Envision Iowa: Leaders offer outlook on jobs, social infrastructure in statewide report

Michael Crumb Nov 24, 2023 | 6:00 am

<1 min read time

0 wordsBusiness Record Insider, Economic DevelopmentMore attention needs to be given to develop the skills that are needed and the talent pipeline that will be needed, business leaders said in response to a survey measuring the economic outlook for 2024 and the challenges companies are facing.

The Business Record partnered with Bâton Global for the 2023 Envision Iowa Statewide Leaders Economic Outlook Survey, with results from the survey being released at a live event on Oct. 4.

The report

The survey focused on three themes that drive state-level economic performance: people and culture, business opportunities and infrastructure. It asked business leaders for their outlook across the three areas for the years 2024, 2026 and 2028.

It asked questions regarding population change, ability to meet the state’s workforce needs, expectations for change in Iowans’ quality of life and changes in social infrastructure, among others.

Those responding to the survey totaled 529 leaders from 51 counties who represent 21 industries. Fifty-one percent were from urban areas of Iowa, 28% were from rural areas and 21% represented suburban regions of the state. Business leaders made up 44% of those responding, with 20% being community leaders, 12% were economic developers,

16% were from the government sector, and 8% were elected officials.

Kavilash Chawla, a partner with Bâton Global, said the survey is intended to “reorient” the focus of the business community from using historical data to make decisions to being more predictive in their decision making.

“I think this at least underscores the necessity to really start to project out or start to think in a future-forward dynamic,” he said.

Chawla said the survey gives members of the business community a sense of how their peers across all sectors are feeling and offers those perspectives for others to consider.

“The primary value of the survey is to give a broader sense of how leaders across the state see the future of the state, and help them make better, more informed capital growth decisions,” he said.

It also provides an opportunity to bring leaders together around the survey results to begin to develop an action plan moving forward, Chawla said.

“It provides an opportunity from a data perspective to use some shared data, shared information, to inform how they can collectively take action, but also how individually, as a leader, they can take action,” he said.

For the purpose of this story, the Business Record focused broadly on the topic of workforce, and Chawla said the survey data shows that the state needs to consider other strategies to bring more people into the workforce.

Iowa’s workforce participation rate was 68.6% in September, the most recent data available from the Federal Reserve Bank of St. Louis.

Chawla said growing a state’s population is difficult because there are so many variables someone might consider in making a move.

“Without population growth, it is going to get increasingly difficult to develop the workforce, but also understanding that trend will hopefully provide some insight to business leaders to understand, given those constraints and limits of population growth, what alternative strategies they need to deploy,” he said.

One strategy might be addressing the social infrastructure challenges some people face that keep them out of the workforce, Chawla said.

That could include child care access, access to affordable housing or health care issues, such as having to care for an elderly parent, he said.

“How do you engage and enable those who want to be in the workforce but because of some of these social infrastructure constraints, the cost of engaging in the workforce is too high,” Chawla said. “I think understanding social infrastructure and addressing social infrastructure needs is a secondary key set of data that needs to be assessed and used by decision makers and business leaders, so they can develop strategies to engage those who are already in the state who have a willingness to engage in the workforce but currently aren’t able to because of those constraints.”

