Economist Goss offers his take on tax collections, tariffs

Business Record Staff Mar 28, 2025 | 11:36 am

2 min read time

567 wordsAll Latest News, Economic Development

In his monthly newsletter, Ernie Goss, the Jack A. MacAllister chair in regional economics at Creighton University, this week summarized the state of the economy.

Goss publishes the monthly Creighton University Mid-America Business Conditions Index and the Rural Mainstreet Index, which offer an overview of the health of the economy in the Midwest. He also sends out an email newsletter, which provides a snapshot of how current events are affecting economic indicators. His latest newsletter was sent out this week and emphasized tax collections and tariffs.

He offered his take on the positives and negatives of the economy:

The good:

- The 30-year mortgage rate fell to a four-month low of 6.6% due to concerns over an economic slowdown.

- The U.S. economy added 151,000 jobs in February.

- The federal government shed 10,000 jobs in February.

- Investors are far too bullish, with the gap between the junk bond yield and U.S. Treasury bonds far too low at 2.5%.

The bad:

- The U.S. unemployment rate rose to 4.1%.

- The Atlanta Fed’s GDP Now model estimates that Q1 2025 will decline by 2.8%. That compares with the New York’s Fed GDP forecast of an expansion of 2.67% for the same time period.

- January U.S. retail sales sank by 0.9% from December.

- U.S. single-family housing annualized starts for January were 8.4% below December’s number.

- In fiscal year 2024, the U.S. federal budget deficit was $1.8 trillion, which was $138 billion over the previous year and the third-largest on record.

Increasing tariffs is a bad move for the economy, Goss stated in the newsletter, referring to President Donald Trump’s recent threats to increase tariffs on Canada, Mexico, China and others.

Goss stated: “Economists argue that tariffs are useful in only two incidences: 1) To protect infant industries from unfair competition from abroad, and 2) To shield the U.S. from international espionage. Neither of these two factors played into President Trump’s decision to expand tariffs on Canadian, Chinese, and Mexican products on April 2, 2025, one day after April Fool’s Day.”

Goss also provided an analysis of corporate and individual income tax collections following the tax reduction program passed in 2017 by Congress and Trump during his first term.

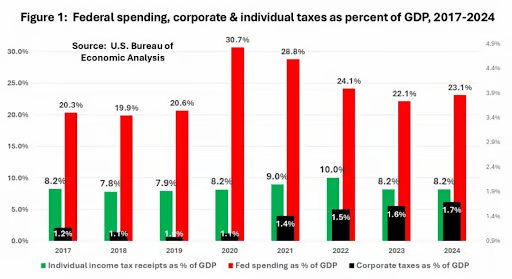

“Critics argued incorrectly that this would put a hole in tax collections and would reward billionaires at the expense of low income individuals,” Goss wrote. “Figure 1 below shows that the exact opposite occurred with tax collections growing faster than the overall economy, and tax collections for taxpayers earning less than $75,000 declining and all other groups climbing.”

According to Goss’ analysis, while corporate taxes fell as a percentage of GDP between 2018 and 2020, they expanded for each year during 2021-2024, reaching a high of 1.7% in 2024. Corporate taxes more than doubled during that period, from $230.3 billion in 2017 to $493.1 billion in 2024.

Individual income taxes went from $1.61 trillion in 2017 to $2.39 trillion in 2024, for a 48.3% gain, Goss stated. As a percentage of GDP, individual income taxes were flat at 8.2% in 2017 and 2024. Individuals with higher income shouldered the largest share of income tax gains over the period.

According to Goss, allowing the expiration of the tax provisions would likely slow growth and differentially punish lower-income individuals. As highlighted in Figure 1, the real problem, Goss says, is federal overspending as the U.S. continues to run a “war-time deficit in a peace-time economy.”