Further farm income decline expected, Rural Mainstreet Index shows

Business Record Staff Mar 21, 2025 | 3:40 pm

3 min read time

715 wordsAll Latest News, Economic Development

More than 60% of rural bank CEOs expect farm income to decline this year, according to the latest Rural Mainstreet Index. The report is based on a survey of bank CEOs from a 10-state region dependent upon agriculture or energy economies.

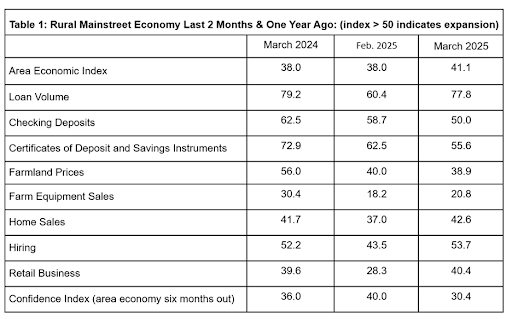

Regionally, the index fell below growth-neutral in March for the 18th time in 19 months – increasing to 41.1 from February’s 38.0. The index ranges between 0 and 100, with a reading of 50.0 representing growth-neutral.

Farmland prices sank for the 10th time in 11 months, while farm equipment sales dropped for the 19th month.

“The economic outlook for 2025 farm income remains weak, according to bank CEOs. However, farm commodity prices have recently improved, but not enough for profitability among a high share of producers,” said Ernie Goss, Jack A. MacAllister chair in regional economics at Creighton University.

The farm equipment sales index rose to 20.8 from February’s 18.2.

“This is the 19th straight month that the index has fallen below growth-neutral. High input prices, tighter credit conditions and weak farm grain prices are having a negative impact on the purchases of farm equipment,” Goss added.

In Iowa, the March index improved to 39.2 from 32.8 in February. The state’s farmland price index for March declined to 33.6 from 38.1 in February. Iowa’s new hiring index for March increased to 55.7 from February’s 40.8.

According to trade data from the International Trade Association, Iowa exports of agriculture goods and livestock for the first month of 2025, compared with January 2024, fell by $62.2 million for a decline of 37.3%. Mexico was the top destination to begin 2025, accounting for 77.4% of January Iowa agriculture and livestock exports, according to the report.

Terry Engelken, vice president of Washington State Bank in Washington, Iowa, said in the survey that, “We are noticing some leases falling through since the renters cannot obtain operating financing for 2025.”

The U.S. Department of Agriculture is expediting $10 billion in assistance to farmers through the Emergency Commodity Assistance Program, officials announced March 18, but it may not be enough to buoy the industries, one banker said.

Jeff Bonnett, president at Havana National Bank in Havana, Ill., said, “A third year of extremely low corn and soybean prices (2025 prices are expected to remain low) continues to keep us on edge. The federal relief coming this week for 2024 will help our farm producers but is half of what was anticipated and discussed at the end of 2024.”

For the 10th time in the past 11 months, farmland prices were below growth-neutral. The region’s farmland price index fell to 38.9 from 40.0 in February.

“Elevated interest rates and higher input costs, along with below break-even prices for a high share of grain farmers in the region, have put downward pressure on ag land prices,” said Goss.

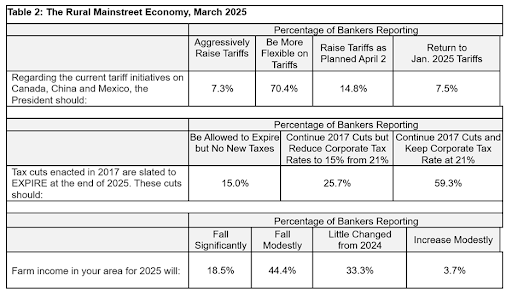

The overwhelming majority, 85.0%, of bankers said they support the continuation of the 2017 tax cuts on individuals and corporations, with 25.7% of backers pushing for a cut in the corporate income tax rate from the current 21% to 15%.

Only 7.5% of bankers support returning to January 2025 tariff levels on Canada, China and Mexico, Goss said. About 70.4% of bankers support the administration taking a more flexible approach to tariffs.

Other regional findings from the survey include:

- Home sales remained soft with a March reading of 42.6, up from February’s 40.0. Regional retail sales rebounded but remained weak, much like the nation, with an index of 40.4, up from 28.3 in February.

- The new hiring index for March rose to 53.7 from February’s 43.5. Job gains for nonfarm employers more than offset weakness among farm producers.

- The March loan volume index increased to 77.8 from February’s 60.4. The checking deposit index plummeted to 50.0 from 58.7 in February. The index for certificates of deposits and other savings instruments dropped to 55.6 from 62.5 in February. Federal Reserve interest rate policies have boosted CD purchases above growth-neutral for 28 straight months.

- Rural bankers remain pessimistic about economic growth for their area over the next six months. The March confidence index sank to 30.4 from February’s 40.0. “Weak grain prices and negative farm cash flows, combined with downturns in farm equipment sales over the past several months, continued to push banker confidence lower,” said Goss.