Equipment Leasing & Finance revises outlook down

Business Record Staff Apr 25, 2025 | 3:39 pm

3 min read time

661 wordsAll Latest News, Economic Development, Manufacturing, Retail and Business

The Equipment Leasing & Finance Foundation, a national nonprofit focused on the equipment finance sector, this week published its second-quarter update for 2025, revising expectations downward.

According to a press release from the foundation, “the U.S. economic outlook has worsened amid sharp declines in consumer and business sentiment, rapidly rising inflation expectations, and sky-high policy uncertainty.”

The 2025 Equipment Leasing & Finance U.S. Economic Outlook has revised its 2025 equipment and software investment forecast to 2.8% (down from 4.7%) and its U.S. GDP forecast to 1.2% (down from 2.7%).

The report expects that “a ‘growth pause’ by the end of 2025 is more likely than a sustained downturn, although the probability of a near-term recession has clearly risen.”

Highlights from the 2025 outlook include:

- U.S. economy: The report stated that tariffs and their related uncertainty effects are expected to weigh on the economy.

- Manufacturing: Several measures of industrial activity have strengthened, including industrial production, capacity utilization and the ISM Purchasing Managers Index for Manufacturing. Moreover, shipments and new orders of core capital goods have been generally positive in recent months, driven by strong growth in primary metals, computers and electronics, the report stated. Authors of the report stated that the readings may reflect tariff-related pull-forward activity, and it is noteworthy that new business volume is roughly flat year-to-date while industry confidence has plummeted as measured by ELFA’s Capex Finance Index and ELFF’s Monthly Confidence Index, respectively.

- Equipment and software investment: First-quarter investment in equipment and software is expected to bounce back after a poor performance in the fourth quarter. The foundation also expects that “uncertainty around trade policy and heightened concerns about the overall economic climate are expected to drag on investment growth over the next six months.”

- Equipment finance industry: Financing options may be explored at a higher rate because of tariffs, leading to a negative effect on the equipment finance industry, the report stated. Economic uncertainty may lead to delayed purchase decisions and slower economic growth.

“Extraordinarily high economic uncertainty related to U.S. trade policy has sent shockwaves through the economy, prompting large swings in financial markets and a sharp reduction in equipment finance industry confidence,” Leigh Lytle, president of the foundation and president and CEO of the Equipment Leasing and Finance Association, said in a press release. “At the same time, labor markets remain healthy, consumer spending bounced back in March, and the manufacturing sector appears to be holding its own. The elephant in the room is tariffs: if the administration ultimately moves forward with the ‘reciprocal’ tariff rates announced in early April, they will weigh heavily on the economy’s growth prospects this year. On the other hand, if bilateral or multilateral deals are struck with key trading partners and these additional tariffs are avoided, the business climate would quickly improve.”

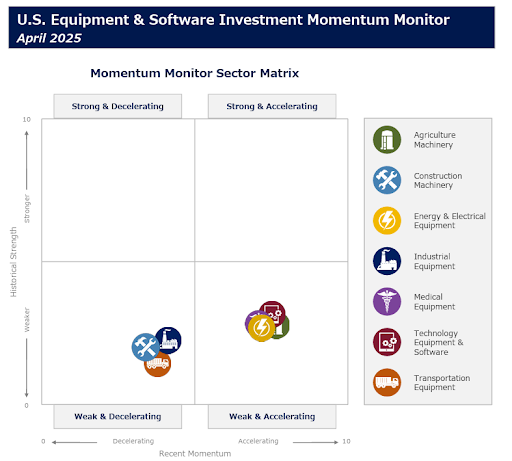

The Foundation-Keybridge U.S. Equipment & Software Investment Momentum Monitor, which is released with the Economic Outlook, has been revised to track seven equipment and software investment verticals, down from 12 previously.

The Momentum Monitor Sector Matrix (pictured above) provides a data visualization of values of each of the seven verticals based on recent momentum and historical strength. This month, four verticals are weak but accelerating, while three are weak and decelerating. Over the next six months the foundation expects the following trends to materialize on a year-over-year basis:

- Agriculture machinery investment growth may improve modestly but is likely to remain weak overall.

- Construction machinery investment growth is expected to remain negative.

- Energy equipment investment growth is expected to improve modestly.

- Industrial equipment investment growth is likely to slow and may turn negative, but recent movement (if sustained) is encouraging.

- Medical equipment investment growth is expected to improve.

- Technology equipment and software investment should strengthen.

- Transportation investment growth is likely to contract.

The foundation produces the Equipment Leasing & Finance U.S. Economic Outlook report in partnership with economic and public policy consulting firm Keybridge Research. The annual economic forecast provides the U.S. macroeconomic outlook, credit market conditions and key economic indicators.