Growth in e-commerce is fueling industrial space construction

More than 2.2 million square feet expected to be built in 2022 in Des Moines area

KATHY A. BOLTEN Feb 16, 2022 | 4:14 pm

7 min read time

1,598 wordsBusiness Record Insider, Real Estate and Development

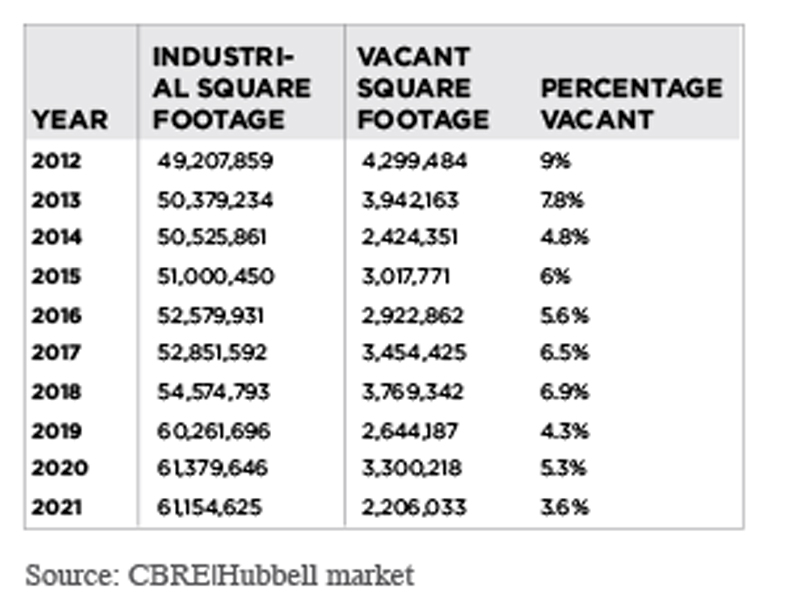

The amount of industrial space in the Greater Des Moines area increased by 12 million square feet in the past decade, with more than half of the space added since 2018, a review of CBRE|Hubbell Commercial’s annual market reports shows.

In 2021, the Des Moines area had more than 61.1 million square feet of industrial space, nearly 25% more than the 49.2 million square feet available in 2012, according to the reports. Nearly 12 million square feet of industrial space has been added since 2012; 6.6 million square feet, or 55%, of that has been added since 2018.

And construction of additional industrial space, which includes the subsections of warehouse and distribution, manufacturing and flex, doesn’t appear to be slowing.

“We’re seeing the vacancy rates get lower and lower, and the amount of product that is out there on the market right now is minimal,” said Michel Anthony, senior project manager for Opus Design Build LLC, which is headquartered in Minnetonka, Minn., and has offices in Clive.

In October, the Opus Group began construction on a 296,300-square-foot speculative industrial building in its Swanwood Logistics Center, located east of Interstate Highway 35 and south of Southeast Corporate Woods Drive in Ankeny. It is the second building in the development, which also includes a build-to-suit project for Brown Warehouse Co. Opus is also building two warehouses at Northridge 80|35, a 60-acre speculative development on the northern edge of Des Moines.

“There is continuing to be a need to get that warehouse space closer to those end users,” Anthony said.

E-commerce in the United States was already growing at a rapid rate before the pandemic, which hit the United States in March 2020. COVID and the shelter-in-place mandates that came with it accelerated the growth as an increasing number of people became comfortable with ordering a range of products online, including groceries, paper and cleaning products, clothing, and workout equipment. Not only did consumers get more comfortable with online shopping, they also began expecting their orders to arrive at their homes within 24 to 48 hours of placing an order.

In addition, businesses that order products or supplies online now expect their orders to be fulfilled within a couple of days.

“If you’re a company that does brake-pad repairs and you have a client that brings in their vehicle to the shop on Thursday and you need to order a part, you want it by Friday,” said Marcus Pitts, managing director of JLL’s Des Moines office. “That consumer mindset that has evolved on the residential side and has driven the demand for more warehouse space has taken hold on the commercial side as well.

“Businesses that place an order [online] expect to have it at least within a couple days, if not the next day.”

The expectation for products ordered online to be quickly delivered means storing the items closer to where consumers are located. And the demand is expected to continue past the end of the pandemic.

“Once people have learned that behavior and that expectation, I don’t see that expectation stopping,” Pitts said. “It is going to become the new norm.”

In the Des Moines area, most of the ground available on which to develop industrial projects is near Interstate Highways 35 and 80. The proximity to the interstates and the mostly flat terrain make the area attractive to developers, Pitts said.

