How will the Iowa economy fare in 2025?

Tariffs, workforce challenges top biggest threats

Sarah Diehn Jan 17, 2025 | 6:00 am

10 min read time

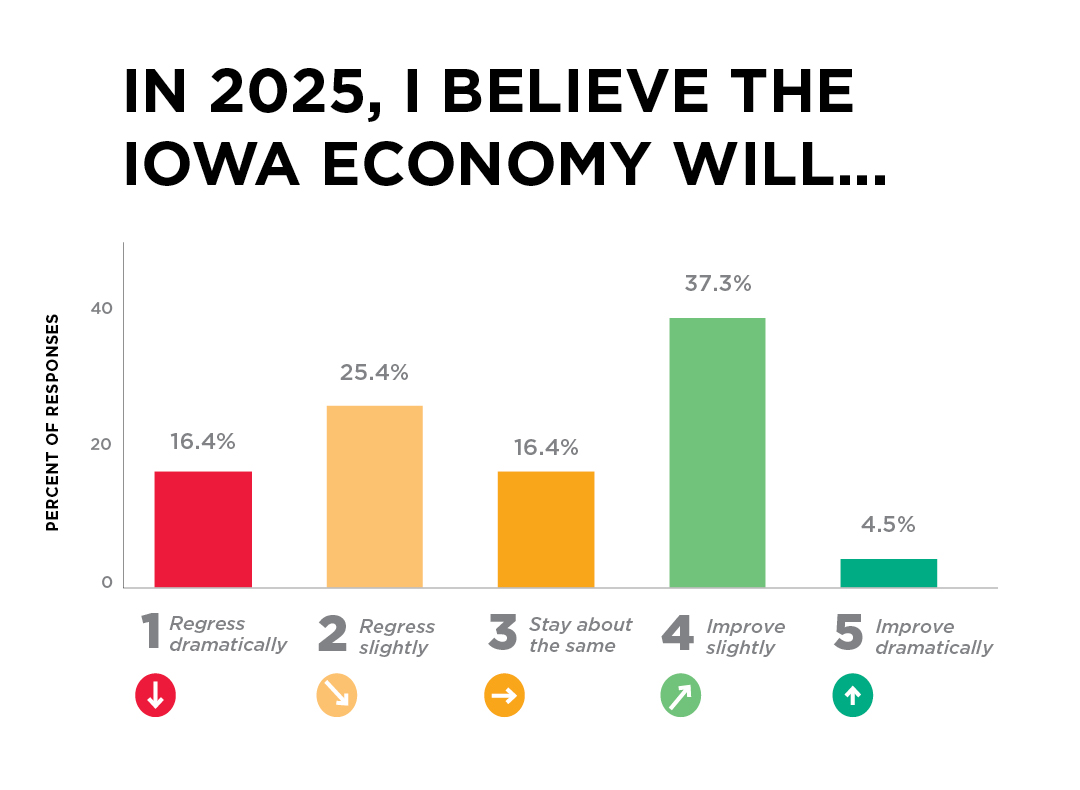

2,351 wordsBusiness Record Insider, Economic DevelopmentEach year, we give our audience the chance to weigh in on how they think the Iowa economy will fare in the coming year in our annual Economic Outlook Survey. We asked respondents to rank their opinion on a scale of 1 to 5. Of the 67 responses we received, the split between predictions for improvement versus regression were fairly even with 41% saying the economy will slightly or dramatically improve and another 41% saying it will slightly or dramatically regress. The other 16% said it would stay about the same. The responses are broken down in the graphic above.

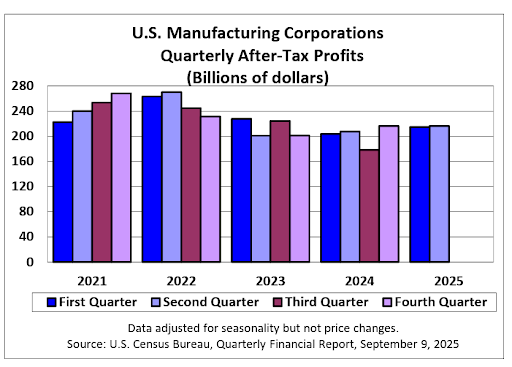

Those who expect the economy to improve cited the focus on tax reduction and better expectations for the real estate industry at the state level and expected loosening of some regulations at the federal level. Some of the main concerns among those predicting regression were headwinds for the agriculture and manufacturing industries and their ripple effects, as well as potential implementation of tariffs and mass deportations by the incoming administration. The effect of new federal policies on Iowa’s trade and workforce was also a common theme in what respondents feel is the biggest threat to Iowa’s economy in addition to continued workforce challenges.

