Market Vibe

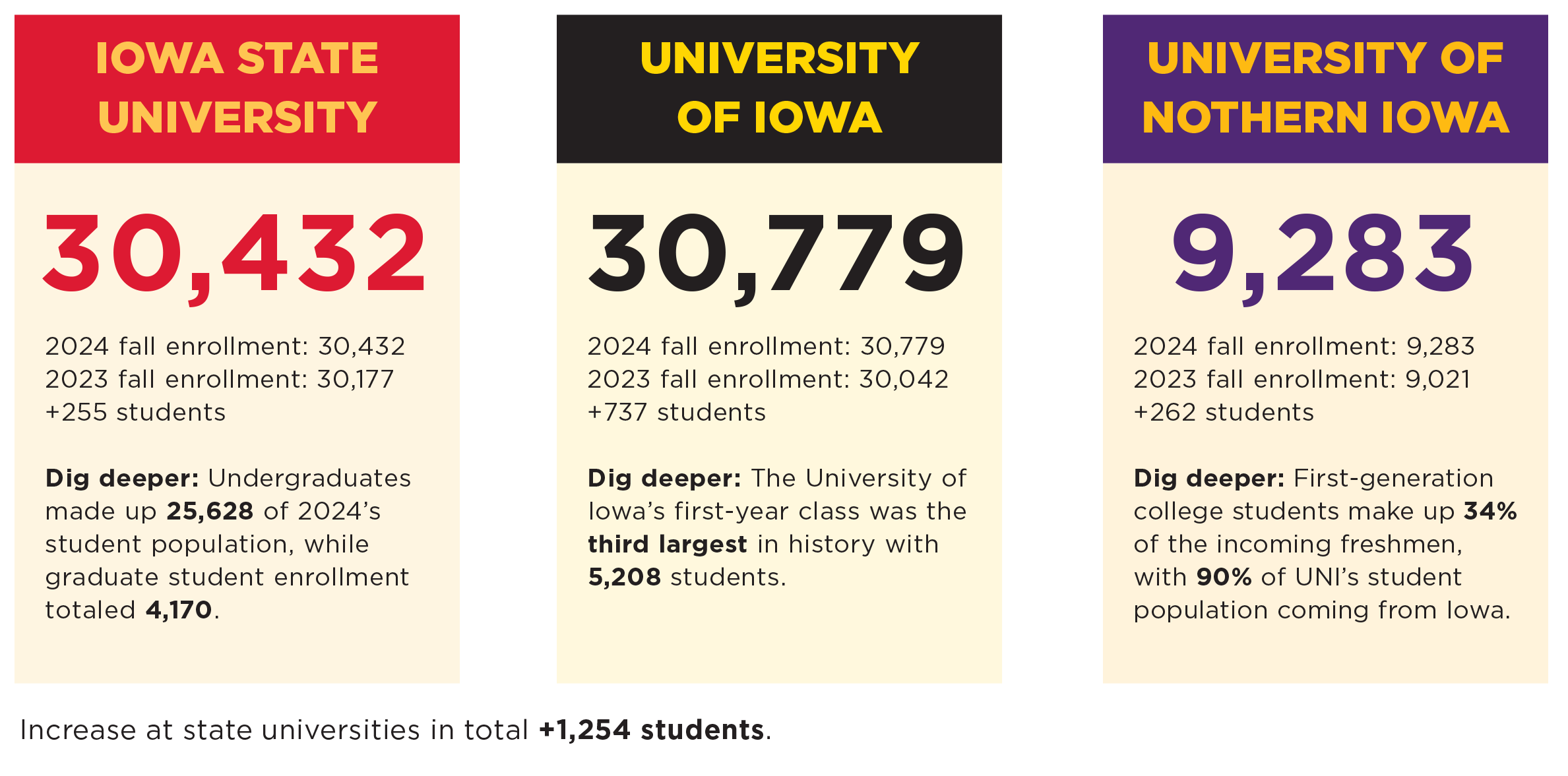

Each year, the Book of Lists provides a resource for business leaders to refer to as they look for new partnerships, colleagues and data points that can help their organizations. The Market Vibe section is compiled to give a snapshot of the region. The data shown here is meant to help you better understand Greater Des Moines’ business ecosystem. This year, we show you vacancy rates in the commercial real estate market, how the region’s rental market compares to regions of comparable size, insurance claims due to storms, record Iowa State Fair attendance, enrollment at state universities and more. These data points are continuously fluctuating. Throughout, we offer context about the important information to know about these numbers and when the data was compiled.