Construction of more than 1.4 million square feet of industrial space is expected to be completed in 2022, a 30% increase over the previous five-year average of 996,586, square feet, according to CBRE|Hubbell’s market report. Two-thirds of the new space expected to be completed in 2022 is in the northeast submarket. Among the projects underway are:

Building 4 of Graham Warehouse’s Anderson Warehouse development north of Interstate 80 in Altoona. The 300,000-square-foot warehouse is expected to be completed in 2022’s third quarter.

The first phase of Northridge 80|35, which is expected to add over 1 million square feet of Class A industrial space to the metro area. The first phase includes two buildings, designed to accommodate a range of uses including logistics, distribution, e-commerce and manufacturing. A 164,000-square-foot building will offer 17 dock doors expandable up to 39, four drive-in doors and 101 parking stalls. A 186,300-square-foot building will offer 21 dock doors expandable up to 50, four drive-in doors and 121 parking stalls. The buildings are expected to be ready for occupancy in 2022’s third quarter. Opus is the developer, design-builder, and architect and structural engineer.

Buildings 1 and 2 in the Altus Commerce Center, located on a 75-acre site at Northeast 62nd Avenue and Northeast Hubbell Avenue in Altoona. The project’s developer is VanTrust Real Estate, a Kansas City-based full-service real estate development company. A 265,200-square-foot warehouse is expected to be completed by the third quarter of 2022; a 496,800-square-foot building is expected to be completed by early 2023.

Building 1 of the I-80 Distribution Center at 451 Ninth St. N.E. in Altoona. The speculative warehouse will include 300,000 square feet of space and is expected to be completed in early 2023.

Building 2 in Crosswinds Business Park in Ankeny. The 220,777-square-foot building by Opus is expected to be completed by the third quarter of 2022.

The 296,300-square-foot speculative industrial building in its Swanwood Logistics Center, also being developed and built by Opus.

At least three other projects are expected to break ground yet this year, according to the CBRE|Hubbell report. R&R Realty Group is expected to start two projects: a 260,000-square-foot structure in Grimes’ Prairie Business Park and a 212,500-square-foot building in Urbandale’s Center Pointe Business Park. In addition, Ankeny-based ATI Group purchased land in Grimes and plans to build up to 1.3 million square feet of warehouse space in a phased development, according to the report.

Grimes’ City Administrator Jake Anderson said the city welcomes the additional industrial development.

“It doesn’t put a tremendous amount of load on our utilities and it’s been great for our tax base,” he said. Anderson said a lot of Grimes’ increase in assessed valuation was from flexible warehouse spaces.

In 2021, the assessed valuation of all of Grimes’ property totaled $1.98 billion, according to the Polk County assessor’s annual report. In 2019, Grimes’ valuation totaled $1.73 billion.

“We expect to see the industrial segment continue to grow in the next few years,” Anderson said.

Metro-area industrial vacancy rate at 3.6%

Just 3.6% of the Des Moines area’s industrial and warehouse space is vacant as more than 1.4 million square feet was absorbed in 2021, according to CBRE|Hubbell Commercial’s 2021 fourth-quarter industrial market report.

A year ago, 3.3 million square feet of industrial space, or 5.4%, was vacant, according to Hubbell’s 2020 end-of-year report.

Currently, 2.2 million square feet of industrial space is vacant, according to the report. Warehouse and distribution vacancy rates range from 1.9% in the northeast part of the market to 5.3% in the western suburbs.

The average asking rent in the fourth quarter was $5.43 per square foot. In the first quarter of 2018, the average lease rate was $4.80 per square foot.

Industrial vacancy rates

The amount of vacant industrial space in the Des Moines area shrunk to 2.2 million in 2021, or to 3.6%. Ten years ago, 9% of industrial space was vacant.

