Office vacancies halting growth in downtown property values

Kathy A. Bolten Feb 1, 2023 | 9:28 pm

2 min read time

545 wordsAll Latest News, Real Estate and Development

The amount of vacant office space in Des Moines’ central business district has more than doubled in the past four years, adversely affecting the value of office property in downtown.

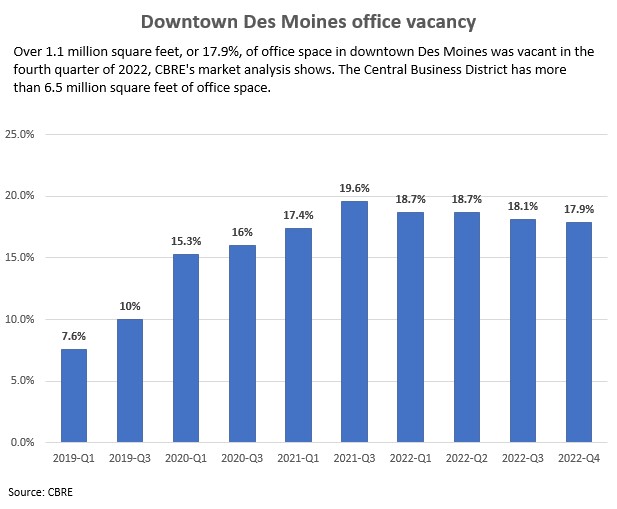

In 2022’s fourth quarter, 17.9%, or 1.16 million square feet, of the downtown area’s more than 6.5 million square feet of office space was vacant, CBRE’s market report shows. In 2019’s first quarter, 7.6%, or 477,573 square feet, of downtown’s office space was vacant, CBRE data shows.

CBRE’s vacancy rate includes the total amount of office space available for lease, including subleased space that is on the market.

The large amount of vacant office space in downtown Des Moines has ramifications.

In early January, Bryon Tack, Polk County’s deputy assessor, said that the value of the county’s commercial properties would likely grow an average of 20% in 2023. However, assessors have struggled with determining values for downtown office properties, he said.

“My best guess right now is that there’s not going to be a change [in the value] to downtown offices or parking garages,” Tack said this week. “There’s going to be increases [in values] of

other downtown property types but not offices.”

The value of downtown parking garages and properties that include office space totals more than $1.3 billion, a review of Polk County Assessor data shows. A 20% increase in values of those properties would add more than $266.3 million in valuation to the tax rolls. However, with the large amount of vacant office space in the central business district, values of office properties will likely remain stagnant, Tack said.

“Right now, our assumption for downtown office space is that it will be several years before we see increases in those property values,” Tack said.

Some properties, like those being vacated by Wells Fargo, could see values plummet by 30% or more, Tack said.

“We’ve seen some office properties in the past couple years that have had excess vacancies, and we’ve made some adjustments in the values,” Tack said. The drops in value of the properties have typically ranged from 30% to 40%, he said.

One example is a building owned by Nationwide Mutual Insurance Co. at 1200 Locust St. In early 2022, the company vacated the second through fifth floors of the building, consolidating its office space at a second building it owns at 1100 Locust St. Before the pandemic, the building at 1200 Locust St. was valued at $48 million. It’s now valued at $30.6 million, a 36% drop.

The city of Des Moines has offered to buy the property for $30 million.

Last week, Wells Fargo told workers that it planned to vacate its downtown office buildings at 800 Walnut St. and 206 Eighth St. and move most of its workers to its 160-acre Jordan Creek campus in West Des Moines. The company is “evaluating our option for these properties, including sale,” according to a Wells Fargo spokesperson.

The buildings include over 515,000 square feet of space. The building at 800 Walnut St. is valued at $43.8 million; the building at 206 Eighth St. is valued at $12.7 million. If the buildings remain vacant for a year or more, their values could drop by at least 30%, Tack said.

RELATED ARTICLES:

Wells Fargo’s exodus from downtown Des Moines hurts, but district is now more than a workplace

What development options are available for Wells Fargo’s downtown properties?

Kathy A. Bolten

Kathy A. Bolten is a senior staff writer at Business Record. She covers real estate and development, workforce development, education, banking and finance, and housing.