Insurance ‘vital and growing industry’ in Iowa

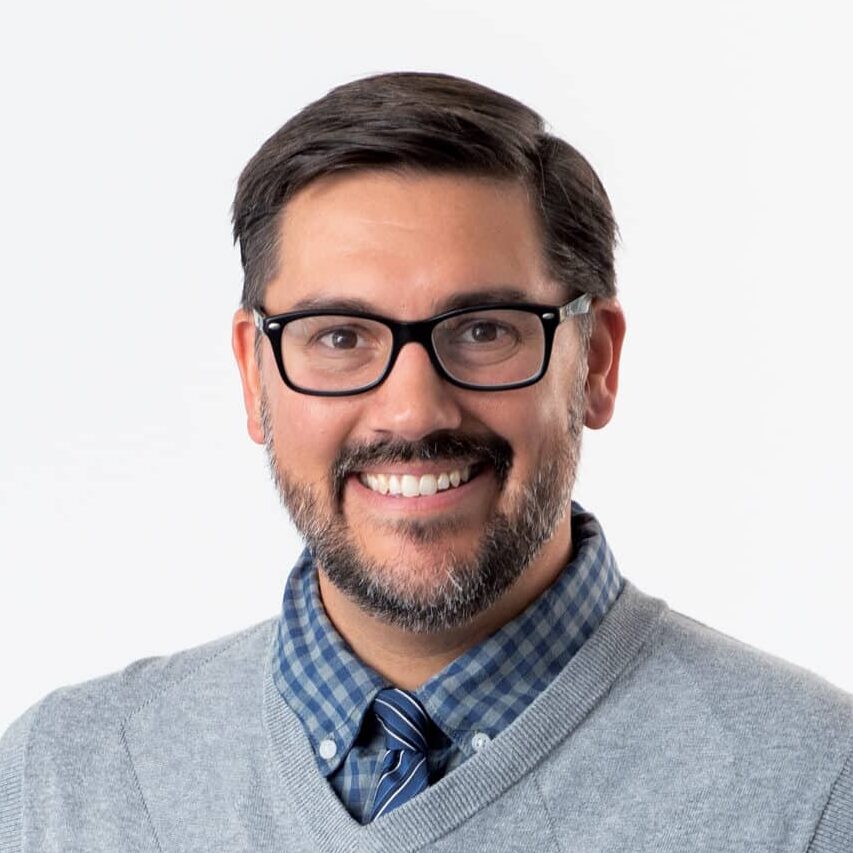

Jim Lewis, executive director of UI’s Vaughan Institute, talks strategy for recruiting talent in insurance and risk management

Mike Mendenhall Dec 8, 2023 | 6:00 am

9 min read time

2,038 wordsA Closer Look, Business Record Insider, HR and Leadership, Insurance, Statewide NewsJim Lewis’ mantra for doing anything is “start with the why.”

In September, the 62-year-old entrepreneur was named executive director of the Vaughan Institute of Risk Management and Insurance at the University of Iowa Tippie College of Business.

According to Lewis, he found his “why” in insurance and risk management in 2017, when he co-founded Benjamin.

Lewis and co-founder Gina Bell saw a need to help high-deductible insurance plan holders analyze insurance claims to save them money on prescription drugs through medication management and help shop for routine health care.

“I’d been helping everyone else solve their problems. And I wanted to be able to say, ‘I want to pick the problem I want to solve,’” he said. “… What’s the purpose? What’s the mission?”

Lewis took the Benjamin concept to the Global Insurance Accelerator (GIA) in downtown Des Moines to get guidance on fitting their product with the market and connect to customers and potential investors, he said.

“So we created this network of pharmacists that would do teleconsults. We formed a strategic partnership with a business and so we started to take off,” Lewis said.

Growth in the company led to a strategic partnership with the Scottsdale, Ariz.-based artificial intelligence health care firm Clever Health, which purchased Benjamin in 2021.

Lewis’ first exposure to the industry was through Relationship Marketing Inc., an agency he founded in 1993 and led as CEO until 2012. It served Fortune 100 clients in the insurance, financial services, and pharmaceutical industries with a goal to “make their key relationships more loyal and profitable,” according to Lewis’ LinkedIn profile.

Lewis also co-founded and was chief operating officer of the West Des Moines-based Splashlight from 2013-2017, which worked to reduce self-insured workers’ compensation medical plan costs through advanced claims analytics.

“I’ve worked in just about every industry you can imagine. I’ve either helped companies or had them as clients. There’s nothing that compares to insurance. It is the most complex ecosystem of people and relationships and regulation,” Lewis said. “Distribution is so complex.”

Lewis replaced former Vaughan Institute Professional Director Terri Vaughan, who stepped down but continues to serve on the institute’s advisory board.

The Vaughan Institute recruited Lewis while he was alumni director at the GIA.

The job was a return for Lewis. He graduated from the Tippie College of Business in 1983 and later taught in the MBA program.

