A look at the Des Moines area home building market

25% of homes sales are new construction

Home buyers unable to find existing homes to purchase are turning to new construction, a more readily available option in a tight market.

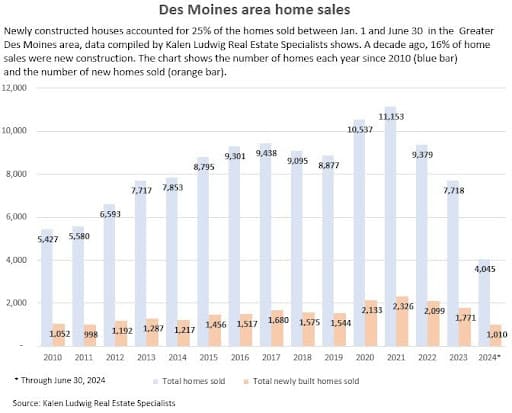

In the first six months of 2024, 25% of houses sold in the Greater Des Moines area were newly built, information compiled by Kalen Ludwig Real Estate Specialists shows. The proportion of new home sales to all sales has been steadily rising since 2020, when 20% of the houses sold were new builds. In 2015, 16.5% of sales were new construction, the data shows.

“We’re seeing a greater [percentage] of new home sales because that’s the options that are available for people,” Ludwig said.

While there are more homes listed for sale in the Des Moines area than a year ago, houses in good condition and ranging in price from $325,000 to $600,000 tend to sell quickly, especially if they are located in western Polk County or in Dallas County. New home construction is filling some of the need for houses in that price range.

Still, there isn’t a glut of newly built homes on the market, Ludwig said. “We still have a lower inventory which isn’t surprising considering the higher interest rates.”

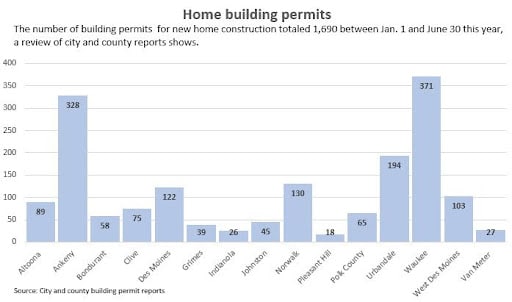

Between Jan. 1 and June 30, 1,690 building permits for houses or townhomes were issued by 14 area communities and Polk County, a Business Record review of permit records shows. During the same period in 2023, 1,631 residential permits were issued. In 2021, when interest rates were lower, communities issued 2,250 residential building permits during the first six months of the year.

“This year has been what I’d call a very normal year,” Wade Hiner, president, sales and marketing for Waukee-based Destiny Homes, said. “The fact that we’re in a 7% interest rate environment, and still maintaining what we typically have as an average year, I would say that’s a huge victory.”

The current uncertain economic conditions have prompted builders to adopt a cautious strategy and not have a lot of inventory on the market, Ludwig said. Home builders typically construct numerous speculative houses in the summer, giving buyers a choice of floor plans and housing styles. Now, builders only have a small number of spec homes for sale, adding more only when sales occur, she said.

“It’s really a unique time,” Ludwig said. “We’re all watching the market. We don’t want to miss opportunities, but we also don’t want to put ourselves too far out there.”

The upcoming presidential election and economic unknowns are prompting builders “to be more careful,” Ludwig said.

This week, the Federal Reserve left interest rates unchanged. However, in public comments after the meeting, Chair Jerome Powell said that a reduction could come “as soon as the next meeting in September.” If that occurs, there was speculation that another rate cut could occur in November.

Currently, the interest rate home builders are typically charged on loan to buy land and materials is between 8% and 9%, Ludwig said. If interest rates are lower, builders could start building more speculative houses, she said.

“It’s hard to throw up a lot of spec houses at 9% interest rates,” Ludwig said.

Hiner said higher interest rates for commercial lines of credit have prevented Destiny Homes from having a large inventory of new homes to buy. “It costs us more to do that,” he said.

That could change in 2025 if the Federal Reserve begins lowering interest rates, Hiner said.

“Nobody’s got a crystal ball, but if what everybody is saying occurs, we’re in for a really good 2025.”

More online: To read Kalen Ludwig’s blog about the homebuilding market, click here.

Kathy A. Bolten

Kathy A. Bolten is a senior staff writer at Business Record. She covers real estate and development, workforce development, education, banking and finance, and housing.