Is a Recession Around the Curve?

Business Record Staff May 1, 2019 | 6:00 am

6 min read time

1,454 wordsBusiness Insights Blog, FinanceBY KENT KRAMER, CFP®, AIF®, Chief Investment Officer, Foster Group

What interest rate would you expect to receive on a:

- 12-month CD?

- 5-year CD?

If your answer was higher for the 5-year CD, you are expressing the normal expectation of a higher return for a longer term to maturity. The same intuition holds when homebuyers consider a 15-year mortgage vs. a 30-year mortgage. The higher interest rate is compensation for bearing more risk of interest rate and inflation changes, as well as the opportunity cost of not investing in other things over that same time period.

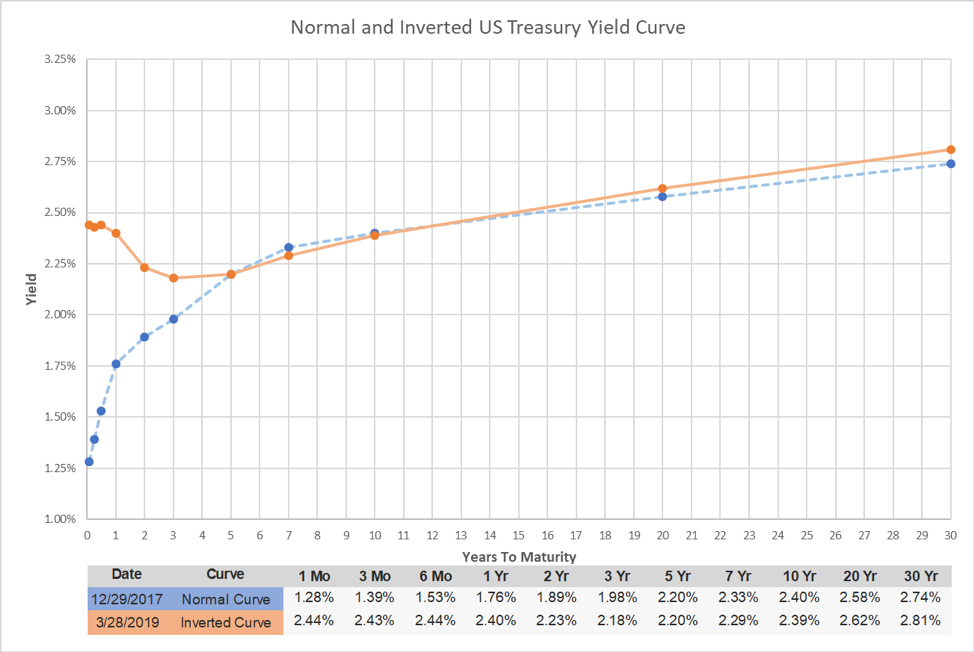

Normal and Inverted Yield Curves

This relationship between interest rates and the term of CDs or bonds can be illustrated in a yield curve. In the graph below, the dotted line depicts a “normal,” upward sloping yield curve for US Government debt as of December 2017, when rates were lower for short-term, 30-day Treasury Bills, and higher for longer-term 10, 20, and 30-year Treasury bonds.

Recently, following the 2018 raises of the short-term bank borrowing rate set by the Federal Reserve, something rare developed. Short-term interest rates on US Government securities became higher than longer-term rates. When this happens, the yield curve is said to be “inverted” or downward sloping. The solid line on the chart illustrates the recent inverted yield curve for US Government debt.

Why would bond investors be willing to receive a lower rate of interest for a longer-term bond?

The yield curve is an expression of investor expectations about future interest rates and their required return for a given time period. During the fourth quarter of 2018 as stock prices declined, intermediate and longer-term bond pricesrose, sending some interest rates lowereven as the Fed raised their short-term rate. Investors became pessimistic about future stock market returns and economic growth, so they seemed willing to pay more for lower risk, low interest rate bonds today in anticipation of even lower stock prices and interest rates in the future.

Recessions Are Hard to Time

Some forecasters think that inverted yield curves indicate impending stock market declines and economic recessions. Inverted yield curves are rare, having occurred in the United States only 7 times since 1969,1making it easy to review how the US economy and stock market performed during these periods.