In their comments, readers share how they think the economy might affect their industry this year. The results of the survey, in its 14th year, are not scientific but offer a glimpse into what other business leaders think as you make plans for your own business.

Here’s some of what we heard. Responses have been lightly edited for clarity and brevity.

— Sarah Diehn, Business Record editor

AGRICULTURE

Billi Hunt Executive director, America’s Cultivation Corridor

3-Stay about the same

The food and ag industry is facing lots of pressure, from costs to workforce, then layer that with global trade. Our industry will continue to navigate the rough terrain with hopes for better markets and economy in the near future.

Biggest threat: Global markets. With each change in political leadership on the national level, global policies become the priority. This isn’t uncommon but can impact our state’s ability to market across the world.

Robert Riley Chairman emeritus, Riley Resource Group

1-Regress dramatically

Agriculture will suffer. Prices for commodities are below the cost of production. This affects land prices, implement sales, conservation practices, nitrogen, phosphorus, and potassium (NPK) prices, the communities that rely on farm income. Add to this the incessant talk of tariffs, with no Farm Bill in sight, we might see a 25% reduction in agricultural income in 2025.

Biggest threat: We are a manufacturing state with a heavy emphasis on manufacturing for agriculture. With the downturn in the ag economy, the receding tide will lower all boats.

BANKING AND FINANCE

John Rigler II Chairman and CEO, Peoples Bank

2-Regress slightly

Iowa’s two major industries, agriculture production and manufacturing, along with insurance, are facing unusual headwinds at the same time. Those headwinds will be challenging for Iowa banks.

Biggest threat: Depressed farm commodity prices and heightened claim losses for property and casualty insurance companies.

Nick Callison Vice president of development, Forvis Mazars

1-Regress dramatically

Implementing tariffs in 2025 is likely to have a significant impact on the overall cost of goods in the U.S. Tariffs generally increase the prices of imported goods, which can lead to higher costs for consumers and businesses. This price increase often occurs without a corresponding rise in wages, putting additional financial strain on households.

Additionally, the current state of the housing market is unsustainable. The high rates and prices cannot continue indefinitely. Many experts predict that the housing market will experience a slowdown, with prices stabilizing or even decreasing as mortgage rates remain relatively high. This adjustment is necessary to prevent further economic imbalances and ensure long-term stability in the housing sector.

Biggest threat: Tariffs and employee wages.

Dan Downs Head of lending, Lincoln Savings Bank

3-Stay about the same

Potential rate reductions by the Fed will improve margins for our industry. Given the “static” of the jobs data and stubborn inflation figures, now the narrative from the Fed being “higher for longer,” the market expecting less reduction in 2025, operating in thinner margins will continue, delaying substantive improvement.

Biggest threat: More inflationary pressures without a strong jobs market. Renewed supply chain challenges given geopolitical events currently underway.

Steve Jacobs President, BCC Advisers

4-Improve slightly

In the investment banking industry, given the continuing aging of baby boomer business owners, 2025 and beyond should be excellent years for business transition.

Biggest threat: Tariffs could be a very bad thing for companies in the U.S.

Tony Dickinson President, NCMIC

4-Improve slightly

At the state level, a continued focus on tax reduction and job creation should be good for all.

Biggest threat: Iowa is heavily influenced by agriculture. The unknown possibility and impact of tariffs on exports is a threat.

CONSTRUCTION

John Irving President Central Iowa division, Tri-City Electric Co.

1-Regress dramatically

The construction industry has been slowing throughout 2024 and continues now, so I do not see anything changing in the coming months.

Biggest threat: Inflation and high interest.

