Envision Iowa: Why economic confidence among leaders outside metro areas may be on the rise

Mike Mendenhall Nov 22, 2024 | 6:00 am

9 min read time

2,224 wordsEconomic Development, HR and Leadership, Workforce Development

Entrepreneur Robert Abbott built a career founding and establishing digital strategy and design companies primarily in the city of Columbus, Ohio, 523 miles from his hometown of Maquoketa, Iowa.

His decision in 2021 to form the nonprofit innovation, entrepreneurship and coworking center Innovate 120 and house it in a historic bank building on the town’s Main Street wasn’t because he knew demand for the concept was already there.

“It’s this little burning desire. It’s my hometown. There has always been a connection there, Abbott told the Business Record.

Abbott had success in business out of state and led an entrepreneurship and design thinking program as an entrepreneur in residence at Denison University in Granville, Ohio.

“But then the question was what if we brought that back to Iowa? What if we brought it back to my hometown, which is a rural community? How might that work?” Abbott said. “So I said, ‘Well, let’s run an experiment and see what happens.’”

More than three years after launch, Innovate 120 has seen slow growth in its coworking space subscriptions, Abbott said.

However, the center, located in the northeast Iowa town of 6,051 people, has seen success in youth programs like the UX Design internship which connects students with corporate clients to provide product solutions. Initiatives like the 10X E-commerce Accelerator aids cohorts of 10 individuals and companies in understanding, developing, sourcing and launching an online product business using the Amazon sales platform.

Envision Iowa findings

The momentum Abbott is feeling at Innovate 120 may not be isolated to Maquoketa’s Main Street.

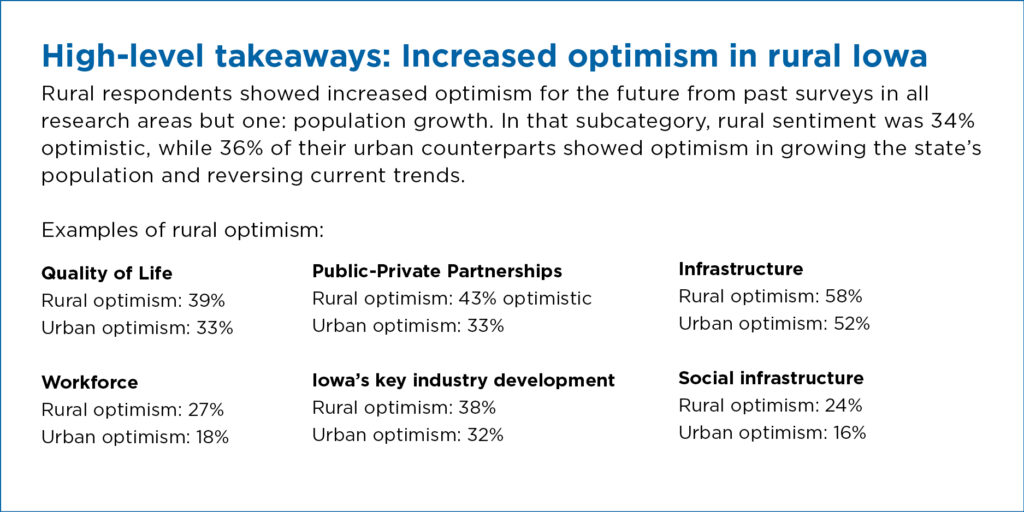

Rural Iowa leaders expressed more optimism for the future in all but one research area in the Business Publications Corp. and Bâton Global 2024 Envision Iowa Statewide Leaders Economic Sentiment Survey released Oct. 11.

Across all categories surveyed, Iowa leaders continued to show cautious optimism for the state’s economic future, researchers said in the report. But the increased level of optimism among Iowa’s rural leaders was a key takeaway for Bâton researchers.