– Emily Barske Wood, Business Record special projects editor

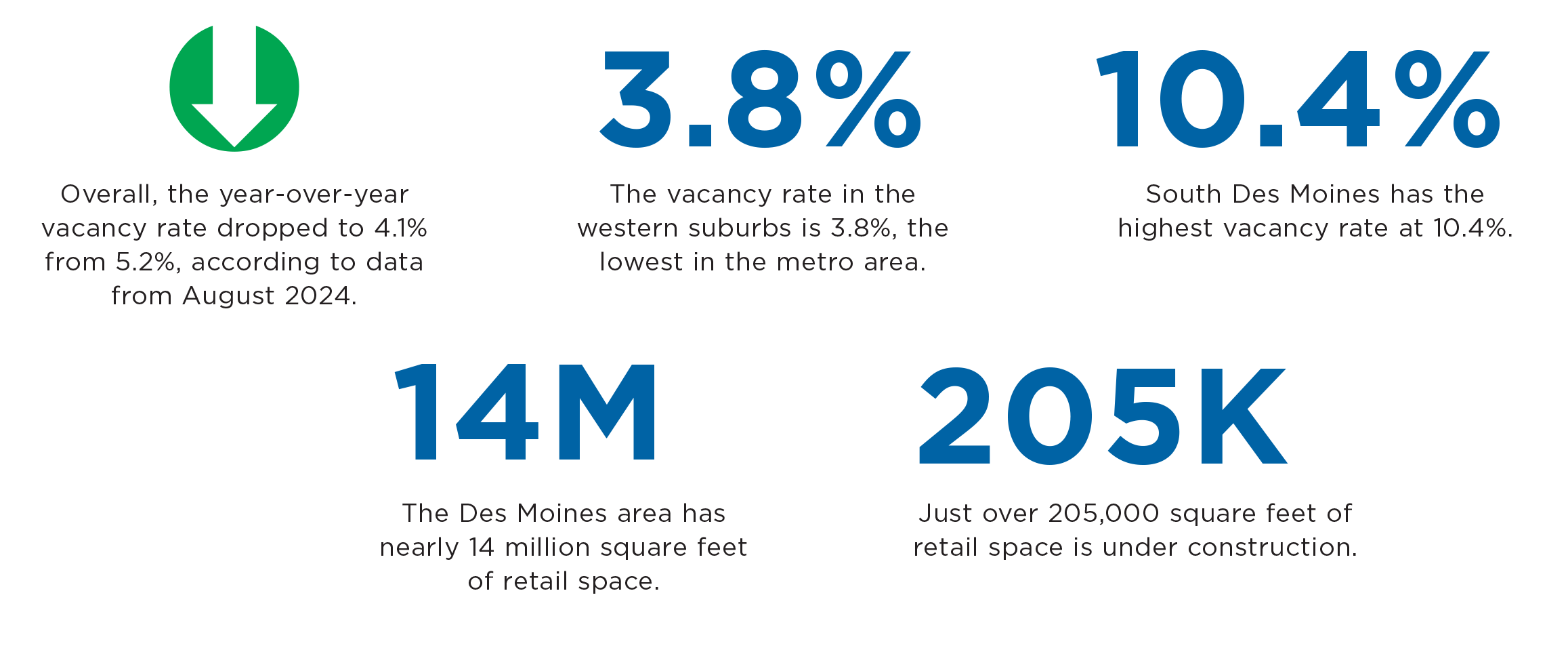

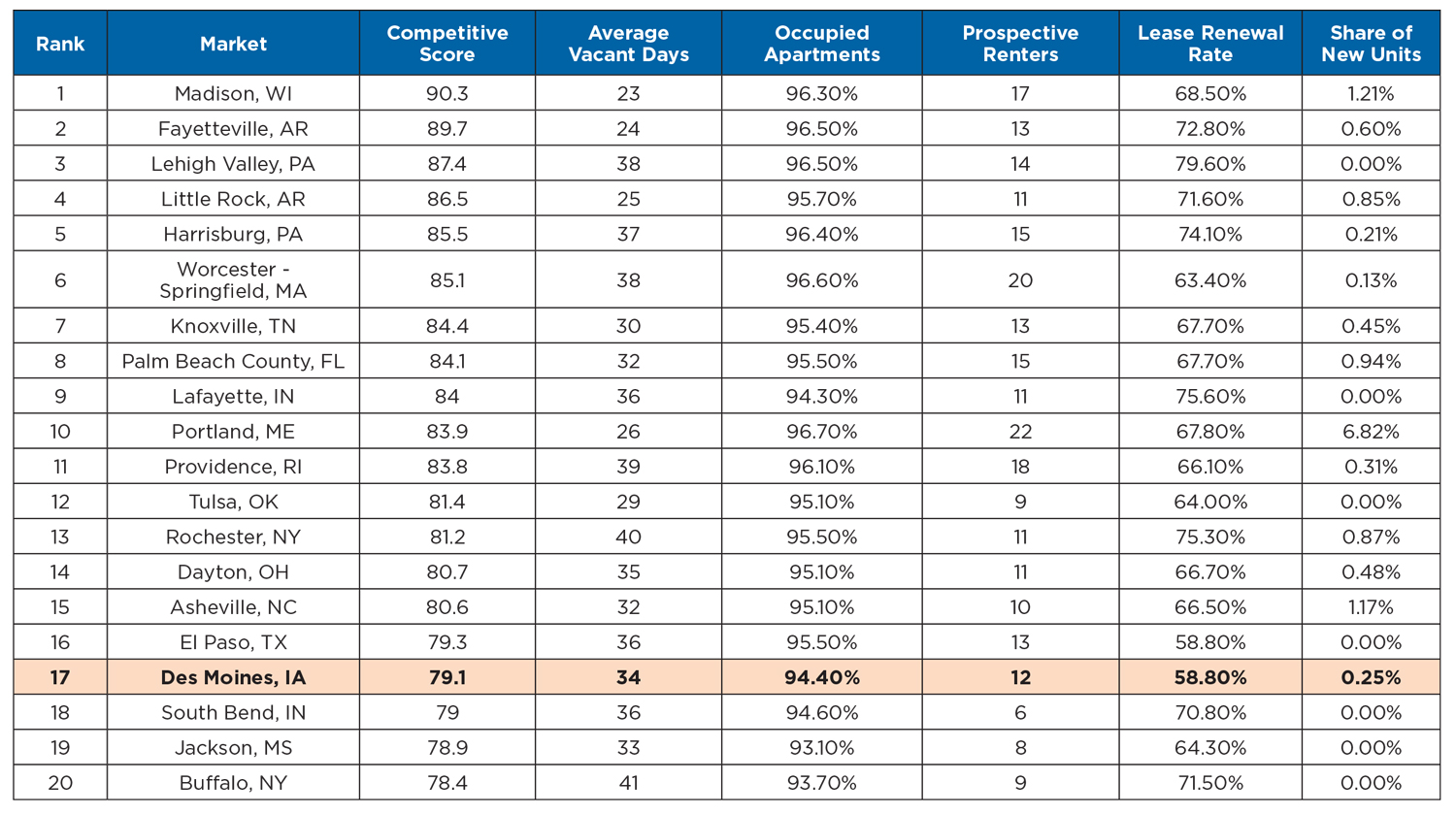

Greater Des Moines among U.S.’s 20 most competitive small rental markets

The Greater Des Moines area is one of the 20 most competitive small rental markets in the U.S., with an average of 12 prospective renters competing for each vacant apartment unit in the area, a report by RentCafe shows. Des Moines ranked 17th in RentCafe’s survey, which was released in September 2024, with vacant apartments getting filled in an average of 34 days. The occupancy rate in the Des Moines area was 94.4%, and nearly 60% of renters in the metro renewed their leases, according to the report. Des Moines’ overall competitive score in the survey was 79.1. In 2023, Des Moines’ competitive score was 73.3. The hottest small rental market was Madison, Wis., with a competitive score of 90.3. In Madison, 96.3% of apartments are occupied, and it takes an average of 23 days to fill a vacant unit. An average of 17 prospective renters competed for vacant units; the area’s lease renewal rate was 68.5%. The overall national competitive score was 75.8, RentCafe reports. In addition, 93.7% of apartment units were occupied and 62% of renters renewed their leases. RentCafe attributed the increase in Des Moines’ competitive score to few new units added to the market in recent months. However, a recent multifamily report by CBRE Inc. showed that 1,946 units were delivered to the market in the first half of 2024, 633 more than were delivered in all of 2023. Among the area’s newest apartment developments are the Tempo at 317 E. Sixth St. in Des Moines and the Cunningham at 950 Jordan Creek Parkway in West Des Moines. The CBRE report noted that 1,902 apartment units are under construction in the Des Moines area and another 2,729 units are planned.

