As Iowa’s ag slowdown persists, insiders and observers monitor closely tied manufacturing sector in 2025

Mike Mendenhall Jan 17, 2025 | 6:00 am

6 min read time

1,398 wordsBusiness Record Insider, Economic DevelopmentOn the shop floor at Osmundson Manufacturing Co.’s facility in Perry in early January, workers shape, cut and powder coat tillage blades that will be installed on some of the most recognizable agricultural equipment brands in the U.S. and worldwide.

As the company enters 2025, fewer workers are on the lines making the circular blades and farm cultivation tools at Osmundson than a year ago.

Heather Bruce, president and CEO of the fifth-generation family-owned company, said that Osmundson was able to offer workers a voluntary separation package to avoid layoffs or production shutdowns as orders slowed in the last two years alongside the U.S. agriculture economy.

“ [The voluntary separations] really worked. We went from having about 97 employees on the shop floor to … now we have 57,” Bruce said. “Some of it was due to attrition in general. Some of it was a lot of people decided to take that compensation and found new opportunities while they had the chance.”

Manufacturing is Iowa’s largest industrial sector, making up 17% of the total real gross domestic product in the state’s most recent quarterly estimate. Many of Iowa’s manufacturers, like Osmundson, are tied to agriculture.

The U.S. Department of Agriculture’s farm sector profit forecast, updated on Jan. 5, predicts that net farm income in the U.S. will be $140.7 billion in 2024. That is down $6 billion, or 4.1%, from 2023.

When adjusted for inflation, USDA’s forecast expects a steeper 6.3% decrease. Although the report shows farm income is still 15.9% above the 20-year average.

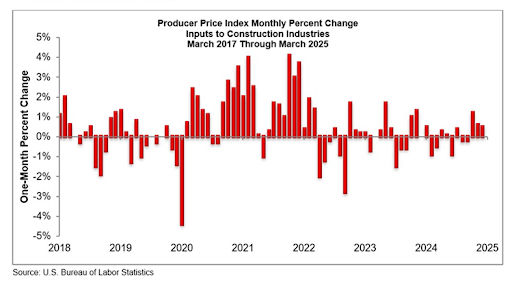

Christopher Pudenz, economics and research manager for Iowa Farm Bureau Federation, told the Business Record in advance of its Jan. 28 Economic Forecast luncheon, that continually high input costs for farmers and margin pressure have caused agricultural machinery manufacturers to lay off “thousands of workers” and “purchase fewer manufacturing inputs.”

“Last year everybody had too much inventory,” Bruce said. “There [weren’t] enough orders. We’re going into the same [this] year. They’re finally going to be chewing up more of their inventory because farmers don’t have the cash to buy this really big equipment. So they’re going to be rebuilding. They’re going to be rebuilding last year and this year.

“So the beauty of what we make is you still are going to turn up blades,” Bruce said. “You’re still going to have to plant and till and all those different things. So there’s still a market for it. The usage of those varies depending on the economy.”

Now entering the third year of the downturn, Bruce said she and others in her industry believe 2025 will bring the bottom of the market for agriculture manufacturers, with a rebound beginning in 2026.

“Right now, diversification is the name of the game. Everybody’s depressed this year,” Bruce said.

She said, in addition to working on efficiencies at Osmundson by reducing employee workload through automation, the company’s leadership is looking into new markets for its products. Osmundson wants to expand from selling its parts to original equipment manufacturers for planting and tillage and add value-added products and services.

The component manufacturer also wants to adapt its components to harvesting as well as construction and mining to diversify the number of markets Osmundson can access, Bruce said.

Manufacturing vs. Iowa’s broader economy

Iowa’s manufacturing sector as a whole did see recent job gains. Manufacturers added 600 jobs between October and November 2024, up 0.27%, according to Iowa Workforce Development’s statewide employment statistics data released in December.

However, job levels for the sector were down 2.55% year over year in November.

