How much are houses selling for in Greater Des Moines? A lot, data shows

Higher sales prices plus rising interest rates prompting new loan products

KATHY A. BOLTEN Jul 13, 2022 | 8:17 pm

3 min read time

703 wordsAll Latest News, Housing, Real Estate and DevelopmentSoaring home prices and higher mortgage rates are making homebuying more expensive, prompting some lenders to offer financing tools that haven’t been in the market for several years.

In June, 1,682 residences were sold in the Des Moines area, 61 fewer than the 1,743 sold in June 2021, according to Des Moines Area Association of Realtors data. During the first six months of 2022, 7,616 residences were sold, just 28 more than the 7,588 sold during the same period in 2021.

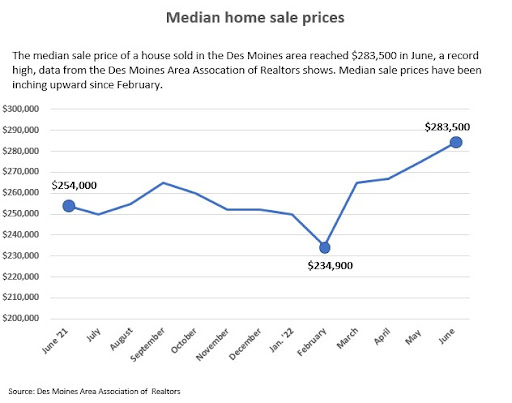

The striking difference between 2021 and 2022, however, is what has occurred with median home sale prices. In the first six months of 2021, monthly median sale prices ranged from $226,000 to $254,000, according to the association’s reports on home sales in the Greater Des Moines area, which includes Polk, Dallas, Warren, Jasper, Marion, Madison and Guthrie counties.

In 2022, monthly median sales prices have ranged from $234,000 in February to $283,500 in June, the highest level it’s ever been, association data shows. June’s median sales price was $48,600 higher, or nearly 21% higher, than in February and $29,500, or 12%, higher than in June 2021.

Soaring home prices are not confined to Central Iowa. Nationally, the median existing-home sales price in May was $407,600, the first time it has exceeded $400,000, according to the National Association of Realtors, headquartered in Chicago.

Also, the group’s housing affordability index fell to 102.5 in May, the national association announced last week. In January, the index was 145.4. An index above 100 means that a family with a median income had more than the income required to afford a median-price house.

The most affordable region was the Midwest, with an index value of 140.5, the association reported. However, that could change if median sale prices of homes continue to increase and interest rates for home mortgages continue their upward march, which is predicted to occur.

Last week, the average rate on a 30-year-fixed rate mortgage was 5.3%, according to Freddie Mac, the federally chartered mortgage investor. In early January, the average rate was 3.2%.

The increase in home mortgage rates is prompting some lenders to offer adjustable-rate mortgages, a home loan that starts with a low fixed-interest rate that is followed by occasional rate adjustments. Low interest rates for home loans in recent years prompted many lenders to take the product off the market.

Bankers Trust, headquartered in downtown Des Moines, has begun offering customers adjustable-rate mortgages, said Emily Abbas, the bank’s chief consumer banking and marketing officer. “We are doing our best to find products and do things to help consumers in this type of environment.”

Abbas said the number of applications for new home mortgages is less than it was a year ago. In addition, average loan sizes have increased, she said. At the end of June, the average loan for a home mortgage was $350,000 at Bankers Trust, Abbas said. During the same time in 2021, it was $285,000.

“We’ve definitely seen housing prices go up,” Abbas said. “When housing prices are up and [interest] rates are up, it makes it more difficult for homebuyers to afford a [mortgage].”

Listing prices have begun to drop In the past couple of weeks, said Jen Stanbrough, president of the Des Moines Realtors Association. In addition, more residences are being listed for sale and they’re staying on the market longer. More houses on the market and longer listing times could help spark additional declines in listing prices, she said.

In June, 2,364 houses were listed for sale, up from 1,838 in June 2021, according to association data.

But while the number of listings has increased, it continues to be difficult for buyers to find homes listed for sale that are priced at less than $300,000, Stanbrough said. “We aren’t seeing the inventory in that price range to keep up with demand.”

Stanbrough said there likely will continue to be a slowdown in the number of houses sold in the coming weeks, particularly if interest rates for home mortgages continue to climb.

“We will have a little bit of a readjustment phase but then I think we’re going to see buyers re-educate themselves and begin looking at those different loan products that are out there,” she said.