Data

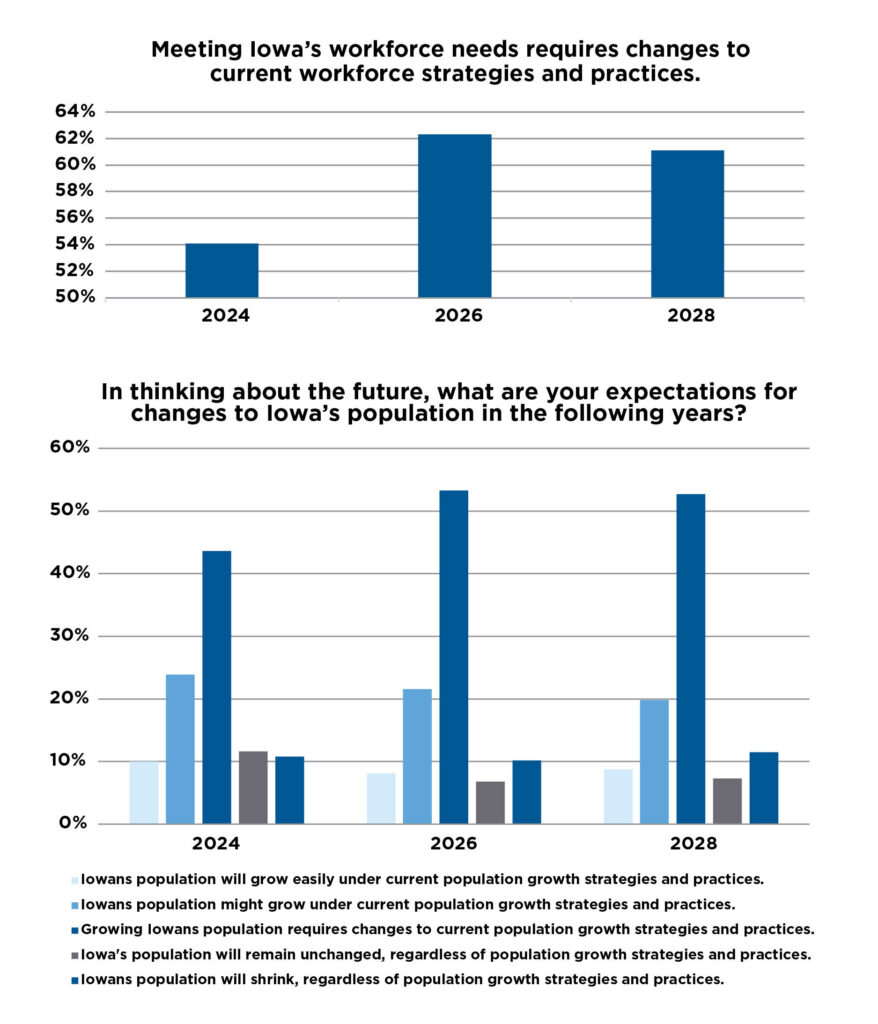

According to the survey, 54.1% of those responding said changes are needed to current strategies and practices for Iowa to meet its workforce needs in 2024. That number jumps to 62.3% for 2026 and 61.1% for 2028.

When it comes to growing Iowa’s population, the survey showed that 43.6% of those responding said changes would be needed to grow the state’s population. That number increases to 53.3% in 2026 and 52.7% in 2028.

