Envision Iowa: Key takeaways from second 2024 think tank ‘Business Opportunities: Which industries are poised for growth?’

Mike Mendenhall Sep 20, 2024 | 6:00 am

9 min read time

2,222 wordsBusiness Record Insider, Economic Development, Manufacturing, Workforce DevelopmentAs part of Business Publications Corp.’s Envision Iowa think tank series, we spoke Aug. 22 with three experts who work with Iowa manufacturers, entrepreneurs and business owners about business opportunities and innovation in the state.

The panel discussion, focused on what industries are poised for growth, included Mike Ralston, president of the Iowa Association of Business and Industry; Chris Deal, director and mechanical engineer at Modus Engineering; and Jill Wilkins, executive director of New Bohemian Innovation Collaborative (NewBoCo) in Cedar Rapids.

Brian Waller, president of the Technology Association of Iowa, delivered the keynote discussion for this think tank.

Our second virtual Envision Iowa event of 2024 also featured a preview of data collected for the Business Record’s Envision Iowa Statewide Leaders Economic Outlook Survey by consulting firm Baton Global.

Envision Iowa consists of a three-part virtual Think Tank series, culminating in an in-person event on Oct. 22.

Here are some key takeaways from the Baton Global sneak peek, the keynote discussion and responses by our panel to questions asked during the 30-minute conversation:

Baton Global: Respondents’ sentiment generally more optimistic further out into the future

This is the third year that Baton Global, in partnership with the Business Record, has collected data on economic sentiment in Iowa. This year’s study measured respondents’ predicted sentiment for 2026, 2028 and 2030.

According to data presented by Baton Global Managing Director Wade Britt, when asked about entrepreneurship in Iowa, respondents felt more optimistic about the future for manufacturing, logistics and building and construction than other industries. When the study focused on innovation, people were more optimistic about energy and technology than other industries.

Manufacturing also showed above-ordinary levels of optimism when respondents were asked about their sentiment on Iowa’s key industries. People were more pessimistic about their sentiment toward key industries and public-private partnerships in Iowa.

When thinking about public-private partnerships, respondents were most optimistic about possibilities in arts and culture, retail and manufacturing.

The study found rural respondents were more optimistic about future years than those in urban areas, and respondents were generally more optimistic on their economic sentiment further into the future the study looked.

“We’re seeing that there is a little more optimism further out, which is positive. There are some pretty high neutrality scores, people that aren’t quite sure,” Britt said. “And what we have seen across some of these sectors is that neutrality has sometimes broken more towards pessimism as we’ve gone over the years (of the studies).”

Keynote: Iowa’s legacy industries integrate AI, digital experience for growth

Waller said Iowa’s banking and agricultural industries are embracing tech for growth. Farmers are using data analytics for crop management, soil health and to aid autonomous combines in the field to increase yields and improve efficiency.

“We’re seeing lots of banks becoming members of the Technology Association of Iowa because they know that if this isn’t a digital experience – we’re using artificial intelligence to do customer service feedback,” Waller said. “If we’re using this digital environment, we need to protect the data, we need to have that seamless customer experience. And they know they need to be cybersecurity experts, data analytics experts, and so that whole digital space is moving.”

Think tank panel:

What industries do you feel are best positioned to grow in the coming decade?

According to Ralston, revenue for Iowa’s manufacturing businesses aren’t as high as they were in recent years but are “still very strong.” He said 60% of ABI members surveyed in the organization’s quarterly poll indicated they expect to make capital expenditures before the end of the 2024 calendar year.

“That’s another reason we see manufacturing poised for growth – capital expenditures like a plant expansion or a multimillion-dollar piece of equipment,” Ralston said. “Folks don’t do that unless they think that business is going to come along with it.”

He said much of the leveling off recorded in the manufacturing sector in recent months is linked to agriculture, specifically lower commodity prices for corn and soybeans. But the ABI president said most economists are forecasting prices to rise in late 2025 or the first quarter of 2026.