The survey focuses on the three critical themes that drive state-level economic performance: people and culture, business opportunities and infrastructure. Within each of the three themes, the survey focuses on the four subthemes that capture the most pressing issues on Iowa’s economic performance agenda for 2024, 2026 and 2028.

The survey data showed that in the category of people and culture, 39% of rural respondents expressed optimism in quality of life, 6% greater than the sentiment of urban leaders. When asked about business opportunities, rural respondents were 43% optimistic about the future outlook of public-private partnerships compared to urban sentiment at 33% optimistic.

Rural sentiment on the development of Iowa’s key industries showed 38% optimism compared to 32% optimism from urban leaders. Rural leaders were also more bullish on the future of the state’s physical infrastructure with a 58% optimistic outlook versus 52% of urban leaders.

Social infrastructure – which includes the state of housing, health, education and child care – showed “significant pessimism” from both urban and rural leaders, however, respondents outside Iowa metros still showed more optimism than leaders in the cities and suburbs by 8%.

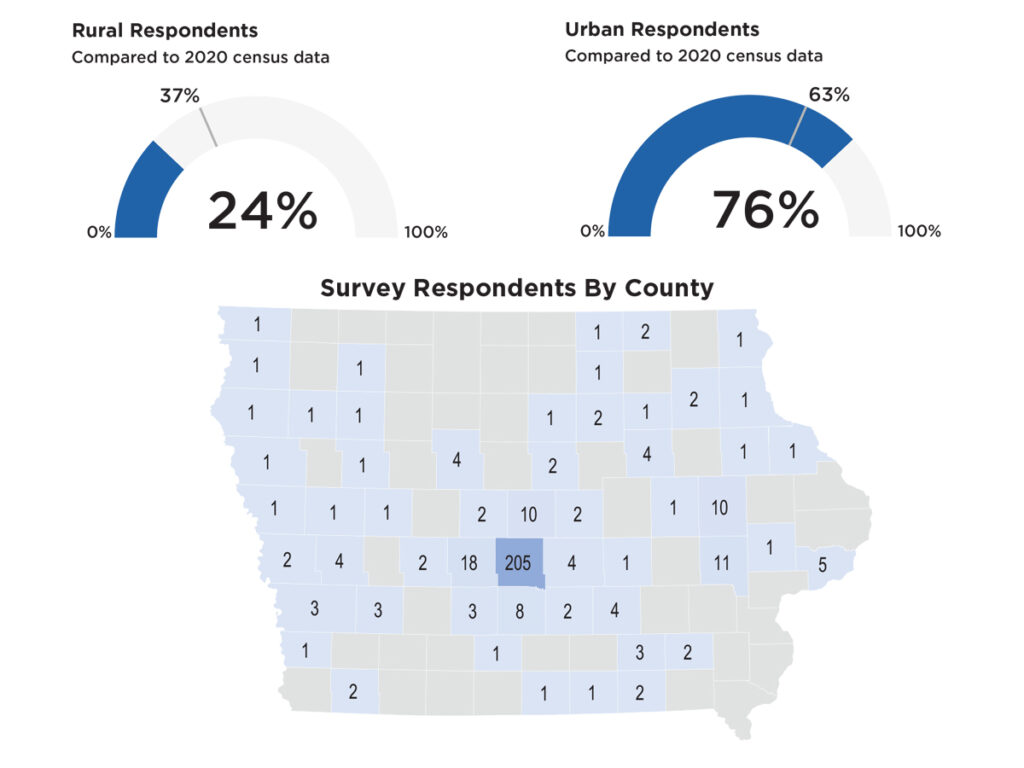

In the survey’s third year, 24% of the leaders surveyed represented 15 industries, and 85 counties were based in rural communities.

Is rural optimism trending?

Wade Britt, managing director of Bâton Global, said researchers began to see more favorable rural optimism on Iowa’s economy in the 2023 survey after the results in 2022 showed more consistency in the sentiment of rural and urban leaders.