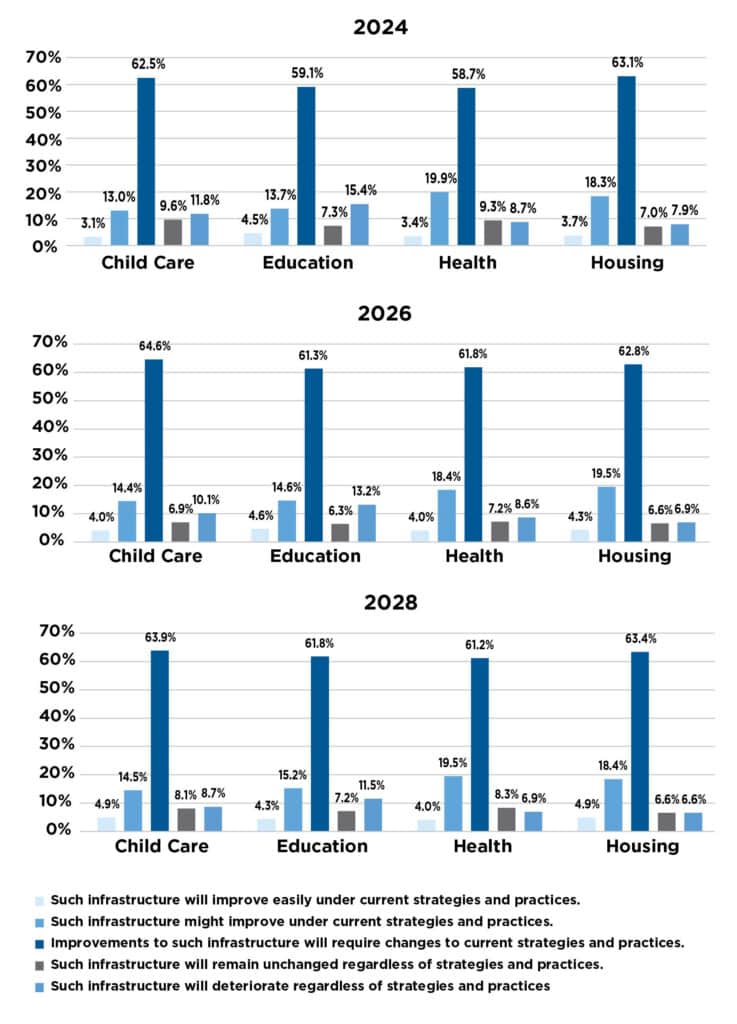

Under social infrastructure, the survey addresses child care, education, health and housing.

According to those results, 62.5% of those responding said changes in current strategies and practices are needed to improve child care in Iowa in 2024. That increases to 64.8% for 2026 and 63.9% in 2028.

For education, those numbers are 59.1% in 2024, 61.3% in 2026 and 61.8% in 2028. For health, the percentage responding that changes would be needed to see improvement were 58.7% in 2024, 61.8% in 2026 and 61.2% in 2028. And for housing, the percentages are 63.1%, 62.8% and 63.4%, respectively.

What leaders had to say

The Business Record reached out to leaders at three companies across Iowa to learn about challenges they are facing and gauge their expectations for the future. The Business Record spoke with Lori Mason, president of Seneca Foundry in Webster City; John Kehoe, vice president of marking, manufacturing for Involta in Cedar Rapids; and Mark Willett, president and general manager of Clow Valve in Oskaloosa.

Here is some of what they had to say. Their responses have been lightly edited for clarity and brevity.

What is your company’s top workforce challenge?

Kehoe: With our focus on technology and infrastructure, growth attracting more talent to pursue a STEM (science, technology, engineering and math) career is critical. Today, STEM pursuits after college are seeing lower growth than other careers. STEM skills are needed in our supply base, innovation clusters and to support our customers.

Willett: The manufacturing industry as a whole faced a major setback after losing in excess of a million jobs during the pandemic. Since then, there have been substantial strides toward recovery, but according to the U.S. Chamber of Commerce, more than 600,000 total manufacturing jobs remained open as of August 2023. At center stage is the significant skilled trades pipeline that must be filled. That is, in part, because we’re losing thousands of boomers from the skilled trades to retirement. Compounding the issue is the lack of interest among younger generations in taking over these jobs.

Mason: The most challenging workforce issue that we are experiencing is finding candidates with acceptable employability skills, such as being able to problem solve, having good communication skills, ability to collaborate with a team and having appropriate emotional intelligence in the workplace.

What needs to happen to address that challenge?

Kehoe: Today, we are partnering with colleges and universities to increase their focus on STEM classes. We are also participating in elementary and high school programs to promote interest in STEM: robotics competitions, data and computer science challenges and providing tours of our facilities to allow students an opportunity to see high-end computing in action.

Willett: To help address the deficit in skilled trades, more programs are needed as part of the high school curriculum that provide the option to learn basic knowledge and skills within a safe and appropriate setting for student exploration and achievement. Beyond the high school level, partnerships are needed between industry and local trade/vocational schools. We have partnered with our local community college to create a degreed path for our maintenance, machinists and programmers that is tailored directly to our needs. We recruit local high school graduates to enter the program where we require them to work at least 20 hours while enrolled in school. We provide a $1,500 sign-on bonus, tool allowance and $1,500 graduation bonus while also paying their tuition. Once these individuals graduate, there is an 18-month employee retention commitment. We have found this to be highly effective at recruiting and retaining talent for our skilled trades.

Mason: In my opinion, many of the employability skills are either not being taught in the school system or not being enforced in holding students accountable. Parenting is the No. 1 influence on a child’s ability to learn and be a productive member of society, but the partnership between parents and schools can have an even greater impact. Both need to be working together setting expectations and truly holding them accountable for decisions and actions that are ultimately preparing them to be in the workforce with developed employability skills.

How optimistic are you that positive change will occur to address that challenge? What are your expectations?