Creighton Cox Business development leader, Greiner Construction

4-Improve slightly

The new normal is finding its place in office space needs and employees returning to work. With interest rates settling, we are seeing more companies redesigning their offices and adding amenities, resulting in increased work for architects, general contractors and trade partners in 2025.

ECONOMIC DEVELOPMENT

Carla Eysink Director, Marion County Development Commission

2-Regress slightly

Less emphasis on workforce recruitment.

Biggest threat: International trade impacts.

Tiffany Tauscheck President and CEO, Greater Des Moines Partnership

4-Improve slightly

Our investors have indicated that they are optimistic about the economy, and we continue to see significant momentum and growth across the region. We have more than 100 economic development project leads, which is the highest in years. This indicates that we should expect to see projects come to fruition in 2025 and beyond, as economic development is a long game.

Biggest threat: Our strength over many years and decades is in our ability to work together as one region, across sectors and across jurisdictional boundaries. This will continue to be critically important to our economic development growth as we know our spirit of regional collaboration helps us stand out when attracting projects.

HEALTH CARE

David Stark Chief of government affairs and philanthropy, UnityPoint Health

4-Improve slightly

Health care is impacted by an increased population with more demand for services, which puts a strain on current capacity. The bigger impact is the silver tsunami or aging of our population.

Biggest threat: Continued challenge of not enough skilled labor.

Angela Franklin President and CEO, Des Moines University Medicine & Health Sciences

4-Improve slightly

Health care, education and health professions workforce remain top of mind for me and my industry as they all can be affected by administrative and policy changes at the state and federal level. I plan to stay vigilant and strategic in finding ways to collaborate on growing the pipeline of further learners, preserve academic excellence, expand training opportunities, and find ways to keep more of our health professionals in the state, particularly the most rural and underserved areas.

Biggest threat: Supporting the workforce; finding ways to keep more of our graduates in the state and making sure Iowa remains an attractive and comfortable place for all to thrive.

HOSPITALITY

Jessica Dunker President and CEO, Iowa Restaurant Association and Iowa Hotel & Lodging Association

4-Improve slightly

Pending tax decreases in multiple areas are expected to boost disposable income, which should lead to increased spending at Iowa’s restaurants, bars and entertainment venues.

Biggest threat: If the 2017 federal tax cuts aren’t extended and regulatory overreach aren’t addressed as promised, the resulting pressures could significantly challenge Iowa’s hospitality industry and its potential for growth.

INSURANCE

Scott Jean President and CEO, EMC Insurance Cos.

3-Stay about the same

Property inflation could have the biggest impact on property and casualty insurance companies, but that isn’t of particular concern after the inflation experienced the past few years. The stock market is due for a correction at some point and that could have an impact on firms with a large equity portfolio.

Biggest threat: Nothing in particular stands out as a threat to Iowa’s economy in my mind. The biggest fear is that of the unknown as we have seen many unforeseen events in recent years.

Michael Elam Vice president of underwriting and actuarial, Delta Dental of Iowa

4-Improve slightly

Will grow total nonfarm employment, which will increase our employee benefits business.

Biggest threat: Continuing strong dollar will suppress exports of both agricultural and manufactured products.

LAW AND GOVERNMENT

Steve Richardson City council member, city of Indianola

2-Regress slightly

I believe the tax cuts being discussed will limit the dollars to all levels of government, which will have a direct effect on those industries that rely on government spending. Specifically in Iowa, we are already seeing the effects the tax cuts are having on construction firms that do business with cities.

Biggest threat: HF 718

MANUFACTURING AND LOGISTICS

Brent Clark Executive vice president, Concentric International

3-Stay about the same

Being an ag and industrial parts distributor, we experienced a notable decrease in the second half of 2024. I expect more “softness” in 2025 as well. Tariffs, if implemented, would have a negative impact on our business.

Biggest threat: Tariffs

Jim Roy CEO, Percipio Workforce Solutions

4-Improve slightly

I am in the manufacturing recruiting industry, so we are projecting an increase in job openings.

Biggest threat: The downward pressure on agriculture. John Deere layoffs caused significant additional layoffs in the Iowa manufacturing industry. We project slight improvement overall, which will lead to slightly more job creation.

