Guest Opinion: 5 steps to a smooth retirement from a family business

This year, according to AARP, U.S. baby boomers will be turning 65 at a rate of about 8,000 a day. That’s 2.9 million per year. Millions in this generation are family business owners who are making plans to solidify their legacy by passing the company reins to family members, employees or a third party. In fact, an estimated $10 trillion in family-owned businesses is expected to change hands by 2025.

For the owners of privately held companies, it’s not always easy to cash out and retire. They often turn to their banking partners for advice about navigating the transition’s financial fundamentals. As a commercial banker for the leading lender to middle-market, family-owned American businesses, I’ve spent more than 25 years working side by side with business owners through generational successions.

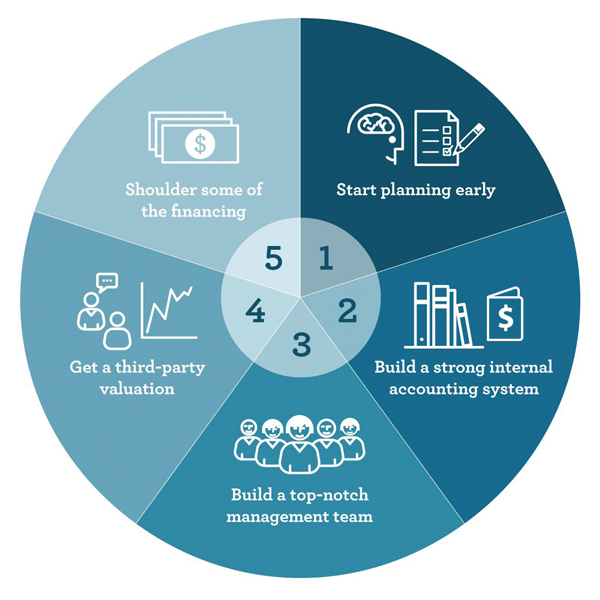

I recommend five steps for Iowa business owners to seamlessly transition ownership to the next generation:

1. Start planning early

When’s the best time to begin transition planning? Five to 10 years in advance of your target retirement provides ample time to develop a formal board of directors and assemble a team of advisers to guide business owners through the process. In addition to securing a knowledgeable banking partner, building relationships with experienced lawyers and accountants sooner rather than later is a must. Having skilled, effective advisers on your side early ensures a well-organized ownership transition.

2. Build a top-notch management team

A solid management team helps to preserve the legacy and make a successful long-term transition. Before initiating a sale, build a proficient management team. Skilled leaders and dedicated employees add considerable value for buyers. Remember:

- Providing long-term incentives and deferred compensation boosts loyalty through the transition.

- Rewarding valued managers ensures a deep bench when positioning the company for a successful transition.

3. Build a strong internal accounting system

A robust internal accounting system can make or break the transition, especially if it involves nonfamily or third-party buyers such as private equity or strategic acquirers.

Most sales to nonfamily require independently produced financial statements that accurately picture the company’s balance sheet and income statement. Without advanced preparation, this could mean producing three to five years’ worth of financial statements from scratch. Eliminate unnecessary stress by establishing a sound accounting system and retaining a financial officer before it’s time to sell.

4. Get a third-party valuation

Pouring years of blood, sweat, and tears into a family business can bias an owner’s view of the company’s true value. Solicit a third-party business valuation ahead of the transition to ensure an accurate picture. An independent adviser can better determine the proper market value of your business based on its cash flow and income-producing capabilities. Check with your accountants, bankers and lawyers for recommendations.

5. Shoulder some financing

Sometimes buyers need a little help purchasing the business. Founders can limit the buyer’s dependence on third-party lenders by combining bank financing and seller financing. Take on some of the financing yourself in the form of subordinated debt, preferred stock, employment contracts or earn-out provisions. Your buyer benefits from financing flexibility.

2016 continues to be a favorable time to sell a business. Banks, strategic buyers and private equity firms are flush with cash. Interest rates remain low, even with the Federal Reserve increase in December 2015. Start planning now to ensure a smooth transition when the time is right to create your legacy.