GOP legislators rank property tax reform as top 2025 priority during Partnership breakfast

Mike Mendenhall Dec 3, 2024 | 5:01 pm

5 min read time

1,215 wordsAll Latest News, Government Policy and LawRepublican leadership in the Iowa Senate and House made it clear during a panel discussion with Central Iowa business and local elected leaders that GOP lawmakers intend to pursue state property tax reform when the Legislature convenes in January.

“At the end of this session, I think that one thing you will see get done is reform on our property tax system,” said Sen. Mike Bousselot, R-Ankeny.

Bousselot and Iowa House Majority Leader Matt Windschitl, R-Missouri Valley, made their push to reduce property taxes during the Greater Des Moines Partnership’s annual Legislative Leadership Breakfast today at Stoney Creek Hotel in Johnston.

The panel, moderated by the Partnership’s 2024 Government Policy Council Chair Anne Roth, also included Senate Minority Leader Janice Weiner, D-Iowa City, and House Minority Leader Jennifer Konfrst, D-Windsor Heights.

The property tax issue was part of a broader discussion by the panel on ways to restrain rising costs of living in Iowa, including housing, and keep the state an attractive place for business investment and workers.

“Iowans, loud and clear, have said property taxes are making it unaffordable for them to live in our communities,” Bousselot said.

Republicans in Iowa have been aggressive on pursuing tax cuts in recent years. Gov. Kim Reynolds has stated her desire to focus in 2025 on reducing property taxes collected by local governments like cities, counties and school districts, according to a report by Radio Iowa.

During the 2023 sessions, Iowa lawmakers approved House File 718, which capped property tax levy rates for cities and counties and created a $6,500 homestead exemption from property taxpayers over the age of 65 by fiscal year 2027 and an exemption for veterans.

Last year, Reynolds and the Legislature also signed off on legislation to accelerate the state’s transition to a flat 3.8% income tax.

In a media interview after the panel, Bousselot said that local governments’ revenue from property taxpayers has gone up in recent years. He did not say what kind of limits, if any, any proposed legislation could put on local governments’ ability to levy taxes.

“We also know that local communities play an important role in the way services run. You’ll see, I think, a vigorous debate in making sure that we make Iowa a competitive place when it comes to property taxes for Iowans to work and invest,” Bousselot said during the panel. “But also maintaining vital services at the local level.”

The Democrats on the panel, who are in the minority in both chambers, cautioned that a discussion on property taxes needed to include the cities, counties and school districts whose revenue would likely be affected by changes to the code, and urged maintaining local governments’ ability to make their own decisions.

“We don’t believe that [cities like] Red Oak and Des Moines are the same,” Konfrst said. “We’ve been hearing for a long time those two communities aren’t the same. Let’s not treat them the same at the state Legislature.

“… When we’re talking about taxes and property taxes, we want to make sure that we’re talking to local communities as well, to make sure you don’t get left high and dry when the time comes to pay for the roads in your community,” Konfrst said. We want to make sure that we’re having a community conversation about this, not a top-down approach.”

Steve Richardson, an Indianola City Council member and former state legislator, asked the panel to, as part of a property tax discussion, consider policy such as forming public-private partnerships to build housing that could increase the property tax base and fully fund more projects that use local revenues.

He said in recent talks with a number of city clerks from Iowa communities under 1,000 people, a drop in property tax revenues would have few options in terms of budget cuts.

“They were asking me, ‘What do you cut? If they take property taxes away from us and do those kinds of things, what do you cut?’” Richardson said.

Bousselot acknowledged that “no two cities are the same,” but money paid by property tax payers “is not bequeathed” to cities and it reduces the taxpayer’s resources to spend that money in their community.

Windschitl said he wants to work with cities and localities to determine where the state can help fund local projects.

“When you have communities where their property taxes continue to increase, and increase and increase, but you’re not seeing improvements in the services provided, whether that be a new road or a new sewer system, and then it falls back on bonding and property taxes, that is where it comes untenable and that is why this becomes such a complex issue,” Windschitl said.

“If you look at all the different sources that go into property taxes and all the different taxing entities out there, that’s what makes this such a monumental and gargantuan task to try and tackle,” Windschitl said.

Konfrst and Weiner urged leaders in the room to consider their caucuses’ agendas and look beyond the party’s messaging in the 2024 elections.

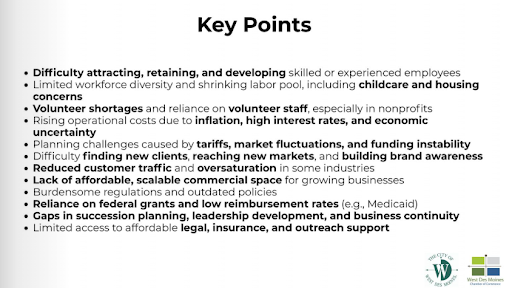

“Iowa House Democrats want to help every business in this room make more money and every community in this room thrive. And that means looking at workforce, looking at every aspect of your bottom line carefully, and not just taking an ax to everything that we see as a problem at the top, but looking holistically at how we can make your businesses thrive,” Konfrst said.

Partnership legislative agenda

The annual breakfast also serves as a forum for the Partnership to release its slate of state legislative priorities for 2025. Two of the featured priorities – economic development and housing – were direct holdovers from the organization’s 2024 policy agenda.

Here is what the Partnership intends to focus on after the Legislature gavels in next year’s session on Jan. 13, 2025:

Economic growth

Recognizing the competitive nature of economic development and the vital need to attract

business and talent to Iowa, the Partnership supports economic development tools and

incentives that enable state and local governments and enhance an overall competitive tax

environment and a streamlined, efficient and modernized tax structure that promotes business

growth.

Workforce readiness

A well-educated and skilled workforce is a top priority for Partnership investors, affiliates and

members. The Partnership supports workforce strategies and programs that attract new talent,

assists with the retention and training of talent, and supports work-based learning opportunities.

Housing

The Partnership supports the creation and expansion of housing options through funding and

policies that incentivize communities and employers to invest in new and existing housing for all

Iowans.

Quality of life

A strong quality of life and placemaking are important to attracting and retaining talent and play

a key role in the transformation and vibrancy of Iowa communities, main streets and local

economies. The Partnership supports continued investment in programs that support quality of

life projects driven by public-private partnerships.

“We look forward to continued collaboration with state elected officials to advance policies that grow our communities and our state,” said Daryl Bouwkamp, senior director of industry, international and government relations at Vermeer Corp. and 2025 chair of the Partnership’s Government Policy Council. “The strength of our region lies in our ability to unite and work toward shared goals as one community.”

The Partnership’s full 2025 State Policy Agenda is available here.

Mike Mendenhall

Mike Mendenhall is associate editor at Business Record. He covers economic development, government policy and law.