Source: RentCafe.com

A look at industrial and office vacancy rates

Industrial vacancy rates climbed in the second quarter of 2024, with more than 760,000 square feet of speculative space being available and more than 1 million square feet under construction, according to second-quarter reports from brokerage firms JLL and CBRE.

According to the CBRE report, the Des Moines industrial market had nearly 198,000 square feet of negative absorption, with 95% of that negative absorption being seen in the northeast and western suburbs.

The CBRE report showed the overall bulk modern warehouse and distribution vacancy rate increased to 16.5% in the second quarter, while lease rates increased 3.3% year over year.

The JLL report showed industrial vacancy rates rose to 6.2% in the second quarter, with more than 1.26 million square feet of space under construction.

JLL forecast that vacancy rates will fall as competition for space persists, with data centers and warehouse developers competing for space.

“While industrial starts have slowed down, it is anticipated vacancy rates will decrease during the second half of the year,” JLL analysts said in the report.

On the office side, vacancy rates ranged from 12.9% to 19%, according to second-quarter reports from Cushman & Wakefield, CBRE and JLL.

JLL’s report showed vacancy rates ticking up to 18%, with a forecast for vacancy rates to continue rising in the second half of 2024. The report showed a negative net absorption of nearly 1.4 million square feet year to date, with more than 37,000 square feet under construction.

“To remain competitive, tenants and office occupiers will persist in considering upgrades for their spaces,” JLL said in the report.

Cushman & Wakefield reported an office vacancy rate of 19% in the second quarter, with 265,000 square feet of negative net absorption.

“It isn’t typical that an absorption number of negative 265,000 square feet of space might be seen as a good thing,” the Cushman & Wakefield report read. “However, in this case, that absorption number is greater than the quarter 1 number by nearly 200,000 square feet of space. Within the last five quarters, the Des Moines market has seen significant blocks of space get brought to the market as a result of announcements made in late 2022 and early 2023. Barring any new announcements, the Des Moines office market has made it through that storm. Thus, any significant leasing activity seen in the upcoming quarters will likely cause the market to show positive absorption.”

CBRE reported office vacancy rates of 12.4% with overall net absorption of more than 186,000 square feet. The Central Business District accounted for more than 60% of that positive absorption, the report said.

Source: 2024 Q2 reports from Cushman & Wakefield, CBRE and JLL.

Iowa State Fair breaks attendance record in 2024

The 2024 Iowa State Fair saw its largest attendance in its 170-year-old history with 1,182,682 fairgoers. The officials attributed it to the “perfect weather” conditions.

- The Grand Champion 4-H Market Steer exhibited by Mason Shalla of Riverside was sold for $175,000.

-

Finnegan, a crossbred boar shown by Bryan and Tricia Britt of Monticello, set a new State Fair record in the Big Boar competition, tipping the scales at 1,420 pounds.

-

A total of 9,204 people voted in the Best New Food Competition. The Cheeseburger Eggroll from Winn & Sara’s Kitchen won the People’s Choice Best New Food Award. The winner of the Best New Drink (with alcohol) went to JR’s SouthPork Ranch for the Cowgirl Cooler, and the Bubbly Bar & Bistro received Best New Drink (without alcohol) for the Abracadabra Butterfly Lemonade.

-

Exhibitors entered 203 pies and 321 cakes in food competitions.

-

In the fabric and threads department, 466 quilts were entered.

-

One super-sized pumpkin weighed in at 1,294 pounds.

-

The Woodcarvers’ Auction on the last day auctioned off the work of three chainsaw artists during the fair. Proceeds from the auction will benefit the Blue Ribbon Foundation Endowment, and the event raised $78,146 for improvements to the Iowa State Fairgrounds.