In September of 2018, Vanguard researchers noted that all seven US recessions since 1970, have been preceded by an inverted yield curve though the time from inversion to subsequent recession start dates varied from five to seventeen months. Additionally, the inverted yield curve was not a reliable predictor of the timing or duration of past recessions. They also “…acknowledge the changes that have occurred as a result of QE (Federal Reserve policy of Quantitative Easing), … may prolong the timebetween the inversion of the yield curve and the subsequent recession.”1

Stock Market Response

In the “The Flat Out Truth”2prepared by Dimensional Fund Advisors in November of 2018, authors examined the four US Treasury yield curve inversions since 1976 and subsequent stock market performance. Of these four inversions, the first two did not appear to directly coincide with stock market declines. The third closely coincided with the tech bubble and broader US stock market decline of the early 2000’s. The fourth occurred in February of 2006. The researchers note:

“The US yield curve inverted in February 2006, after which the S&P 500 Index posted a positive 12-month return. The yield curve’s slope became positive again in June 2007, well prior to the market’s major downturn from October 2007 through February 2009. If an investor had interpreted the inversion as a sign of an imminent market decline, being out of stocks during the inverted period could have resulted in missing out on stock market gains. And if the same investor bought additional stock once the curve’s slope became positive, they would also have been exposed to the stock market weakness that followed.” 2

Conclusions

It is hard to say what conclusions, if any, can be made regarding forecasting stock market returns or repositioning an investment portfolio based on an inverted yield curve. Rather than trying to predict a specific outcome in this situation, investors can prepare for various potential outcomes by maintaining a diversified portfolio designed to achieve their long-term objectives.

1.“Rising rates, flatter curve: This time isn’t different, it just may take longer”, September 2018, Vanguard

2. “The Flat-Out Truth”, November 15, 2018, Dimensional Fund Advisors

Charts and graphs do not represent the performance of the Foster Group or any of its advisory clients. They do not show the impact that advisory fees, taxes, and other expenses will have on the results. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. There are no assurances that an investor’s portfolio will match or outperform any particular benchmark.

All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals, and economic conditions may materially alter the performance of your portfolio. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses.

Foster Group is registered as an investment adviser and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.

PLEASE NOTE LIMITATIONS: Please see Important Disclosure Information and the limitations of any ranking/recognitions, at www.fostergrp.com/info-disclosure. A copy of our current written disclosure statement as set forth on Part 2A of Form ADV is available at www.adviserinfo.sec.gov.©2019 Foster Group, Inc. All Rights Reserved.

Explanation and Disclaimer for Treasury Yield Curves

* The 2-month constant maturity series begins on October 16, 2018, with the first auction of the 8-week Treasury bill.

30-year Treasury constant maturity series was discontinued on February 18, 2002 and reintroduced on February 9, 2006. From February 18, 2002 to February 8, 2006, Treasury published alternatives to a 30-year rate. See Long-Term Average Rate for more information.

Treasury discontinued the 20-year constant maturity series at the end of calendar year 1986 and reinstated that series on October 1, 1993. As a result, there are no 20-year rates available for the time period January 1, 1987 through September 30, 1993.

Treasury Yield Curve Rates: These rates are commonly referred to as “Constant Maturity Treasury” rates, or CMTs. Yields are interpolated by the Treasury from the daily yield curve. This curve, which relates the yield on a security to its time to maturity is based on the closing market bid yields on actively traded Treasury securities in the over-the-counter market. These market yields are calculated from composites of indicative, bid-side market quotations (not actual transactions) obtained by the Federal Reserve Bank of New York at or near 3:30 PM each trading day. The CMT yield values are read from the yield curve at fixed maturities, currently 1, 2, 3 and 6 months and 1, 2, 3, 5, 7, 10, 20, and 30 years. This method provides a yield for a 10 year maturity, for example, even if no outstanding security has exactly 10 years remaining to maturity.

Treasury Yield Curve Methodology: The Treasury yield curve is estimated daily using a cubic spline model. Inputs to the model are primarily indicative bid-side yields for on-the-run Treasury securities. Treasury reserves the option to make changes to the yield curve as appropriate and in its sole discretion. See our Treasury Yield Curve Methodology page for details.

Negative Yields and Nominal Constant Maturity Treasury Series Rates (CMTs): At times, financial market conditions, in conjunction with extraordinary low levels of interest rates, may result in negative yields for some Treasury securities trading in the secondary market. Negative yields for Treasury securities most often reflect highly technical factors in Treasury markets related to the cash and repurchase agreement markets, and are at times unrelated to the time value of money.

At such times, Treasury will restrict the use of negative input yields for securities used in deriving interest rates for the Treasury nominal Constant Maturity Treasury series (CMTs). Any CMT input points with negative yields will be reset to zero percent prior to use as inputs in the CMT derivation. This decision is consistent with Treasury not accepting negative yields in Treasury nominal security auctions.

In addition, given that CMTs are used in many statutorily and regulatory determined loan and credit programs as well as for setting interest rates on non-marketable government securities, establishing a floor of zero more accurately reflects borrowing costs related to various programs.

|

Kent Kramer View Bio |