He said that neutrality was from a “confluence of things,” but he attributed some of the feeling to emotional and mental “hangover” from the COVID-19 pandemic.

Britt said three years of data on the topic is not enough information to show a statistical trend in rural Iowa’s economic sentiment, but he believes there could be a positive sustained shift happening.

“Reading tea leaves like I do, yeah, I feel comfortable saying it,” Britt said.

Abbott said the lower cost of living in rural towns like Maquoketa can leave entrepreneurs more money to invest in a business in areas of the state where startup capital can be difficult to find.

While launching Innovate 120, Abbott learned that building a successful business concept there wasn’t as simple as plugging into the existing ecosystem of a growing, urban metro area. But he said the increasing ability for rural leaders to connect with ideas and resources statewide and beyond is beginning to make things easier.

“There’s a difference between demand and desire,” Abbott said. “Demand means it’s ready to go. You can fulfill it. It’s something that you can mean right away. Desire or aspiration is more subtle, and it means that we have to put more pieces in place in order to build the demand and the opportunity. It’s more complex.”

In the case of Innovate 120, the nearly $1 million renovation of the former U.S. Bank location into a state-of-the-art facility with fiber internet connections has also drawn the interest of investors in the rural Iowa asset.

Use of the center as an event and meeting space for Jackson County organizations and public officials has become part of the business model, and state funding including a $200,000 grant awarded in April by the Iowa Economic Development Authority has helped support its innovation program costs.

In Britt’s opinion, some of the rural optimism shown in the survey could be explained by the rise of “super commuting.” The phenomenon became more prevalent during the pandemic as office workers relocated to rural communities while working remotely for a city-based job and took advantage of the lower cost of living in less-populated areas.

“That’s coming from a place of better technology infrastructure [and] less demand of full-time, strict work schedules,” Britt said. “People have a little more control over their working schedule, even if they are in a more office-dominated requirement kind of firm. People are having more freedom and flexibility, and I think those things contribute to this idea of, ‘Well, yes, I can move further out. I can be closer to nature. I can have a better quality of life.’”

As state and federal government investment in communications infrastructure expands, so could market opportunities for existing rural businesses and entrepreneurs.

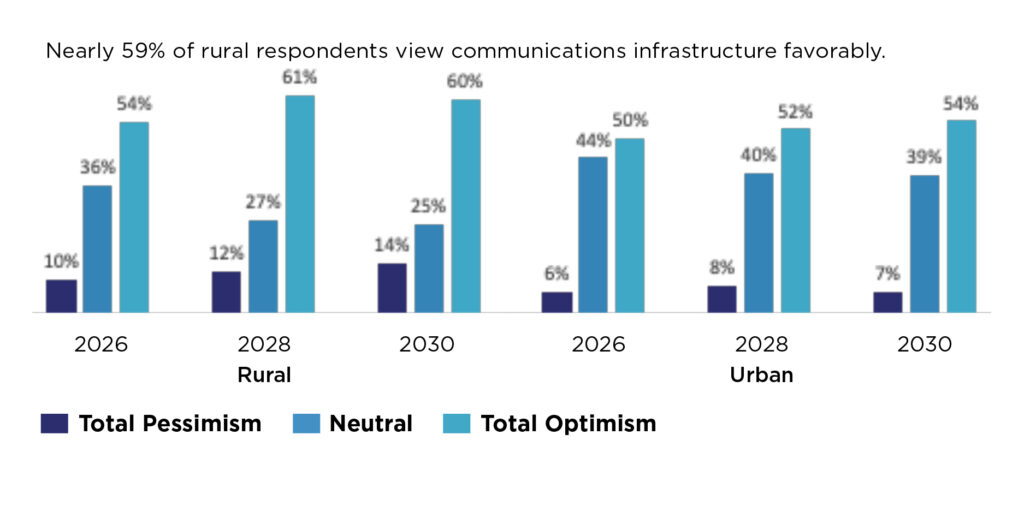

The Envision sentiment survey showed rural leaders are more likely to expect improvements in Iowa’s communications infrastructure in the future, with nearly 59% viewing it favorably, although the positive sentiment in this category fell more than 2% from prior years.

