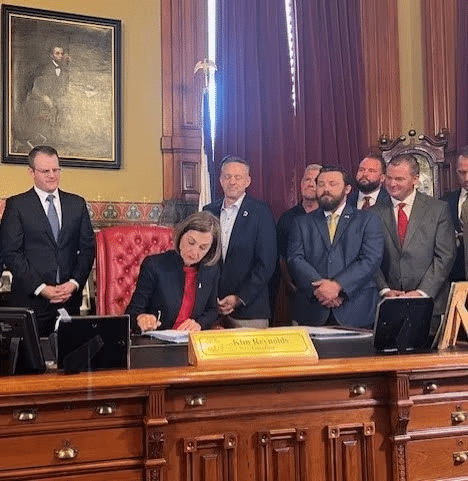

Gov. Reynolds signs MEGA tax incentives program into law

Mike Mendenhall May 3, 2024 | 3:49 pm

2 min read time

456 wordsAll Latest News, Government Policy and Law

A state incentives program designed to attract $1 billion projects in advanced manufacturing, biosciences, and research and development sectors to Iowa, long sought by business groups and economic development officials, is now law.

Iowa Gov. Kim Reynolds signed Senate File 574 on Wednesday creating the Major Economic Growth Attraction (MEGA) program. The two-year program will allow the Iowa Economic Development Authority to use a new suite of tax refunds and credits to negotiate with qualified companies looking to expand their operations to the state or existing Iowa companies planning to grow here.

IEDA and Iowa Finance Authority Director Debi Durham thanked Reynolds, state lawmakers and business organizations for supporting the bill in an email to the Business Record on Friday. An earlier version of the bill stalled in the Iowa House during the 2023 legislative session due to some lawmakers’ concerns with language in the bill regarding foreign land ownership.

The House amended the legislation to allow foreign businesses not aligned with U.S. adversaries abroad to acquire agricultural land in Iowa and receive tax credits.

SF 574 passed the House 89-4 in March and was approved by the Senate in a 47-0 vote on April 16.

“IEDA introduced the MEGA proposal last year, knowing we needed new tools in our economic development toolbox to attract extremely large-scale projects,” Durham said. “We’ve seen significant interest in Iowa, and this program positions Iowa to turn that interest into investment.”

The MEGA program promotes the development of 22 IEDA-certified sites across the state big enough to meet the MEGA program’s 250-acre minimum requirement.

The program would refund services tax and sales and use taxes paid to contractors or subcontractors for building and construction materials. The incentives also include a refundable investment tax credit of up to 5% of a company’s capital investment in the project recouped over five years based on project progress performance.

It would also provide the employer with a withholding tax credit.

Data centers, retail businesses and businesses that require a cover charge or membership for customers don’t qualify for incentives under the MEGA legislation.

In addition to the $1 billion investment, businesses would have to create jobs that pay at least 140% of the area laborshed wage to qualify for the MEGA incentives.

Durham told the Business Record in February that IEDA officials were already negotiating with an industrial manufacturer using “advanced manufacturing techniques” that she thinks will qualify for the MEGA program.

It would take additional legislative approval to reauthorize and extend the MEGA incentives program beyond its two-year sunset.

Mike Mendenhall

Mike Mendenhall is associate editor at Business Record. He covers economic development, government policy and law.