Founded in 2002, the Vaughan Institute focuses on education, research and thought leadership in risk management and insurance regionally, nationally and globally. According to the institute’s website,, there are nearly 140 insurance companies located in Iowa, and less than 60 universities in the country offer a risk management and insurance program.

Lewis sees military veterans, MBA students and working adults looking to change career paths as potential talent pools for the institute to tap and help fill jobs in what is an aging insurance and risk management industry, he said.

One issue of concern, Lewis said, is the industry doesn’t “have a voice.” He hopes universities and programs like the Vaughan Institute can be promoters of insurance and risk management as a “worthy industry.”

According to Lewis, the institute has 130 students in its degree program and 57 seeking certificates. That exceeds its goal set last year to have 100 degree-program students in three years.

Lewis recently sat down with the Business Record to discuss headwinds facing insurance and risk management, academia’s role in replacing the industry’s aging workforce and his strategy to lead the Vaughan Institute.

This interview has been lightly edited and condensed for clarity.

U.S. insurance markets have seen a lot of pressure in recent years from increased payouts, a challenging economy and the pandemic. How is the insurance and risk management landscape different today for Tippie College Vaughan Institute students than when you founded Benjamin in 2017?

We have such turmoil. Think about just geopolitical [challenges]. And then you think about the climate. In the insurance industry, certainly the property/casualty, climate risk is just unbelievable. Who saw that coming, especially all at the same time? [There are] profitability [challenges] with inflation and a lot of skepticism right now in big institutions, rightfully so. Insurance companies are big institutions also, and so are universities. Since 2017, it’s just dramatically different. The industry itself is very big and very strong. It has tremendous assets. It’s amazing how much of our economy is driven by those assets. They reinvest that into everything. And without that, I don’t know that we have an economy that would run. They provide all that liquidity. Thank goodness we have that. Because that was really what drives stability, if you will, during all that craziness. There’s been some huge losses and somehow, they absorbed that. Risk is an interesting thing.

What would you say is the most complex challenge to insurance and risk management today, and what is one thing that gives you optimism for the industry’s future?

I think there’s two big ones. The first one is innovation. [Industry leaders] are looking for bold ideas that will solve some of these [profitability and climate] issues. How do we get that into our organization? And so you either have to go outside and get [solutions from] insurtechs and the fintechs.

They struggle even when they find a really good company, how do you bring that in and implement? This is not something they’re necessarily good at. I think we can help them at the University of Iowa and we should.

It’s a struggle for most industries, but I’d say insurance, you know, being risk-averse. It’s extra hard for them.

But the second really big one that [insurance and risk management firms] are facing right now is talent shortage. Big time. This is one that we should all care about in the state of Iowa. Because unless we can provide a steady flow of career-ready talent that can also be maybe more innovative and bring ideas from the outside [and] from inside and know how to work with that, unless we do that, we’ve got a problem for our entire state. This is one of the largest industries in our entire state — 11% of our GDP. Imagine you’re in economic development or you’re an executive of a large insurance company, or maybe even a new one that is just getting started and going to be the next era, where do you put your company? Well, you need to have great talent available. It’s not just Iowa. It’s everywhere that is having problems, but we are just unique in the state of Iowa. We really need to pay attention to this. We need to invest in our future with talent. It’s also an aging industry. I love doing meetings with students. They’re like my customer. I love discovery. I’ve got thousands of them available to me. I’ll buy them coffee, we sit down and these are some of the smartest [people]. It gives you great hope for our future if you sit down and talk with them. This one [student] said, “It’s such an older white-men-kind-of-an-industry.” And then the other student says, “I know, it’s perfect. They’re all leaving.” And they’re right.

If you were thinking about getting into an industry, it’s perfect. [The insurance industry is] needing all of this young, diverse talent. And guess what? They’re aging and leaving. So golden opportunity to rapidly advance. And that gives me hope, that although we have talent shortage, we can do something about that. I would say that we can’t solve the problem at the University of Iowa. I don’t think that Drake (University), University of Iowa and if Iowa State keeps getting more involved and others, there are so many more positions open than we can fill. So, it really is going to take more of what I call this collaborative ecosystem where we come together, and we make it open. It’s an open invitation where we all have a stake in this and a reason that we want to try to help get this next generation plugged in.

Undergraduate, four-year institutions have faced increased scrutiny in recent years because of affordability and graduating career-ready students. How is the Vaughan Institute responding to that challenge?

What students are looking for – there are three things. One is I want to get a financial return on my investment because I’m scared to death of student debt, and can I get that paid off? Is this really gonna give me value? A second one is, I want to know that I can use these experiences, more real-world experiences. And the third one, which is very interesting, is this generation in particular is looking to make a difference and want to be part of something that is meaningful and impactful.