Fifty-two percent of urban respondents expressed an optimistic outlook on communications infrastructure in the 2024 survey, declining about 12% from previous survey results.

According to the state’s Department of Management, Iowa received a $415,331,313 allocation from the federal Infrastructure Investment and Jobs Act to implement its Broadband Equity, Access, and Deployment program, which is designed to implement reliable high-speed internet connections in underserved locations.

“What’s driving the positive sentiment, especially post-COVID, is that people feel a lot more connected. The world feels flatter,” Abbott said. “We don’t have to make excuses for being from a small town anymore. I feel it’s an advantage. And I think a lot of people are feeling like opportunities are closer to them than they might have been before because technology has enabled that to happen. It eliminates distance, it eliminates time now. Then the question is, how do we build those opportunities to take advantage of that?”

Population and workforce challenges

The Envision survey shows there is increasing optimism among Iowa leaders as a whole that the population will grow through 2030.

But population was the only area of the survey where rural respondents felt less optimistic than their urban counterparts, the survey said.

Iowa’s rural population has been declining for decades while the number of people living in urban areas has increased by more than 3% in the last 10 years, according to a 2023 study by Iowa State University Extension and Outreach Indicators Program. Rural sentiment showed 34% optimism on population, while urban leaders were 36% optimistic that the population, would grow in the future.

The size of Iowa’s workforce remains a challenge and the leaders’ sentiment in the survey matches with a more pessimistic view, although the outlook gets better as leaders think about expectations in 2030.

A Nov. 15 report from Iowa Workforce Development says the state’s labor force participation rate ticked down by 0.1 percentage point to 66.2% in October, the 10th straight monthly drop in the size of Iowa’s workforce.

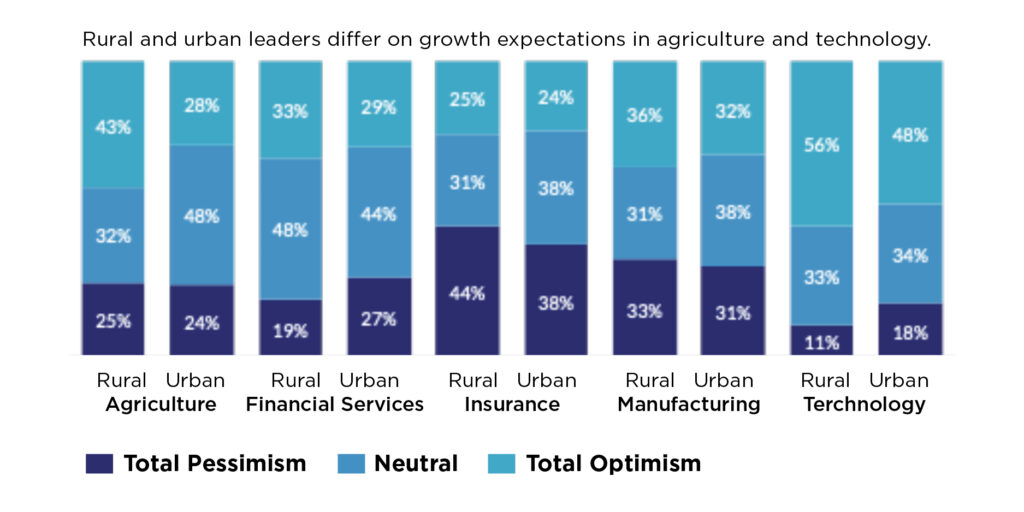

Iowa’s slow-growing population and shrinking workforce have persisted while the agricultural economy has experienced a downturn. Low prices and high yields for commodities like corn and soybeans are low resulting in declining revenue for farmers, according to the Farm Journal.

