Business Council’s Q1 economic outlook index falls, but remains positive overall

Business Record Staff Apr 7, 2025 | 3:31 pm

3 min read time

824 wordsAll Latest News, Economic Development

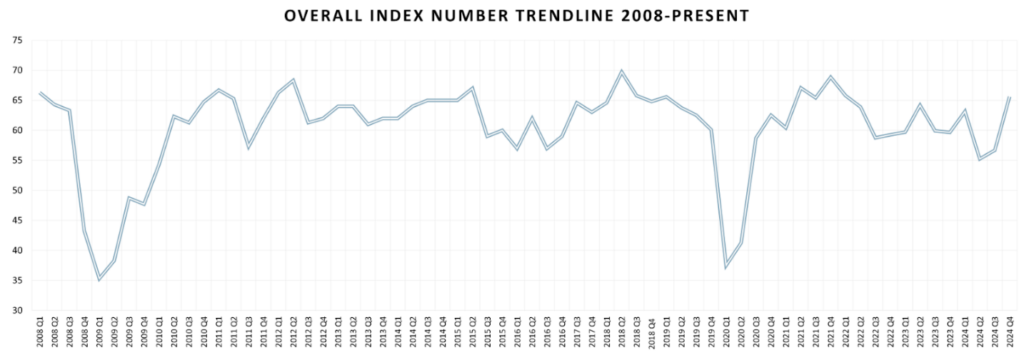

The Iowa Business Council published its first-quarter Economic Outlook Survey results today, showing an 8.49-point decrease from the previous survey.

IBC’s Economic Outlook Survey measures expectations and optimism for the six months ahead regarding sales, capital spending and employment. A reading of above 50 is positive.

For the first quarter of 2025, the index came in at 57.14. That’s down from the 65.63 reading for the fourth quarter of 2024, which was up 8.96 points from the third quarter. The first-quarter results are also down 3.27 points from the historical average of 60.41.

All three index categories experienced declines compared with the 2024 fourth-quarter survey:

- Sales expectations declined 4.46 points to a value of 64.29.

- Capital spending expectations declined 9.30 points to a value of 54.76.

- Employment expectations declined 11.68 points to a value of 52.38.

The survey results were captured before the April 2 tariff announcements.

Of those surveyed, 71% listed national supply chain issues, infrastructure and federal regulations as top business challenges. Inflation and workforce attraction and retention were cited by 43% of survey participants.

Joe Murphy, IBC’s president, said the results were not a complete surprise.

“It’s obviously a moderation from the high we started the year with,” he said. “I think what’s positive is that all three categories remain above that 50-point threshold, so we do continue to project a positive outlook for Iowa’s economy in the coming six months.”

The dip reflects the events of the preceding 90 days, Murphy added.

“There’s still a lot of questions on federal regulatory policy — we haven’t really seen a lot of action there yet, although it’s still relatively early with the new Congress and new [presidential] administration. The tax policy continues to be something we’re very optimistic about when we talk to our delegation. But still, it’s a process and we’re not even close to being at a point where we’ll see a final bill. And then, thirdly, just the uncertainty regarding the tariff situation leading up to this last week.”

Last week, President Donald Trump announced new tariffs on imports. China, one of the U.S.’s largest trading partners, responded by matching Trump’s tariff rate on the country, imposing a 34% tariff on the United States. News of China’s move sent the U.S. stock market falling. Today, U.S. stock indexes are down 2% or more for a third consecutive day.

“What happened last week is not reflected in these [first-quarter survey] numbers. But I think leading up to April 2, the uncertainty about what those tariffs would look like, would they be overly broad, is there a possibility that these will be long lasting, what’s going to be tariffed, that sort of anxiety around what’s in the policy is reflected in this,” Murphy said.

The IBC remains optimistic overall, he said.

“There are a lot of good things happening, but in order to sustain that momentum and optimism, at the state level, we continue to support tax policy that reforms our unemployment insurance taxes, that’s still going through the process [in the Legislature],” Murphy said. “We’re still looking at the property tax proposals out there. We have not officially endorsed that policy yet, but it’s definitely a step in the right direction.”

Iowa ranks 32nd in property tax competitiveness, according to the Tax Foundation’s 2025 State Tax Competitiveness Index.

“There’s obviously some room for improvement there,” he said.

How the tariffs shake out will play a role in future optimism in Iowa. The IBC will be watching how the tariffs and potential retaliatory tariffs will affect state businesses, especially in the agriculture and advanced manufacturing industries, Murphy said.

“When we think about the national landscape, obviously getting a handle on how these tariffs will impact Iowa companies and economy is some of that uncertainty that we have. We don’t want these tariffs to be overly broad; they seem to be that. We don’t want them to be long-lasting. It’s unknown whether that will be the case or not. We would also hope the tariffs are kept low on areas and products that our country imports that we can’t easily source in America, whether that be certain types of metals for manufacturing or even ingredients for pharmaceuticals,” he said.

IBC is also watching tax policy on the federal level.

“We’re moving in the right direction, it’s just going to take some time to see if the 2017 Tax Cuts and Jobs Act, how that gets put back together and extended,” he said.

Since 2004, IBC has surveyed its member companies quarterly. The nonprofit’s members are from Iowa’s 22 largest employers and have a presence across all 99 counties. To review previous Economic Outlook Surveys, visit the IBC’s website.

“We look forward to continuing to work with policymakers in Iowa and in Washington, D.C., to craft pro-growth business policies that expand opportunity across all sectors of Iowa’s economy,” Gage Kent, CEO of Kent Corp. and chairman of the Iowa Business Council, said in a press release.