Office vacancies increasing in Greater Des Moines area

Business Record Staff May 8, 2024 | 9:59 am

1 min read time

316 wordsAll Latest News, Real Estate and DevelopmentThe percent of vacant office space in the Greater Des Moines area increased in the first quarter, prompting an increase in concessions to office tenants, market reports from CBRE Inc., JLL and Cushman & Wakefield show.

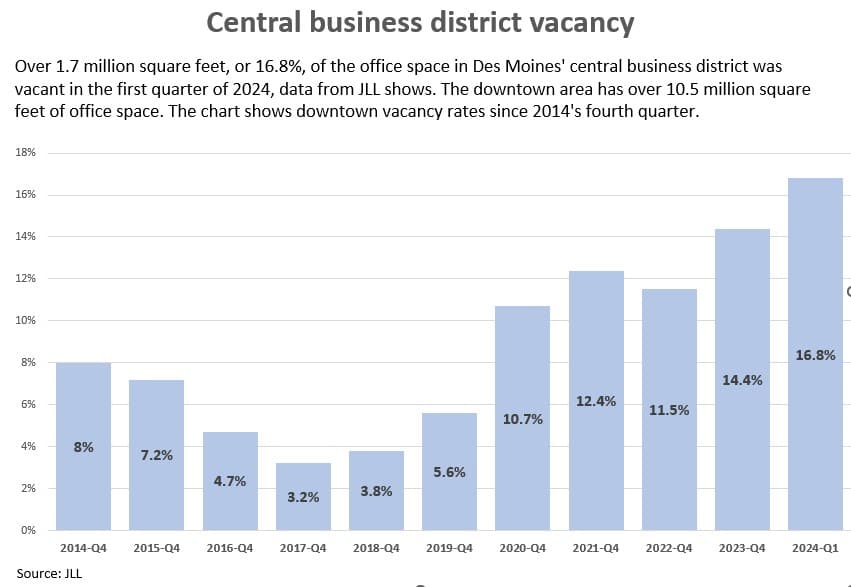

In Des Moines’ central business district, over 1.7 million square feet, or 16.8%, of the office space was vacant in 2024’s first quarter, JLL data shows. The percentage is the highest vacancy rates have been since 2007, according to Eric Land, research manager for JLL.

The increase in vacancy in the central business district can mostly be attributed to Wells Fargo relocating many of its downtown office workers to its West Des Moines campus, Land wrote in an email.

“The downtown real estate market goes through cycles,” Carrie Kruse, the city of Des Moines’ interim economic development administrator, said during the Business Record’s recent commercial real estate forum. “We saw [high vacancy rates] in the early 2000s. We saw it again coming out of the recession in the 2010-era.”

Light tech projects helped fill vacancies in the mid-2010s, Kruse said. Also, “a lot of market-rate housing and boom of hotels downtown really built us out of those issues at that time. I see housing being a key component to solving some of the [current] vacancy issues downtown.”

Highlights from the first-quarter office market reports show:

- Suburban office markets had the highest leasing activity quarter over quarter, accounting for over 80% of new leases, according to CBRE’s report.

- About 878,000 square feet of office space was taken off the downtown market, either because of conversions to residential or being bought by a government entity, according to JLL’s report.

- Portions of Wells Fargo’s downtown properties that have been vacated are being marketed for “redevelopment into multifamily or hotels,” according to Cushman & Wakefield.

To read CBRE’s first-quarter report, click here.

To read JLL’s first-quarter report, click here.

To read Cushman & Wakefield’s first-quarter report, click here.