Pursuing a Better Investment Experience

Business Record Staff Aug 1, 2018 | 11:00 am

2 min read time

565 wordsBusiness Insights Blog, FinanceBY KENT KRAMER, CFP®, AIF®, Chief Investment Officer, Foster Group

Does the increased volatility in financial markets in 2018 compared to 2017 have you feeling a bit anxious? Recently, on separate occasions, I heard the executive producer of “The Big Bang Theory” and the author of “Principles,” who is also the founder of Bridgewater & Associates, talking about the same subject, uncertainty.

Ray Dalio, the best-selling author of the book “Principles” and the founder of Bridgewater & Associates, one of the world’s largest hedge funds, referred to a piece he wrote in 1987 titled “Making Money vs. Making Forecasts,” in which he wrote:

“Truth be known, forecasts aren’t worth very much, and most people who make them don’t make money in the markets. … This is because nothing is certain and when one overlays the probabilities of all the various things that affect the future in order to make a forecast, one gets a wide array of possibilities, not one highly probable outcome.”

Dave Goetsch, executive producer of “The Big Bang Theory,” spoke recently of how his life as an investor became less stressful when he embraced uncertainty. His life and investment philosophy now include the acknowledgement that life is uncertain, but he is not powerless. By embracing uncertainty, he can take a much longer perspective on current circumstances, because he likely won’t understand just how good or bad something was until 10 to 15 years in the future. He related the story of how not getting one writing job in New York he really wanted left the door open for him to take the job on “The Big Bang Theory,” which has been the best writing experience of his career. But he knew none of that 12 years ago.

“You can either be bummed out or happy that you don’t know what will happen tomorrow.” Dave Goetsch

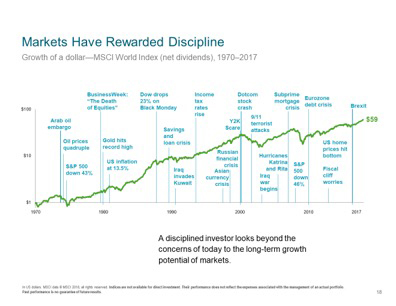

In a sense, uncertainty is necessary for successful investing. Because risk and return are so inextricably linked, investors desiring higher expected returns must accept additional risk to increase the odds that they will achieve better results. Risk, which is an expression of the uncertainty and unpredictability of the future, is reflected every day in securities prices that, in turn, reflect investors’ expected returns. Relatively lower prices being paid for earnings or book value indicate higher risk (uncertainty and unpredictability) and higher expected rates of future returns. Therefore, investors seeking long-term higher returns have a reason to be happy that they don’t know what will happen tomorrow.

Long-term investors recognize “tomorrow” is not the finish line or the place where ultimate success or failure is measured. Uncertainty means investors don’t know whether stock markets will go up or down tomorrow, or next month, or next year. However, even with a future consisting of what Dalio referred to as a “wide array of possibilities with varying probabilities” investors can position themselves for long-term success by taking steps like being well diversified.

| Kent Kramer View Bio |

PLEASE NOTE LIMITATIONS: Please see Important Disclosure Information and the limitations of any ranking/recognitions, at www.fostergrp.com/info-disclosure. The above discussion should be viewed in its entirety. The use of any portion thereof without reference to the remainder could result in a loss of context. Foster Group cannot be responsible for any resulting discrepancy. A copy of our current written disclosure statement as set forth on Part 2A of Form ADV is available at www.adviserinfo.sec.gov.