Kehoe: Very Optimistic. With the introduction of how artificial intelligence (AI) can accelerate business growth, STEM is getting a renewed focus. The skills to build, program and leverage AI in business is exciting for students entering college as well as working professionals who are looking to change careers. Iowa is well positioned with access to well-known colleges and universities who consistently prove they bring innovations to market. I expect to see more focus on economic development to attract key businesses across the state. By attracting key innovative companies, the ability to retain talent will increase, allowing for investments to expand and provide a funnel for talent to find job opportunities in the state.

Willett: As more and more high schools work to implement training programs that highlight skilled trades as a stable, secure career path with significant opportunity, my optimism increases. Moreover, state funding is becoming increasingly available for industry and institutions alike to help fill the skilled worker shortage. It’s a marathon, not a sprint, and it will take significant effort on all sides – from parents to educators to students to employers – to break through the misconceptions around skilled trades that drive the lack of incoming youth.

Mason: I am not optimistic that there will be a positive change to address the employability skills in the near future. As employers, we are needing to redefine and create new positions within the company to work with and work around the lack of employability skills the workforce currently has. It is critical that companies are investing in advanced technology and automation for long-term sustainability.

What is your top economic concern?

Kehoe: Tremendous pressure is being applied to smaller businesses as a result of inflation and high interest rates. With more people focused on basic necessities, entrepreneurs have had to pull back, and some small businesses have had to close their doors. It is never good to see retraction in the market as ripple effects run through every business vertical.

Willett: My biggest economic concern is a continuing upward movement in interest rates, which would prolong the nationwide slowdown in construction, leading to a sustained softening of our market.

Mason: My top concern falls within social infrastructure. As a state and as communities, we need to invest more resources making changes to current strategies and practices impacting social infrastructure needs.

How optimistic are you about the overall economy?

Kehoe: The survey results suggest “cautious optimism” across the state. One cannot disagree that between 2020 and 2022, with disruptions created by COVID-19, people still feel the aftermath and worry about markets returning. As we look toward 2024, companies are affirming investments, and the government has pledged investments in key infrastructure areas. Both of these signal positive market movement and will continue to provide job opportunities across multiple vertical sectors. As an example, looking at manufacturing, many companies are reviewing investments to have supply and production closer to customers. This reinvestment is bringing manufacturing jobs back to the U.S., allowing Iowa to participate in these efforts.

Willett: Despite the current economic headwinds, our long-term outlook remains optimistic. We recently initiated construction of a $75 million replacement and expansion of our iron foundry. This new facility will focus on automation, significantly reducing potential safety and ergonomic hazards, and implementing environmental controls that will allow us to recycle and reuse approximately 9,000 tons of iron sand, diverting it from the landfill. The capital project will allow us to easily flex our output to match customer demand and further secure the plant’s long-term viability.

Mason: I am proud to be born and raised in Iowa, proud to raise my family in Iowa and proud to operate a business in Iowa. I am confident that as we work on never-ending economic issues, we will continue to grow and thrive, positively impacting the quality of life for Iowans.

After reading the executive summary of the survey results, what is one key takeaway from the report you would like to share?

Kehoe: A renewed energy starting early with high school programs and internships will help students find the career they consider fun. A strong focus needs to be applied in workforce attraction and development in order to meet business demands. The expansion of trade school programs all the way through higher education needs attention. Businesses are already short of welders, electricians, data scientists and advanced robotics skills. Also, seeing the need for succession planning in smaller businesses will continue to create challenges unless the pipeline of talent expands. The state is well positioned to capitalize on growth, has a great culture and promotes business expansion.

Willett: The evolving needs of the workforce really resonated with me as I read the executive summary. Over the last five years, we have invested more than $2 million dollars in training for our workforce. We have found that the key to success is an engaged workforce that comes to work with a purpose that allows them to make sense of how their jobs tie to the success of the organization. Rooted in the eight key founding principles of our organization – safety, environmental, leadership, accountability, excellence, trust, teamwork and communication – the impact of our program is evaluated through employee assessments and 360 reviews. The positive influence the program has had is paramount to our employee engagement.

Mason: One key takeaway from the executive summary that I found is that looking at the big picture, there is no one industry or no one geographical region that stands out among the others. Most issues, concerns and optimism fall across all industries and all geographical areas.

Michael Crumb

Michael Crumb is a senior staff writer at Business Record. He covers real estate and development and transportation.