Drake University Associate Professor of Finance Tom Root told the Business Record that Iowa’s manufacturing sector is “kind of stagnant” and expects to see slow growth until there is a clearer picture of how the trade policies of President-elect Donald Trump will affect industries after he takes office Jan. 20.

Root points to Creighton University’s Mid-America Business Conditions Index December 2024 survey, which shows Iowa’s manufacturing exports down compared to a majority of its peers in the region.

According to the December survey, Iowa experienced a $1.4 billion drop in 2024 year-to-date manufacturing exports compared to the same period in 2023 for a 9.9% decline. Of the nine states surveyed, the manufacturing sectors in North Dakota and South Dakota were the other two that experienced a drop in exports. The other states surveyed were Arkansas, Kansas, Minnesota, Missouri, Nebraska and Oklahoma.

“That’s a kind of problem for Iowa, and it’s kind of slowing us down relative to everybody else in the region. I don’t think that’s going to change,” Root said.

Root said he was surprised by the Creighton survey’s finding that 45% of respondents expected worsening conditions for the first six months of 2025.

Some data suggests the slowdown in Iowa’s manufacturing sector is not being felt through the general economy or in the sentiment of Iowa business leaders more broadly moving into 2025.

As of November, data from Iowa Workforce Development shows the state’s economy had added 4,000 jobs from the previous year and the total unemployment rate was 3.1%, one percentage point better than the national average of at that time of 4.2%.

Two recent member surveys conducted by the Iowa Association of Business and Industry and the Iowa Business Council found an increase in optimism from state business leaders about the economy in 2025.

Respondents to the IBC 2024 fourth-quarter Economic Outlook Survey – which polls from its 21 business executive members – showed higher expectations for sales, capital spending and employment for 2025.

A majority of ABI members also expect an increase or stable sales and employment levels in the first quarter of 2025, according to its quarterly business survey.

“It’s really weird because there’s also [an economic sentiment] bump from the administration coming in, with people being excited about the broad business environment, potentially if we deregulate and if we increase spending and do some other things,” Root said. “And so it’s really difficult to try to sort out what that’s going to look like. And that’s that uncertainty piece.”

More than 70% of ABI respondents said they plan to make capital expenditures, the survey says. That’s up from 53% in the third quarter of 2024.

“That’s great to see, especially in Iowa,” ABI President Nicole Crain told the Business Record. “If you’re increasing your capital expenditures, that means you’re staying here. That means you’re reinvesting in your company, you’re adding new equipment, you’re just continuing to support your local economy. That number was as high as we’d seen it in a couple of years.”

Crain said more than 50% of ABI’s board, the group surveyed, are in the manufacturing sector.

At Osmundson’s Perry plant, Bruce said there is still a chance the company could do previously planned capital investment in 2025.

“For our industry, the first quarter is the telltale sign of how well that’s going to go. If the first quarter goes as well as we’re anticipating, we’ll still be able to do some capital expenditures this year,” Bruce said. “If not, it’ll just go on the book for next year.”

Tariff uncertainty

One concern on the minds of Iowa business leaders is the incoming administration’s proposed tariffs on Canadian, Mexican and Chinese goods.

Nearly 80% of the respondents in the ABI survey are apprehensive about the potential move’s effect on costs and supply chains.

Bruce, an ABI board member, said new tariffs won’t affect Osmundson’s ability to obtain raw material, as the company sources domestically. But she worries that it could affect her company’s ability to move into new international markets, especially if the countries targeted issue retaliatory tariffs in response.

According to Root, it’s unclear which industries would be affected by the proposed new tariffs, but he said, “One of the things that businesses don’t like is uncertainty.”

“I think the [incoming] administration has been very vocal as partially a negotiating tactic to try to get people to pay attention,” Root said. “But what actually gets imposed and what sectors are hit, we don’t know. When we have uncertainty, you don’t continue to produce and you don’t place new orders, and that slows down their whole process. So I think that’s something that’s really going to impact us.”

Mike Mendenhall

Mike Mendenhall is associate editor at Business Record. He covers economic development, government policy and law.