Event Preview: 2018 Economic Forecast Luncheon

CHRIS CONETZKEY Jan 16, 2018 | 5:28 pm

5 min read time

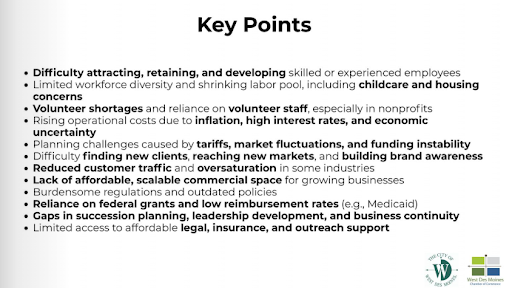

1,126 wordsAll Latest News, Business Record Insider, Economic DevelopmentWhile the stock market continues to hum, new and unpredictable variables present opportunities and potential hurdles for businesses in 2018, including federal tax reform going into effect, changes to the state’s tax environment coming, and the state’s budget challenges looming large.

So what does the future hold in the United States, in Iowa and for your business? In advance of the Business Record’s Jan. 25 Economic Forecast Luncheon, we wanted to get our panelists’ thoughts on the economy in 2018 to preview where some of the discussion will go.

I’m excited to moderate this year’s event, and look forward to seeing you all there and helping you get answers that will guide you to do your best business in 2018 and beyond.

Chris Conetzkey, publisher of the Business Record

Panelist Question: What is the most important thing businesses should know about the economy in 2018?

Beth Townsend, Director, Iowa Workforce Development

Given the current trends in employment on national and state levels, the competition for skilled workers is only going to increase. 2018 is the time to embrace and support the overall strategy to address the skills gap and create a sustainable talent pipeline in Iowa that is the Future Ready Iowa Act. Daily businesses face the effect of not having sufficient numbers of skilled workers in the workforce and can ill afford not to take bold steps to address the issue by doing more, doing it better and doing it now.

Debi Durham, Director, Iowa Economic Development Authority

The most important thing to know about both the Iowa and U.S. economies in 2018 is the positive impact of federal corporate tax reform legislation. I applaud the recent passage of this legislation late last year and am positive that this action, of modernizing our outdated federal tax laws, will give Iowans the fairer, simpler, more competitive tax code they deserve and will benefit from. Prior to this new legislation, in 2017, according to the OECD, the U.S. tax code saddled our workers and job creators with the highest business tax rate in the developed world, making our companies, products and people less competitive in foreign markets. Outdated international tax rules impose penalties on companies that want to bring overseas profits back to Iowa communities to hire, invest and expand operations. Our tax code has weighed Iowa’s economy down. Now, I am confident that as we take the much-needed steps to level the tax playing field, Iowa workers and job creators can compete on a global scale and benefit from the prospect of onshoring, innovation and new wealth creation here at home.

Cameron Hinds, Regional chief investment officer, Wells Fargo Private Bank

A key economic issue is the potential for fiscal stimulus to take over from monetary accommodation to drive growth in an aging economic expansion. For much of the past eight years, monetary accommodation by the Fed has been a key reason for consistent (yet anemic) economic growth. Can the combination of the recent tax bill and moderately higher deficit spending drive even higher growth in 2018? We believe the answer is most likely yes. Wells Fargo has recently increased our 2018 U.S. GDP growth estimate from 2.4 percent to 2.9 percent. We believe that longer-term growth stimulation from the tax bill is more about a change to incentives versus simply lowering corporate taxes in 2018. The majority of future economic growth may come from the newly competitive U.S. corporate tax rate (bringing more operations back to the U.S.), foreign cash repatriation, a territorial overseas tax system, and five years of full expensing for capital equipment investments. All could be major components in businesses increasing growth projects and creating new jobs. Some of this growth potential could be somewhat offset by full employment, modestly higher interest rates and a new concern over slowly building inflation (with an emphasis on wage inflation). Based on the above, we expect stronger economic growth in 2018 with the question of sustainability in 2019 left for next year’s panel.

Jeff Robinson, Senior fiscal legislative analyst, Legislative Services Agency

Perhaps not the single most important economic force, but one most significant to Iowa, is the aging of the Iowa workforce. Iowa employers have struggled lately in finding qualified workers, particularly away from the large population centers. While not a new problem for Iowa, it has been getting worse, and the situation will continue to deteriorate over the next 10 years. Over the 10 years ending 2011, Iowa’s population aged 20 through 64 grew an average of 11,700 each year. For the next six years, annual growth for that age group slowed to 2,700. Over the upcoming 10 years, demographic projections suggest the working-age population in Iowa will decline 1,200 a year. While just a few years back Iowa’s working population grew 117,000 over 10 years, that segment of the Iowa population is expected to contract by 12,000 over the next 10 years. Employers will need to continue to develop ways to entice a higher percentage of the working-age population into the workforce, as well as adequately incentivizing work beyond the normal retirement age.

Dave Nelson, Chairman and CEO, West Bank

We are in an economic boom. So, when will it end? Economic expansions don’t die of old age; something needs to go wrong to stop it, such as a Federal Reserve overreaction, political turmoil, government pension crisis, war in Korea, etc. During the past six to seven years most Iowa businesses have done very well. Conversely, if your business has not performed well during a period where others in the same industry have done great, chances are it won’t improve during a weaker economy. The economy has cycles, and it’s very difficult to determine if we are at the beginning of the boom, somewhere in the middle or near the end. Most of our national and state economic indicators are positive, so my belief is we are somewhere in the middle:

· Consumer confidence is at a very high level.

· Leading national and state of Iowa economic indicators continue to improve.

· The labor force participation rate bottomed in late 2015 and has been stable to slightly increasing since then.

· Expected inflation is right around 2 percent, just where the Fed wants it.

· The unemployment rate is very low.

· Wages at the low end are not rising quickly, but they are rising faster than inflation.

· Retail sales for the Christmas season were very good.

· Household balance sheets are improving.

· Loan delinquency rates continue to decline, and overall credit quality with the banks is strong.

If your business is strong, it would seem prudent to reinvest to keep it that way and build reserves. If your business has not benefited from this economic boom, I would suggest divesting it before the value erodes.