Extended filing and delayed tax payment deadlines result in $500 million drop in state tax receipts

BUSINESS RECORD STAFF Jul 17, 2020 | 4:44 pm

2 min read time

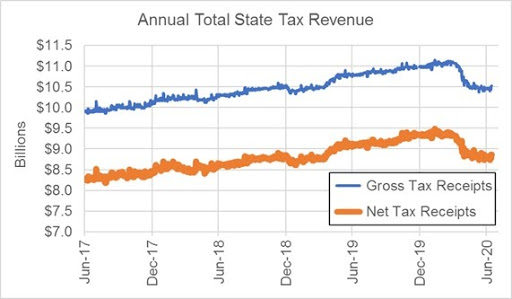

411 wordsAll Latest News, Economic Development, Government Policy and Law, Statewide NewsIowa annual gross and net (gross tax receipts minus tax refunds issued) tax revenue calculated as a 365-day moving total. The time period depicted is June 30, 2017, through July 14, 2020. The graph shows that total annual tax revenue, both gross and net, began to decline around April 8, 2020. Source: Iowa Legislative Services Bureau.

State tax revenue fell more than $500 million from March 19 through July 14 compared with the same period a year before, primarily because of extended tax filing periods and delayed tax payment deadlines that were put in place as a part of the state’s response to the coronavirus pandemic, according to data released this week from the state’s Legislative Services Agency.

Gov. Kim Reynolds issued her public health disaster emergency proclamation on March 17, closing down restaurants, bars, fitness centers, theaters and casinos, and prohibited gatherings of more than 10 unrelated people. Two days later, the Iowa Department of Revenue issued an order granting deadline extensions for annual state tax returns and delayed due dates for payments associated with both business and individual tax returns.

The state revenue department also issued an order on April 9 that temporarily reduced the amount of quarter tax payments some individuals and businesses had to make for the period of April 30 through July 31.

The resulting net decrease in state tax receipts totaled about 18.2% over the same period in 2019, according to the report, which cited the delays in tax filing and payments as reasons for the decline, and not the shutdown of businesses that resulted from the governor’s March 17 order.

According to the report, issued Tuesday, as the new tax filing deadline of July 15 approached, individual income tax deposits began to arrive in higher than usual levels in recent weeks, and that is expected to continue into early August. As a result, individual income tax withholding increased 0.1% over the period, largely because of withholdings from unemployment checks, which generated an additional $63 million for the state’s general fund compared with a year ago, the report showed.

Other findings contained in the report:

- Individual income tax declined $283.8 million, or 23.6%.

- Corporate income tax declined $92.4 million, or 27.4%.

- Sales/use tax declined $28.9 million, or 4.1%.

- Other General Fund taxes declined $23.5 million, or 16.5%.

- Fuel tax declined $24.2 million, or 10.2%.

- Vehicle sales tax (fee for new registration) declined $13.8 million, or 9.9%.

- Gambling tax declined $70.8 million, or 68.9%.