Wilkins said she’s seeing growth in Iowa’s tech space, notably in expanding access to health care in Iowa through telehealth and edtech, “being able to continue to connect schools through different resource opportunities.”

At NewBoCo, Wilkins said sustainable and regenerative agriculture is also a growing field of interest. “One of our current staff members is really seeing a lot of opportunity, in particular, some work in southeast Iowa. They’re pulling together opportunities for communities to really look at being sustainable,” she said.

Post-pandemic habits are pushing small-business startups in the service sector, according to Wilkins. “Mobile catering, food trucks, mobile dog grooming, things that make everyday life a little more simple is something that we’re seeing a lot of growth opportunity and interest in,” she said.

Wilkins said using available information to make data-driven decisions while evaluating customer bases for niche business startups is trending. “Because they’re able to just have a lot more information there, we’re seeing some of them grow so fast and they’re needing to be able to leverage other resources because of that growth.”

According to Deal, there are opportunities for rural economic growth by embracing technology linked to manufacturing to allow Iowa to compete with some of the more historic, coastal tech regions of the U.S., if people are willing to take on some of the risks. “I think there’s incredible opportunity, if we can get over those two hurdles – the workforce, getting people educated and understanding what opportunities even exist in tech. In many of our rural communities, there’s still this lack of awareness and lack of understanding of where that industry can take you,” Deal said. “We’re overcoming that but there’s still work to go.”

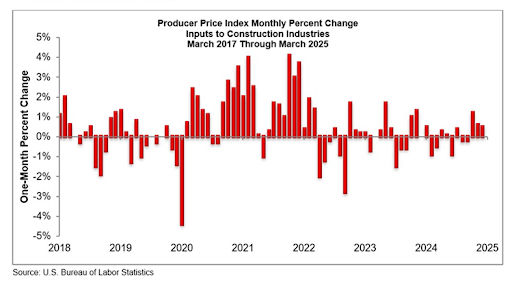

The construction trades are seeing headwinds, Deal said. But he said there are incentives in programs created by the federal Inflation Reduction Act to leverage money for sustainability projects – municipal work with clean water and school projects.

“I’ll take that sustainability vein and move it into ag, too. Yeah, we’re in a downturn. It’s going to be a tough year, probably a couple years in ag, but there’s a lot of movement in sustainability. There’s a lot of interest in how our food is being grown here, and there’s opportunities there for people in our ag sector to take advantage of that and use that to grow,” Deal said.

What factors and incentives need to be maintained to keep the state a favorable destination for new and existing business and industries?

According to Ralston, reducing the cost of government and keeping tax policy “fair and predictable” are helpful to business in Iowa. As an example, he pointed to the state government’s Iowa Manufacturing 4.0 program, which provides incentives to manufacturers to improve processes, automate and increase efficiencies with a goal to increase productivity.

“And perhaps more importantly, it involves an assessment of their existing operations. That assessment is done by the Center for Industrial Research and Service at Iowa State University. And while we have these great global manufacturers, we’ve got a number of small manufacturers that have really benefited simply from that assessment process and the recommendations that result in allowing them to do process better,” Ralston said.

Wilkins said access to funding is a key factor for businesses that work with NewBoCo. “Certainly private capital resources, having consistent access for businesses to be able to pitch to those potential funders. We have some great partners with that within the state, but if they’re at a point where they aren’t in deployment or have closed a fund, there is a time where there might be a lag of access,” she said.

She wants to be able to grow that funding base, as well as creating more access to smaller amounts of funding for early-stage startups.

Deal, who is based in Jefferson in Greene County, pointed to that area of Iowa as an example of how rural entrepreneurship resulted in “homegrown” manufacturers that 30 to 40 years ago chose to keep their operations local. He said he wants to make sure the next generation of local industry has the opportunity to do the same things.

“Anything we can do to lower the threshold to starting a business and then growing that business, that’s critical for the longevity of our communities,” Deal said.

