Challenges, opportunities of changes in Iowa’s property tax system

Panelists weigh in ahead of Feb. 13 Power Breakfast

Michael Crumb Feb 3, 2025 | 11:08 am

4 min read time

1,057 wordsAll Latest News, Economic Development

Local governments, developers and the business community are watching to see how changes in the state’s property tax system will affect them and their ability to grow.

The Legislature voted in 2023 to consolidate the state’s property tax levies and cap tax rates based on growth. Those moves have raised concerns among some Central Iowa communities and developers who see the changes as a possible hindrance to the growth the region has seen as cities and counties prioritize their tax dollars.

The Business Record’s Power Breakfast on Feb. 13 will take a look at the changes and consider challenges and opportunities they present as local governments look ahead at the fiscal year 2026 budget and beyond.

The event will be from 9-11 a.m. at the Des Moines Heritage Center. Register here

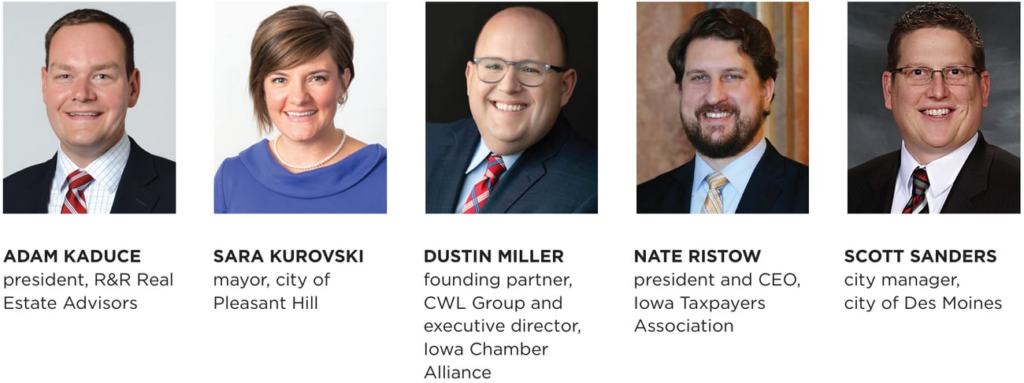

Panelists will include:

Adam Kaduce – president, R&R Real Estate Advisors

Sara Kurovski – mayor, city of Pleasant Hill

Dustin Miller -

founding partner, CWL Group and executive director, Iowa Chamber Alliance

Nate Ristow -

president and CEO, Iowa Taxpayers Association

Scott Sanders – city manager, city of Des Moines

Ahead of the event, the Business Record asked panelists the following questions:

– What challenges do you think recent property tax changes present for local governments and the business community?

– What opportunities do the changes present?

Here are their responses, which have been edited for brevity and clarity.

Nate Ristow, president and CEO, Iowa Taxpayers Association

What challenges do you think recent property tax changes present for local governments and the business community?

Legislation passed in 2023 limited levy rates and legislation passed last session provided local governments more flexibility on meeting those levy rate limits. Under those limits, cities can continue to increase their budgets as taxable value increases. Much of that increased property value is driven by the tight housing market driving up home values and assessments. Services to these existing properties should not inherently cost a city more, but a levy rate limit allows local governments to continue to capture more total levy dollars solely because taxable value increases. On the other hand, allowing additional levy capacity for new development is more understandable. However, new growth should not require a higher levy rate because new growth pays for itself by expanding the tax base. Cities should be able to continue to provide the same level of services to new and existing development under the current levy rate limits. Both taxable value and revenues from property tax grew faster than inflation for cities in Polk County over the past five years. Cities ought to be able to absorb their increasing costs under the existing limitations.

What opportunities do the changes present?

Cities should use the past property tax changes and the current discussion on reducing the burden on taxpayers to innovate and look for ways to reduce spending, such as increasing the use of shared services. That is what individuals and businesses have had to do when the price of goods and materials has risen with inflation, and while their local tax burden has also increased.

Adam Kaduce, president, R&R Real Estate Advisors

What challenges do you think recent property tax changes present for local governments and the business community?

When we work with large customers looking to locate commercial real estate in Central Iowa, they are usually considering several municipalities around the country; it’s a competitive search. They are looking for a reason to narrow down their search and rule out markets. The rate and complexity of the current system can be a reason to rule out locating in Central Iowa. In a 2022 comparison study of property taxes by the Lincoln Institute, Iowa ranks fifth highest in effective property tax rates, compared with the largest city in each of the 50 states. These kinds of reports and the impact of property taxes on real estate budgets have an impact on where businesses locate their offices.

What opportunities do the changes present?

Businesses budget for property taxes, but if they are already located in a low property tax state, Iowa rates come as a surprise. They aren’t accustomed to the level of property taxes in Iowa. The number of taxing jurisdictions that have an impact on property taxes further complicates the situation. The number of jurisdictions creates concern about whether property taxes will remain stable in a market or if the business should expect to see greater volatility in what they pay. The complexity of the system raises concerns for businesses about who is ultimately responsible for the rates and can make it a challenge to seek commercial property tax relief. As it relates to new development, the costs of development, like building permits and infrastructure, are a fee for service and those costs are paid throughout the development of a project by the developer. Those costs are borne by the developer, not through the property tax system.

Scott Sanders, Des Moines city manager

What challenges do you think recent property tax changes present for local governments and the business community?

Cities are having to look at the services they provide holistically, but most municipalities already operate with high efficiency. The challenge now isn’t about trimming excess — it’s about making tough choices that could directly impact the quality of life that has made the metro one of the most desirable places to live in Iowa. Reductions in funding will likely mean fewer resources for amenities, economic development, infrastructure maintenance, and even public safety.

What opportunities do the changes present?

This is an opportunity for municipalities to rethink their approach in service delivery. Are they operating as efficiently as they believe, or are there areas that can be streamlined? As all cities are struggling with budgets, is there a way to successfully look at regional collaboration for different services? How can cities move forward while making sure progress doesn’t stall?

Dustin Miller, founding partner, CWL Group, and executive director, Iowa Chamber Alliance

What challenges do you think recent property tax changes present for local governments and the business community?

Without accounting for new growth the current transition presents unique challenges for fast growth communities and the transition to the new combined general service levy also presents new challenges for prioritization of service for local governments.

What opportunities do the changes present?

Local governments can have hard discussions about efficiencies but this should be in conjunction with a broader discussion that shifts from revenue restriction toward pro-growth reforms.

Sara Kurovski will also be featured as a panelist.

Michael Crumb

Michael Crumb is a senior staff writer at Business Record. He covers real estate and development and transportation.