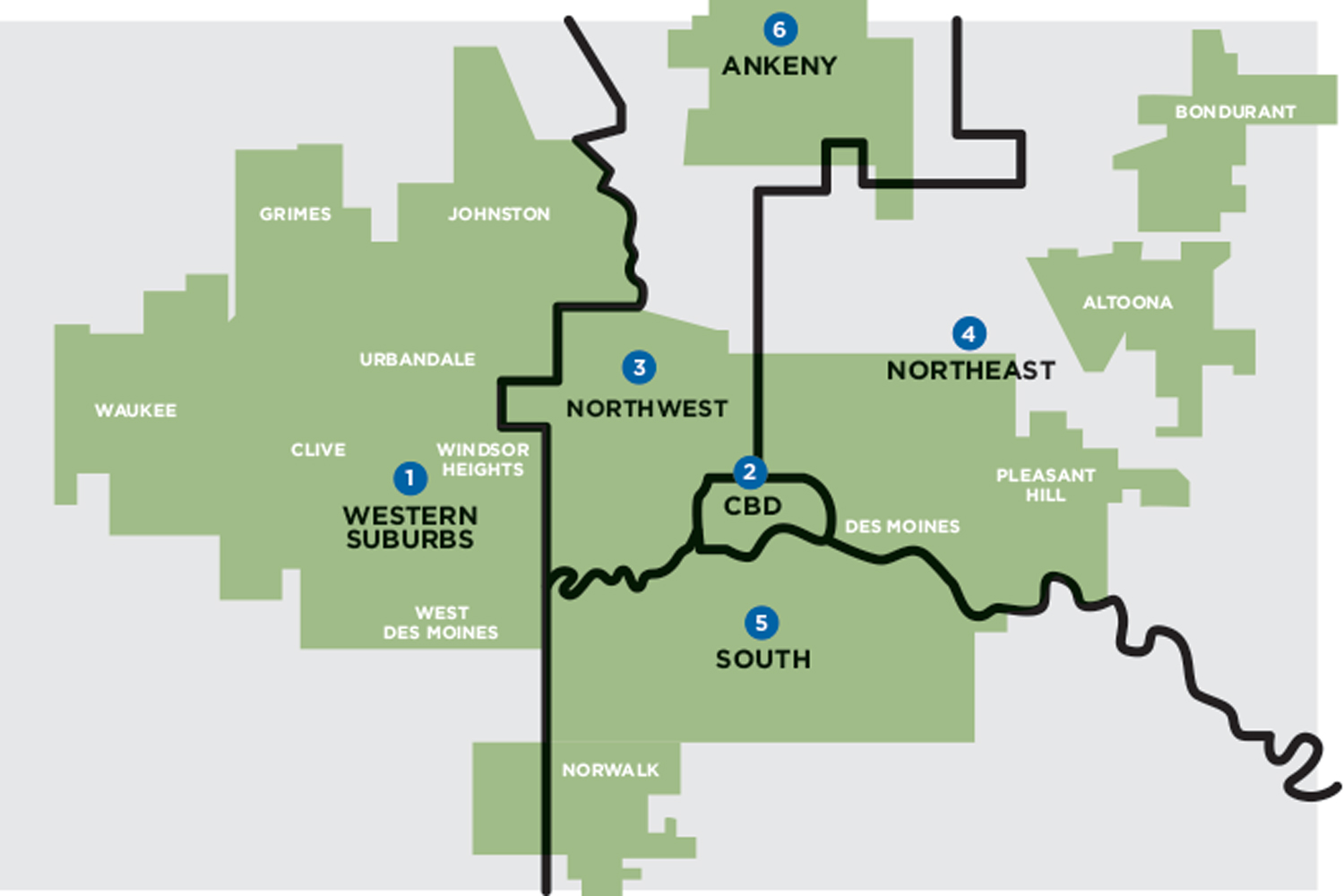

Des Moines-area industrial space

In the past 10 years, the Greater Des Moines area has added nearly 12 million square feet of warehouse, manufacturing and flex space, all subcategories of the industrial market, CBRE|Hubbell Commercial’s market reports show. More than 8.5 million square feet of the new space has been warehouse. The map shows the Des Moines area broken down by area with highlights of the growth.

Greater Des Moines area

49,207,859 2012 total square footage

61,154,625 2022 total square footage

24% Percentage change

Of note: The northwest part of the Des Moines area has added 4.6 million square feet of industrial space in the past 10 years, accounting for 39% of the metro area’s new warehouse, manufacturing and flex space.

1. Western Suburbs

14,995,798 2012 total square footage

18,025,474 2022 total square footage

20% Percentage change

Of note: The western suburbs added more than 2.8 million square feet of warehouse space in the past 10 years, a 33% increase.

2. Central Business District

2,937,142 2012 total square footage

948,368 2022 total square footage

-68% Percentage change

Of note: In the past 10 years, nearly 2 million square feet of industrial space has disappeared from the Central Business District with much of it converted to apartments.

3. Northwest

2,259,670 2012 total square footage

6,915,729 2022 total square footage

206% Percentage change

Of note: The northwest section has gained more than 1.5 million square feet of manufacturing space in the past 10 years, nearly tripling what was available in 2012.

4. Northeast

19,040,011 2012 total square footage

22,331,400 2022 total square footage

17% Percentage change

Of note: Nearly 2.5 million square feet of flex space has been added to the northeast section area since 2012, a 425% increase.

5. South

5,185,151 2012 total square footage

5,388,016 2022 total square footage

4% Percentage change

Of note: The south section has lost nearly 334,000 square feet of manufacturing and flex space in the past 10 years.

6. Ankeny

4,830,087 2012 total square footage

7,545,638 2022 total square footage

56% Percentage change

Of note: Ankeny has added more than 1.3 million square feet of manufacturing space in the past 10 years, an 86% increase.