NONPROFITS AND HUMAN SERVICES

Mary Sellers President, United Way of Central Iowa

2-Regress slightly

Iowa remains high on the cost of basic needs in our region and our country (food, housing, transportation, etc.).

Biggest threat: The number of people in the workforce who can’t afford the basics. Thirty-five percent of our population is an ALICE population – Asset Limited, Income Constrained, Employed. ALICE, unlike CPI, removes things like luxury items and travel and simply looks at the basic needs of people. These are working people who make less than 350% of poverty, but they are employed and, in some cases, have more than one job.

Matt Unger CEO, Des Moines Area Religious Council

2-Regress slightly

I hope the regression is slight vs. dramatic, but I am really concerned that tariffs will lead to large food price increases (as well as other everyday needed goods) and drive more folks over the edge and into food insecurity. The increased need for food assistance has left us in a place that is already beyond sustainable as our volume continues to grow even now.

Biggest threat: Tariffs that lead to decreased agricultural trade and further raising costs on basic necessities.

REAL ESTATE AND DEVELOPMENT

Tyler Dingel Executive vice president, CBRE

4-Improve slightly

The past couple of years have been challenging for the commercial real estate industry. High interest rates and construction costs have limited development. I expect those market dynamics to improve in 2025 along with overall deal volume and activity. Redevelopment and repositioning of tired assets will be the main focus.

Biggest threat: I believe weather will be the greatest threat to the overall Iowa economy. The biggest impact will be on agriculture and all of the industries that service that sector. Property insurance has also increased dramatically due to claims from weather events.

Chris Murray President and CEO, Denny Elwell Co.

2-Regress slightly

A slight regression will occur due to limited liquidity, consumer inflation pressure, high labor costs and high input costs. We will begin to realize some normalization toward the end of this year once President Trump’s policies fully take effect. With a consistent capitalistic approach by our federal government, we should begin to see wage growth that exceeds inflation by year end and fuel consumer spending as we head toward 2026. This will likely begin to fuel the commercial real estate industry once again.

Biggest threat: Limited workforce and local city government overreaching.

Jason Stuyvesant Realtor, Re/Max Concepts

2-Regress slightly

Negative tariffs are a big threat to new home builds, and as new homes get more expensive, fewer people are able to buy them.

Biggest threat: I think the threats to Iowa’s economy are similar to those nationally. Only time will tell what gets implemented. Tariffs threaten a lot of sectors that impact Iowa and all of us.

TECH AND INNOVATION

Tej Dhawan Managing director, Plains Angels

1-Regress dramatically

Since the early-stage capital industry relies upon investments by individuals in the future of the state, any negative economic impact reduces investible dollars. As immigrants start businesses at a higher rate than native-born citizens, I’d also expect deceleration in new ventures.

Biggest threat: My guess is dependent upon the immigration actions predicted for early 2025. If the anti-immigrant sentiment takes hold, immigrant-heavy industries will see an exodus — forced or voluntary — across health care, engineering, agriculture, higher education, financial services and biosciences.

Todd Kielkopf President, KAdvise Solutions

2-Regress slightly

Broadband development, despite federal incentives, is not as attractive at today’s higher long-term interest rates. Revenues per user, in competitive markets with legacy providers, remain flat, posing cash flow debt service coverage challenges for new fiber build outs. Investments in AI to improve customer experiences, operations and efficiencies may offset interest rate impacts.

Biggest threat: Longer-term interest rates being higher, for extended periods, poses refinancing and new capital investment risks across a wide economic spectrum.

WORKFORCE DEVELOPMENT

Rowena Crosbie President, Tero International

3-Stay about the same

Workforce will continue to be a strategic priority in 2025. To respond, organizations will continue to invest in the development of their people.

Biggest threat: If mass deportation happens, instead of thoughtful and strategic immigration reform, the impact on mixed-status families in Iowa will be significant. This will lead to workforce shortages for Iowa businesses across many industries. It will be especially challenging for organizations that are already finding it difficult to fill many open positions. Reduced consumer spending is another likely outcome.

Sarah Diehn

Sarah Diehn is editor at Business Record. She covers innovation and entrepreneurship, manufacturing, insurance, and energy.