Building Value

Out of the recession, Hubbell brought new life to bank-owned developments

KENT DARR Oct 23, 2015 | 11:00 am

2 min read time

508 wordsCommercial Real Estate Guide, Real Estate and DevelopmentIn 2009, Rick Tollakson and his crew at Hubbell Realty Co. began a salvage operation that has returned more than $120 million in value to the Greater Des Moines real estate market.

The pieces of the operation were found in failed developments that had been taken over by banks hoping to recover funds from loans that backed the projects.

Although it wasn’t a part of Tollakson’s playbook as Hubbell president and CEO, the operation helped boost the company to the top of the heap of residential builders, a position it still holds based on permits for all forms of housing, including townhouses and single-family residences.

“The sweet spot for us was in the multifamily arena,” Tollakson said. “Home building companies lacked the wherewithal to finish them off.”

At the time, the Greater Des Moines real estate market was emerging from the Great Recession.

The state’s largest home builder, Regency Cos., was forced to shut down in 2008 when it couldn’t build and sell homes and townhomes fast enough to cover its debts and Wells Fargo & Co. pulled its line of credit with the company.

In some areas of the city, Hubbell was competing against banks that were trying to unload foreclosed properties at bargain prices.

“I was either going to compete with somebody else or compete with myself. I would rather compete with myself,” Tollakson said.

Hubbell scouted a landscape scattered with failed developments; banks looked for developers who could rescue the projects.

“You had bankers looking for solutions, and you had us looking to bankers for opportunities,” Tollakson said.

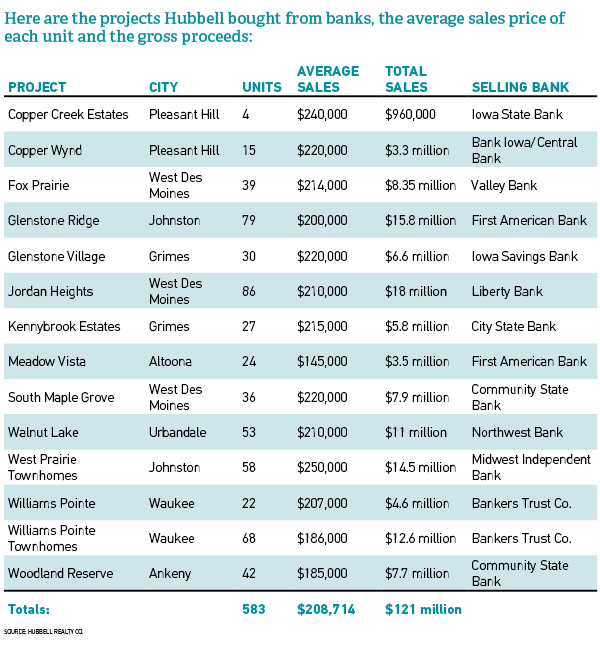

As a result, Hubbell bought 14 developments that were held by seven different banks.

The largest single block of projects had been started by Regency, but Hubbell also bought projects that had been launched during the heady days of the housing boom, when everyone from tree farmers to butchers decided they had the right stuff to enter the development game.

Hubbell also bought on the cheap. One example is the Glenstone Ridge project in Johnston. Hubbell paid First American Bank $1.2 million for the former Regency development, took out a $2.8 million construction mortgage and built 79 housing units. All but four have been sold. Hubbell anticipates a total return of nearly $16 million.

“We came out pretty good on most of them,” Tollakson said.

The key was offering a product, especially in townhouses, that people wanted to buy. The market was glutted with fourplexes that lacked basements and other amenities, he said.

“We had to come up with new and innovative designs for the market,” Tollakson said.

As an example, Hubbell converted attached townhouse designs to ranch-style residences with basements in some developments, such as Glenstone Ridge.

“Namely what we found was that we’re pretty good at doing townhome work, which is a little different from single family,” Tollakson said.

The result has been Hubbell’s emergence as a leading developer of townhouses in downtown Des Moines and the suburbs. It is preparing a townhouse development in Regency’s former Michael’s Landing project in West Des Moines.