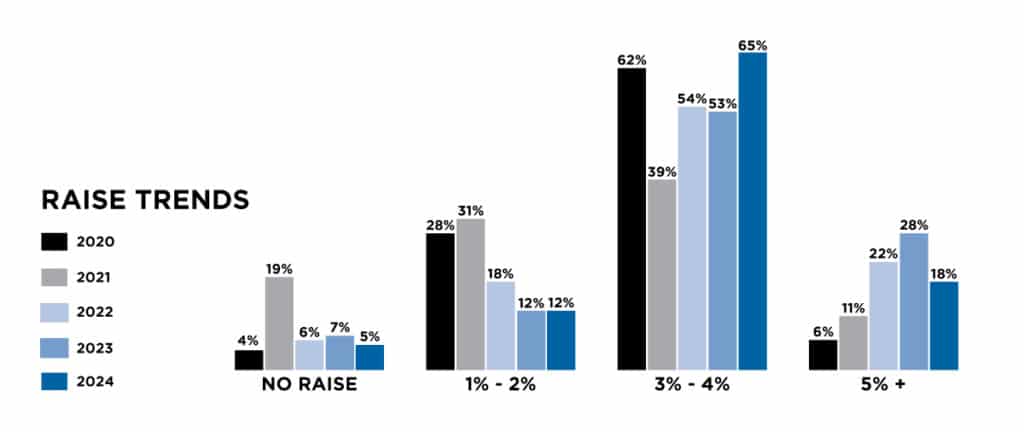

Pay increases

According to responses, 95% of those plan to give raises in 2024, but those planning to give a raise of 5% or more dropped from 28% in 2023 to 18% in 2024. Those planning to give a raise of 3% to 4% totaled 65%, up from 53% last year, with 12% planning to give raises of 1% to 2%. The survey showed that 5% of those responding are planning no raises in 2024.

“So raises are going to continue, just more tempered,” Leto said before the official release of the results. “Given the market and inflation, wages have grown so fast the last several years that companies are having to slow down a little bit on some of that. There is still a lot of uncertainty in the market. They want to continue to give raises and take care of their people but they can’t keep doing what they have been doing the past several years.”

Staffing changes

The survey showed that 50% of those responding plan to add staff in 2024, similar to 49% last year. Leto said that while that is good for the region, those saying they plan to decrease staff rose from 2% last year to 6%.

That increase could be a result of financial challenges created by inflation and increasing costs, as well as other factors, Leto said.

“I think some are just struggling to get their business where they had hoped, some might have a specific business unit within a company that is not doing great and they can’t absorb all those people,” he said. “I think there’s a lot of different factors. Some companies may have just over hired.”

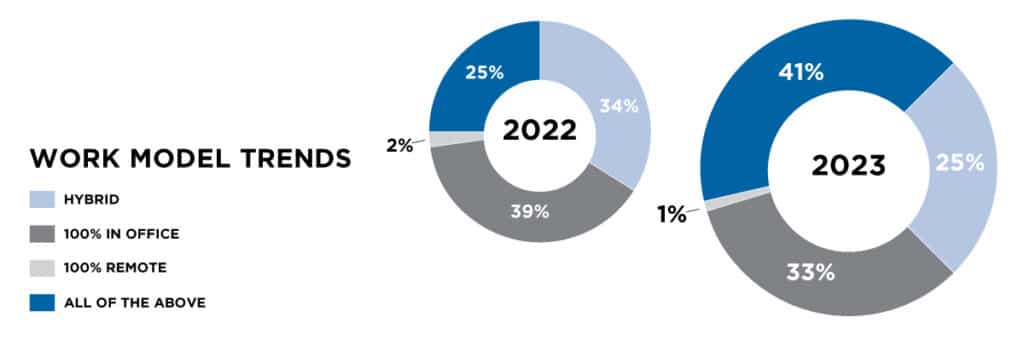

Return to office

The survey also shows some shifts in work models and how companies are addressing return to office.

Of those responding, 25% said their work model was hybrid, down from 34% last year, 33% were all in-office, down from 39% last year, and 41% said they had a mix of all of the above, up from 25% last year.

Leto said it appears that the decline in respondents who work in-office or hybrid was offset by the rise in those who responded all of the above. Those who will offer all remote work dropped from 2% last year to 1% this year.

“I think more people answered all of the above because they have some remote employees that maybe they hired during the [pandemic],” he said. “We just don’t see a whole lot of full remote jobs in this market.”

Companies also are continuing to work to find the balance between bringing people back to the office while maintaining flexibility.

“Flexibility is key, and I think organizations are still trying to figure out what that means or how that works,” Leto said.

He said that he believes that companies have increased their accountability measures to ensure employee productivity doesn’t drop if they are working remotely or taking time off to attend to other matters.

Hiring contract employees

Companies are more willing than before to hire contract or temporary workers to fill full-time positions, Leto said.

According to the survey, 7% of those responding said they would be willing to hire contract workers. Although a new question to the survey this year, Leto said there is evidence that hiring contract workers is increasing.

“We’re seeing an uptick in our contract placements [at Palmer Group],” he said. “Maybe a full-time opening, but it doesn’t mean they’re not willing to hire a contract worker to get stuff done.”

Artificial intelligence

On a question asking about adopting AI, 70% said they don’t intend on adopting AI technology in 2024, with 30% saying yes.

Leto said it’s unclear what’s behind those results.

“Everybody I talk to was looking at new tech, so whether they consider that AI or not, that is where the terminology gets a little fuzzy still,” he said.

According to the survey, more companies are focused on succession planning this year. It shows that succession planning is a focus of 15% of those responding, up from 4% last year.

Key takeaway

Leto said while companies continue hiring, leaders need to understand their needs before they start a search.

“We see a lot of companies start a search without having a plan in place, and that can drag out your hiring process,” he said. “Keep investing in your people. That training and development piece is critical, hiring people without the perfect experience is still OK as long as you have a plan in place to train and develop them, and the retention piece. Finding ways to engage your employees … make sure they understand your purpose, that they’re living your values and committed to where you’re going as a company and understanding the role they play – that is so important to retaining your people.”

Michael Crumb

Michael Crumb is a senior staff writer at Business Record. He covers real estate and development and transportation.