Insurance is a very noble industry, it puts lives back together after tragedy. It prevents bad things from happening. And it helps us secure assets so that you can fulfill your dreams. When I say it like that to the students, they’re like, that’s interesting. I’ve talked to people who have no idea what I’m going to say: would you be involved? Would you like to be part of something like that? They’re like, “that sounds really cool.”

So part of what we’ll be doing at Vaughan is we’re going to be championing the voice of that industry right there. Join a … vital, growing industry that will help keep the world safer, smarter and more secure. And it’s a whole different conversation when you approach it like that.

How do you foresee artificial intelligence changing the insurance industry and risk management products?

I don’t think there’ll be anything bigger that’s going to hit us, frankly. We’re already embracing it in a significant way, so in nearly every one of our classes. But our Dean Amy L. Kristof-Brown, this is one of her highest priorities is to really bring in some incredible talent. You’ll probably hear a lot more about that in the not-too-distant future. But she calls it a transformational hire with someone who is recognized as a worldwide leader in AI and insurance bringing them here.

How would you describe your leadership style?

I love collaboration. I know I can’t do it on my own. I think the easiest way to align and get people to collaborate is joining a shared mission. So my job is to clearly articulate “this is our why.” This is our purpose. And if you’re drawn to this, join us and there’s a seat at the table. I’m all about collaborative innovation. I’m very transparent. I told my [Vaughan Institute] board, don’t think I’m not going to be the one doing this. I’m just going to get it out of all of us, get us going in the right direction. It’s amazing the deep bench you have at a university. You need the external voices and you need the customer, most importantly. So I’m all about really doing collaborative innovation and I love customer discovery. You go out and talk to the actual user of the product service and find out where you’re not meeting their expectations, and you find out things that are pain points that you didn’t necessarily know. And you find out, if I can solve that, how important would that be to you? Would you pay for that? Would you buy that? That’s what we all do as great entrepreneurs. That’s really where it all starts is customer discovery.

What is one book you’re reading or that you’ve recently read that you would recommend?

Strangely enough, Bono’s “Surrender: 40 Songs, One Story.” And you would be like, “what’s that have to do with business?” First of all, he’s a phenomenal philanthropist and business person. He is all about the why, also. And he also was one to say “don’t tell me it’s not possible. We can do it. We just have to find a way.” I think that was a really interesting read and something you would not expect from a business executive. I mean, I love the band U2, don’t get me wrong. I was reading it and just thinking of all these ways I can apply that and I just thought it was fascinating.

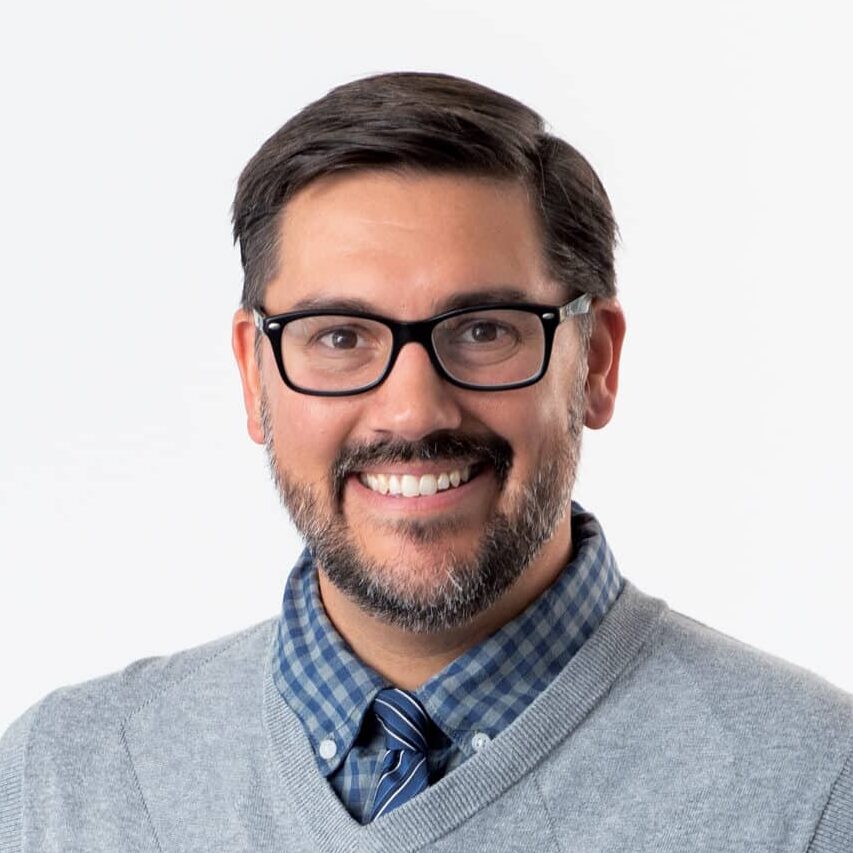

Mike Mendenhall

Mike Mendenhall is associate editor at Business Record. He covers economic development, government policy and law.