Source: Iowa State Fair

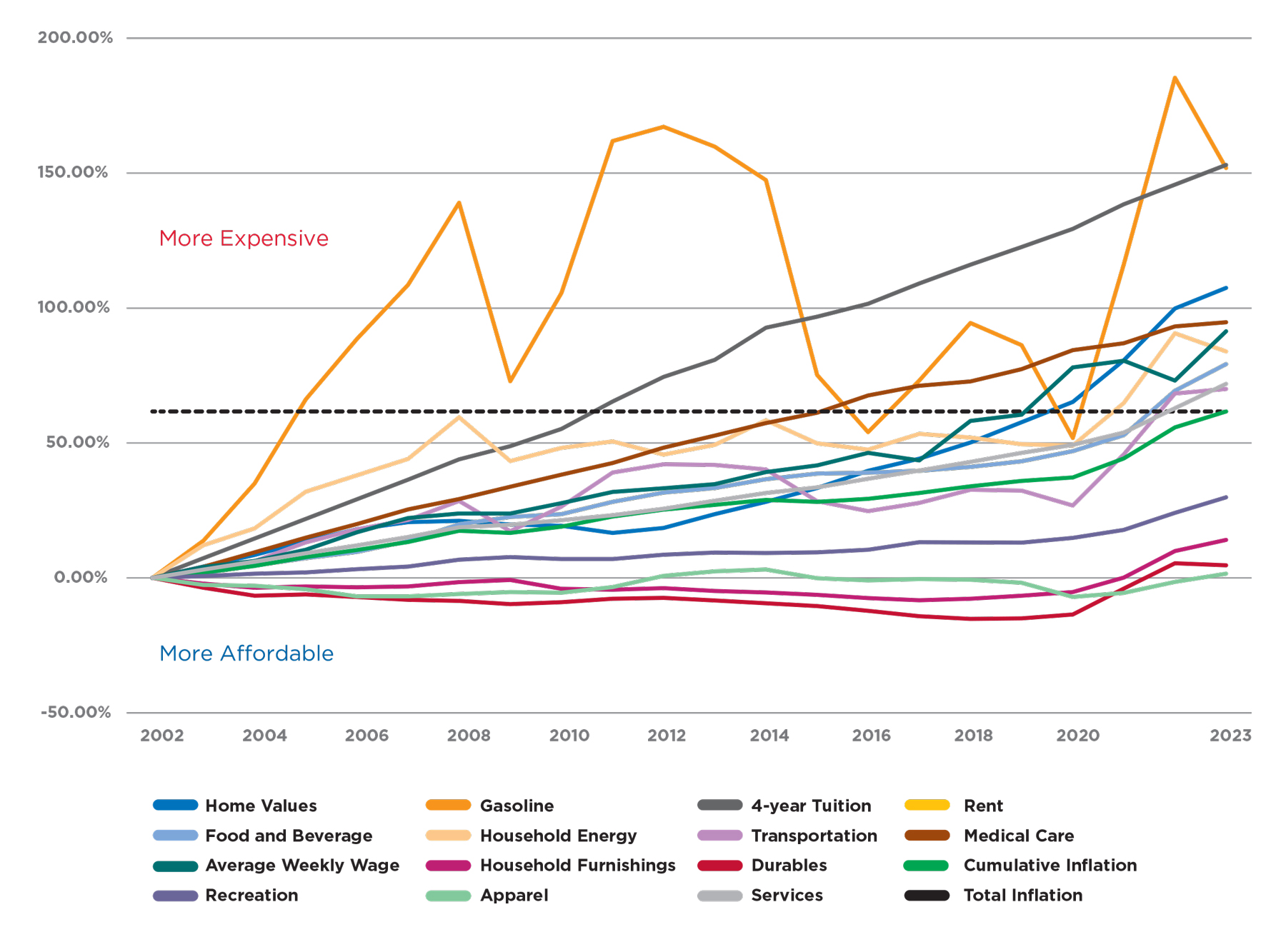

Iowa prices in the 21st Century (through 2023)

Common Sense Institute Iowa compiled data to show 20 years of changes in wages, inflation and the prices of consumer goods and services in Iowa since the beginning of the 21st century. The data showed wages rose while most durable and nondurable goods remained affordable; however, housing, health care and higher education have increasingly taken up more of Iowans’ budgets, according to the institute’s report in February 2024. Broken into two periods — before the COVID-19 pandemic and after — however, the data paints a different picture.

Prior to the pandemic, Iowans’ wages rose at more than double the rate of inflation — a 78% increase in wages versus a 37% increase in prices. From 2020 to 2023, however, Iowans saw a significant decrease in wages, as they experienced an 18% increase in prices while their wages rose only 7.5%. Wages had a 10% surge in 2023 while inflation has tapered off.

Key findings:

- At an increase of over 150% since 2002, the price of four-year tuition at a public university and the price of gasoline remain dominant over all other items; however, gasoline prices remained highly volatile throughout the period with years of drastic increases and decreases, while the cost of tuition has increased steadily at 2% to 7% annually.

- Apparel, durables, household furnishings, and recreation remain well below total inflation rates. While these have increased in price since 2020, Iowa consumers enjoyed deflation in apparel, durables and household furnishings from 2002 through 2020.

- The price increases in food and beverage, services, recreation and rent all outpaced overall inflation (3.8%) from 2022 to 2023.

Source: Data compiled by the Common Sense Institute Iowa