Iowa lags behind nation in personal income growth

|

|

Why you shouldn’t worry about Iowa’s ag economy contraction Iowa State University labor economist Peter Orazem says Greater Des Moines business leaders should not be worried by the latest report on personal income. Read what he has to say about Iowa’s economic health. Read more >>>

|

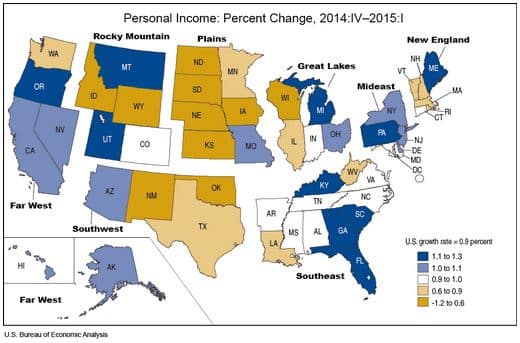

Personal income growth in Iowa and several other Plains states took a hit because farm incomes decreased, according to a new report from the U.S. Commerce Department’s Bureau of Economic Analysis.

Iowa, with a 1.2 percent loss, showed the largest decline in the nation from the fourth quarter of 2014 to the first quarter of 2015. Nationally, personal income grew 0.9 percent, with states with the highest growth recording increases just over 1 percent.

Nationally, farm earnings fell 22.4 percent in the first quarter, with most declines due to lower livestock output. In Iowa, Kansas, Nebraska and South Dakota, the fall in farm earnings entirely offset the earnings growth of their nonfarm sectors, according to bureau statistics.

Earnings grew at variable rates in all other private-sector industries in the first quarter of 2015, with more rapid growth in the professional services and health care industries.

But Iowans’ personal income grew only 1.3 percent that year, compared with the national average of 3.9 percent. The bureau uses three components to measure personal income: net earnings; dividends, interest and rent; and “personal current transfer receipts,” which include government benefits such as Social Security, Medicare and Medicaid, and unemployment and veterans’ benefits.

While Iowa kept pace with the national average in the second and third income categories, Iowans’ net earnings per capita stayed flat from 2013 to 2014, while the national average grew 4 percent.

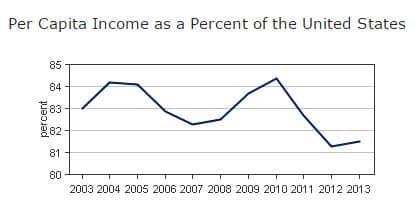

Over 10 years — from 2004 to 2014 — Iowans generally gained ground on the rest of Americans. The compound annual growth rate for Iowa was 3.4 percent, compared with 3 percent for the nation.

But as the rest of the country came out of the recession, Iowans’ income growth began to lag behind growth in other states. Since 2011, the state’s progress has declined or remained fairly flat compared with average growth for the rest of the county, according to the chart above.

Over a similar 10-year period — 2003 to 2013 — personal income in the Des Moines metropolitan statistical area lagged only slightly behind the national average. The compound annual growth rate for the Metro was 3 percent, compared with the national average of 3.2 percent.