Mid-America Conditions Index climbs again in February

Business Record Staff Mar 6, 2025 | 11:52 am

3 min read time

644 wordsAll Latest News, Economic Development

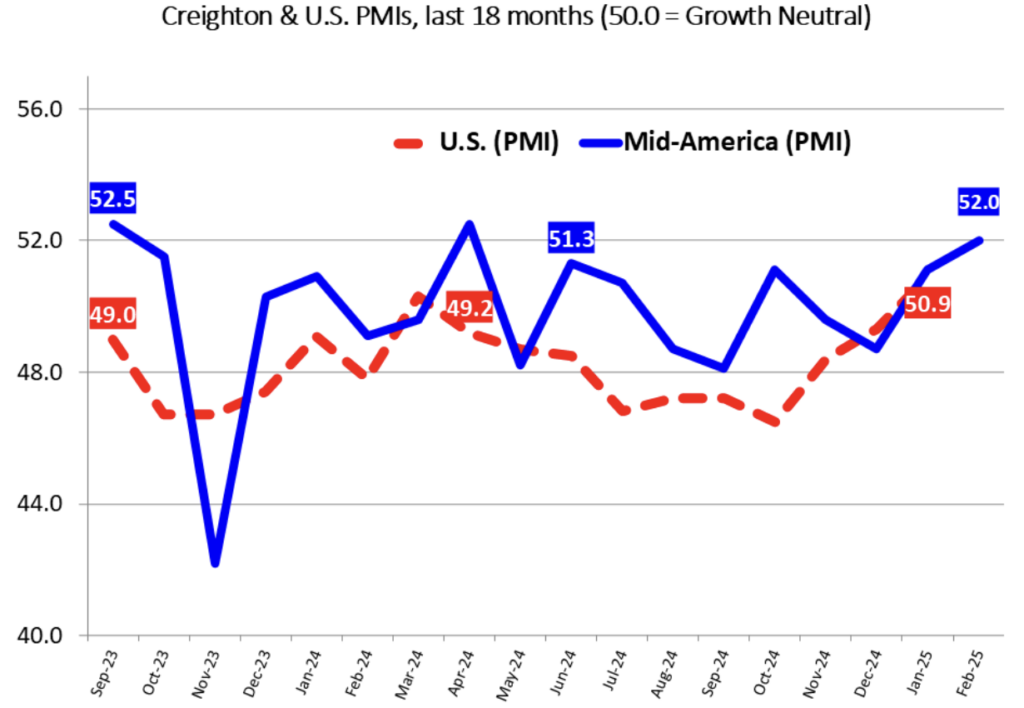

The Creighton University Mid-America Business Conditions Index is once again above the growth-neutral rate of 50.0. The index, an economic indicator for a nine-state region including Iowa, reached 52.0 in February, up from 51.1 in January and 48.7 in December.

The index uses the same methodology as the Institute for Supply Management and ranges between 0 and 100, with 50.0 representing growth-neutral. The Creighton index, which is produced independently of the ISM, has vacillated above and below growth-neutral since April 2023.

“I remain concerned about the negative impact of tariffs on the cost of imported inputs and of retaliation on U.S. manufactured exports. On average, supply managers expect the proposed tariffs to increase the cost of imported inputs by 9.6%,” Ernie Goss, the Jack A. MacAllister Chair in regional economics at Creighton University, said in a news release.

In Iowa, the state’s index for February increased to 44.5 from January’s 43.1. Among the nine-state region, Iowa ranked seventh for the month, with Missouri bringing in the highest index rating at 56.2, and Kansas having the lowest at 43.1.

New orders in Iowa rose to 48.1 from 46.9 in January and 44.3 in December. Iowa production or sales was down to 40.4 following 43.9 in January and 42.1 in December. Iowa delivery lead time was at 37.4 in February following 46.3 in January and 45.4 in December.

The overall regional employment index for February improved to 51.2 from January’s 51.1, and in Iowa it was at 47.8, up from 35.1 in January and equal to December’s 47.8. According to the report, despite weak manufacturing employment readings over the past year, roughly 1 in 4 firms regionally reported labor shortages as their top 2025 economic challenge.

The regional inventory index, reflecting levels of raw materials and supplies, dipped to 51.4 from 52.8 in January regionally and in Iowa was up, at 48.0 from 43.0 in January and 24.6 in December.

“In anticipation of higher costs from tariff implementation, firms continue to add to their inventory levels,” said Goss.

According to U.S. International Trade Administration data, the regional economy expanded the export of manufactured goods for 2024 by $1.0 billion from 2023 for a 1.1% gain. In terms of 2023 to 2024 export gainers, Minnesota registered the top gain at a $2.1 billion addition, and North Dakota recorded the largest loss with a $3.1 billion reduction in the export of manufactured goods.

According to ITA data, manufacturing exports for Iowa declined by $1.5 billion for a reduction of 9% between 2023 and 2024.

The index showed that the relatively strong dollar continues to make U.S. goods less competitively priced abroad and pushed the export index below growth-neutral to 44.6, but up from 41.7 in January. Concerns over higher costs from tariffs pushed supply managers to buy early from abroad, driving the import index to a record high of 68.2 from January’s 67.5, also a record high, the report stated.

The February price gauge rose to 63.2, its highest level since May 2024, and up from 62.0 in January. “The regional inflation yardstick has clearly moved into a range indicating that inflationary pressures are moving higher. Even so, I expect the Fed to leave interest rates unchanged at its March 18-19 meetings,” Goss said.

The February confidence index fell to 45.7 from January’s 61.4 and December’s 52.8. The confidence index measures optimism looking ahead six months. “Due to concerns regarding global economic tensions and rising tariffs, only one-third of supply managers expect improving business conditions over the next six months,” said Goss.

The Creighton Economic Forecasting Group has conducted the monthly survey of supply managers in nine states since 1994 to produce economic indicators of the Mid-America economy. States included in the survey are Arkansas, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, Oklahoma and South Dakota.

Watch the YouTube video of Goss’ report.