Ag-manufacturers like John Deere and Kinze are also laying off workers as demand for farm components slows.

Jeff Davidson, executive director of the Jasper County Economic Development Corp. (JEDCO), said during a Sept. 19 Envision Iowa Think Tank panel discussion on infrastructure that workforce and talent attraction, while still important, are no longer the top issues for employers when considering an expansion or relocation to a new region.

“What we’ve noted is that businesses are, somewhat begrudgingly, but they are figuring out what they’re going to have to do to attract labor to their businesses. It’s not about treating employees the way you used to pre-pandemic,” Davidson said. “It’s about working at remote locations. It’s about higher pay. They are finally understanding they are not going to be able to pay the same rates that they did pre-pandemic.”

JEDCO is the economic development agency for Jasper County, located just east of the Des Moines metro area.

Davidson said what’s emerging in place of labor as the top issue for companies is the site’s electricity and water infrastructure.

“I cannot think of a company that has not asked me in their first round of negotiations the percentage of renewables in electricity, because everybody is trying to get their carbon score down,” he said.

More at play than population

There are factors that the rural economy has going for it. According to Drake University associate professor of finance Tom Root, other market indicators could be countering economic pressures facing rural Iowa industries and explain leader sentiment.

“While rural economic development faces many unique challenges, rural areas have been characterized by robust labor markets,” Root told the Business Record in an email. “Rural counties in Iowa have slightly lower unemployment than the more urban counties. Additionally, the impact of inflation started to decline sooner in rural areas than in urban areas, which may have increased optimism in rural counties.”

Iowa’s cumulative unemployment rate in October rose slightly to 3% from 2.9% in September. Data from Iowa Workforce Development shows counties with lower unemployment rates appear more rural, which Root said might account for part of the optimism shown in the sentiment survey.

The Federal Reserve Bank of New York’s Equitable Growth Indicators report updated in August found that rural households were experiencing lower inflation than the national average while their urban counterparts faced inflation higher than the national average.

The report also shows the inflation rate in rural areas of the U.S. also fell faster than in urban areas.

Root also points to a March 2022 Employee Benefit Research Institute issue brief that states, “When controlling for income, rural individuals had higher median net worths in each income category except for the highest ($100,000 or more).” However, rural individuals appear to have lower levels of financial assets and investments than urban residents, according to the brief.

Root said rural and urban businesses also face different challenges.

The Fall 2022 Small Business Rural/Urban Divide Megaphone of Main Street study by the nonprofit business mentor organization SCORE says that access to capital and technology and growing its customer base are still challenges for business owners nationwide.

Social infrastructure needs

Urban and rural leaders all judged the outlook of Iowa’s social infrastructure critically in the survey. That includes the state of housing, health, education and child care. In the 2022 and 2023 studies, Iowa leaders were mostly neutral in their sentiment toward social infrastructure.

This year, pessimism in this area rose to 53% of respondents. But there was still more optimism on the future of social infrastructure coming from rural leaders in 2024 – 24% of rural respondents with an optimistic view versus 16% for urban.

During the Oct. 22 Envision Iowa Main Event at Hilton Garden Inn West Des Moines, Mid-Iowa Health Foundation President and CEO Nalo Johnson said access to housing, social and human services and other community supports is a struggle for Iowans across the income spectrum.

“What this data is telling us is that people are having a hard time with those additional supports that allow them to be able to thrive in their community, and that’s occurring across our geographic differences,” Johnson said.

Johnson, like Abbott, was selected by BPC as one of its six inaugural Envision Iowa Visionary Leadership award winners and was honored at the Oct. 22 event.

“Sentiment matters when you’re trying to foster a conversation,” Britt said. “And although I don’t know to what extent I’d want to bet the farm on any element of a sentiment-driven survey, the point is to get people talking and to try to drive alignment, to try to drive understanding.”

Mike Mendenhall

Mike Mendenhall is associate editor at Business Record. He covers economic development, government policy and law.