“… I do think that people are recognizing that after so many years of people thinking small communities are just fading away that no, they’re doing the opposite. There’s opportunity there that doesn’t exist in larger communities. There’s a lot of wonderful things happening. And so what we can do to support activities like Main Street Iowa. It’s a wonderful organization that, No. 1, brings some funds to the table, but also it teaches communities how to effectively help themselves, how to organize, how to bring volunteers to the table. It’s not a silver bullet, but it’s a shotgun approach to everything they’re doing,” Deal said.

How long do you think the downturn or slowing in hiring for ag manufacturing is going to last, and how do you see that impacting supporting industries and the broader economy in Iowa?

Ralston cited recent economic analysis that suggests there’s going to be a turn away from lower commodity prices in late 2025 to early 2026.

“That’s still over a year away,” Ralston said. “So a lot of factors played a part in these layoffs, but commodity prices declining is certainly a big factor. Corn and beans were at a historic level just a year ago. Prices were at least $3 higher for both of those commodities. In a business like farming, margins are so tight, and $3 is a big, big deal. So in those days, farmers were feeling pretty good.”

Ralston said those tighter profit margins are keeping farmers from buying new equipment and implements, contributing to recent layoffs at companies like John Deere, Kinze Manufacturing and others.

He said that early announcements about layoffs from Deere and the Tyson Foods plant in Perry have allowed some workers to be picked up by other companies.

“But if I’m one of the folks that has been picked up, that doesn’t make me feel any better. And the good news is, again, that the state has a robust program for unemployment insurance. Iowa benefits are some of the best in the country. We think we can limit this at ABI on behalf of our member companies,” Ralston said.

In terms of Iowa’s workforce more broadly, Wilkins said improving access to child care for entrepreneurs and startup founders in the state would improve work-life balance and lift barriers to launching a business.

“But that still is kind of where we see the biggest struggle is, but that work-life balance to be able to go after that dream that they have, because there’s a lot of of steps to that, and it’s very challenging to be able to have the time to really focus and to be able to go through all of the different pieces that it takes to get that business started,” she said.

Deal said one way to weather cyclical downturns in ag is for companies to find ways to use the cheaper-priced corn and soybeans in value-added products.

Iowa growers are looking toward the Iowa Economic Development Authority and Iowa’s District Export Council for export opportunities while prices are low, according to Ralston.

The ABI president added that there shouldn’t be broad concern about a trend of Iowa manufacturers going out of business due to the downturn. “Most Iowa manufacturers are conservative in their business practices. I don’t mean politically conservative. I mean operationally conservative. They don’t carry a lot of debt. Their balance sheet is strong. They have cash. They can hopefully ride this out. They will have a lot of inventory, and they have to sell off at a loss. Most are quite innovative about operating,” he said.

What can we do to overcome barriers to business growth in Iowa?

All three panelists agreed that the top barrier for business in Iowa is the size of the workforce. “We need more people in Iowa,” Ralston said. Several of the largest business organizations in Iowa, including ABI, the Iowa Business Council and the Greater Des Moines Partnership, have advocated for immigration reform at the Iowa Legislature as a tool to bring more skilled workers to Iowa.

Iowa’s Workforce Participation Rate, the number of people working in the state, has dropped every month since January, according to Iowa Workforce Development.

Ralston said ABI is encouraging more integration of automated systems in manufacturing but to keep employees on in other capacities.

Wilkins said she sees a need for consistent access to educational opportunities and other resources and expanded public-private partnerships.

“We need to try to find a way to do a better job or expanding and conveying what’s available here in our state,” Deal said. “We don’t have mountains, we don’t have oceans but we have everything else. Where would you rather raise a family? Where else would you rather have your kids grow up? The opportunities are there throughout our state. So the challenge is, how do we get above the noise and convey that information?

Mike Mendenhall

Mike Mendenhall is associate editor at Business Record. He covers economic development, government policy and law.