Retirees, farmers will reap big benefits from Iowa’s new tax law

Lower corporate tax rate ‘likely’ to be triggered, reach 5.5% by end of decade

JOE GARDYASZ Mar 15, 2022 | 6:45 pm

10 min read time

2,325 wordsBusiness Record Insider, Government Policy and LawIf there is only one thing that Iowa Republicans and Democrats can agree on regarding the sweeping new state income tax legislation that goes into effect next year, perhaps it’s this: The tax-cut package represents really big changes from the old familiar tax system that Iowans have known for decades.

From the standpoint of a seasoned professional tax preparer, the changes are “really huge,” said Joe Kristan, a tax partner with Eide Bailly in Des Moines.

“I started in the business in the ’80s,” Kristan said. “If somebody who was Rip Van Preparer went to sleep in about 1980 and woke up now, he would be able to pick up an Iowa tax return and it would look very familiar. Now, this is a very dramatic change, and it’s like nothing that has been enacted in decades in Iowa.”

Kraig Paulsen, director of the Iowa Department of Revenue, said: “From my perspective, this is the most exciting and the largest and most impactful tax bill that I’ve ever seen, and I’ve been part of state government for [nearly] 20 years.”

Signed into law by Gov. Kim Reynolds on March 1, House File 2317, “Income Tax Reduction and Exemptions,” represents an effort to return several billion dollars of taxes the state has “over-collected” from Iowa residents and businesses, said Sen. Jack Whitver, Republican senate majority leader, as quoted in a February article in Stateline, an initiative of the Pew Charitable Trusts.

The reductions will help Iowa compete with other states, Whitver said. “The competition is fierce for citizens and for jobs. And we want to make sure that Iowa is looked at as a pro-growth state.”

The tax cuts are seen as a major win by the Iowa chapter of the National Federation of Independent Business, whose top issue has been tax reform.

“Income tax reform is the best way to get money back into the hands of our small business owners and their employees,” Matt Everson, NFIB state director in Iowa, said in a recent statement. “Iowa small business owners have voiced and continue to voice one of their top concerns: our burdensome tax code, and specifically the income tax rates, which are still one of the highest in the country.”

Public policy group Common Good Iowa has been among the most vocal opponents of the tax cuts, as reflected in a recent statement by the organization’s executive director, Anne Discher.

“Child care, clean water, mental health services — are all threatened by a tax cut that will skew our tax system further in favor of the wealthy,” Discher wrote in response to Gov. Reynolds’ response to the recent State of the Union message, in which Reynolds touted the tax provision she had signed earlier that day.

“Our tax code was already upside-down,” said Discher, “with the poorest Iowans paying more of their income in taxes than the top 1%. This tax cut will make inequality — including racial inequality — worse. Almost half of the tax cut will go to the richest 5% of taxpayers, who will see an average cut of over $8,000. The richest 1% get over $23,000.”

Michael Lipsman, an economic policy researcher who previously led the Iowa Department of Revenue’s Tax Research and Program Analysis Section for 11 years, also voiced concerns about revenue adequacy and stability. He argues that the state needs to be further investing in education and other public and social services, which he said are already woefully underfunded.

Michael Lipsman, an economic policy researcher who previously led the Iowa Department of Revenue’s Tax Research and Program Analysis Section for 11 years, also voiced concerns about revenue adequacy and stability. He argues that the state needs to be further investing in education and other public and social services, which he said are already woefully underfunded.Paulsen said that while Iowa looked at what other states have done regarding tax reform, Iowa’s legislation reflects input that Reynolds received from talking to taxpayers in meetings across the state. He said that great care was taken to ensure that no Iowans will pay more state income taxes under the new law.

“We ran model after model to make sure that it correctly treated Iowans,” Paulsen said. “There’s absolutely no Iowan that gets a tax increase in this — none — regardless of some of the gobbledygook that was being reported early on, which was just flat wrong. There are no Iowans that get a tax increase. Any Iowan who pays taxes gets a tax cut in this. She [the governor] invested an incredible amount of time into making sure that it correctly served Iowans, and I think the General Assembly could speak for themselves, but they went through it with a fine-tooth comb.”

Here is a summary of the major provisions of the legislation and their impact

Over the next four years, Iowa’s tax structure will be transformed from a multibracket system with a maximum individual tax rate of 8.53% to a one-bracket, flat-tax system where all individual taxpayers who earn more than the net income threshold will pay a rate of 3.9% on their taxable income. (Individuals or heads of household with less than $9,000 of income, and couples with less than $13,500 in taxable income are exempt from filing. For married couples over 65, the low-income exemption is $32,000.)

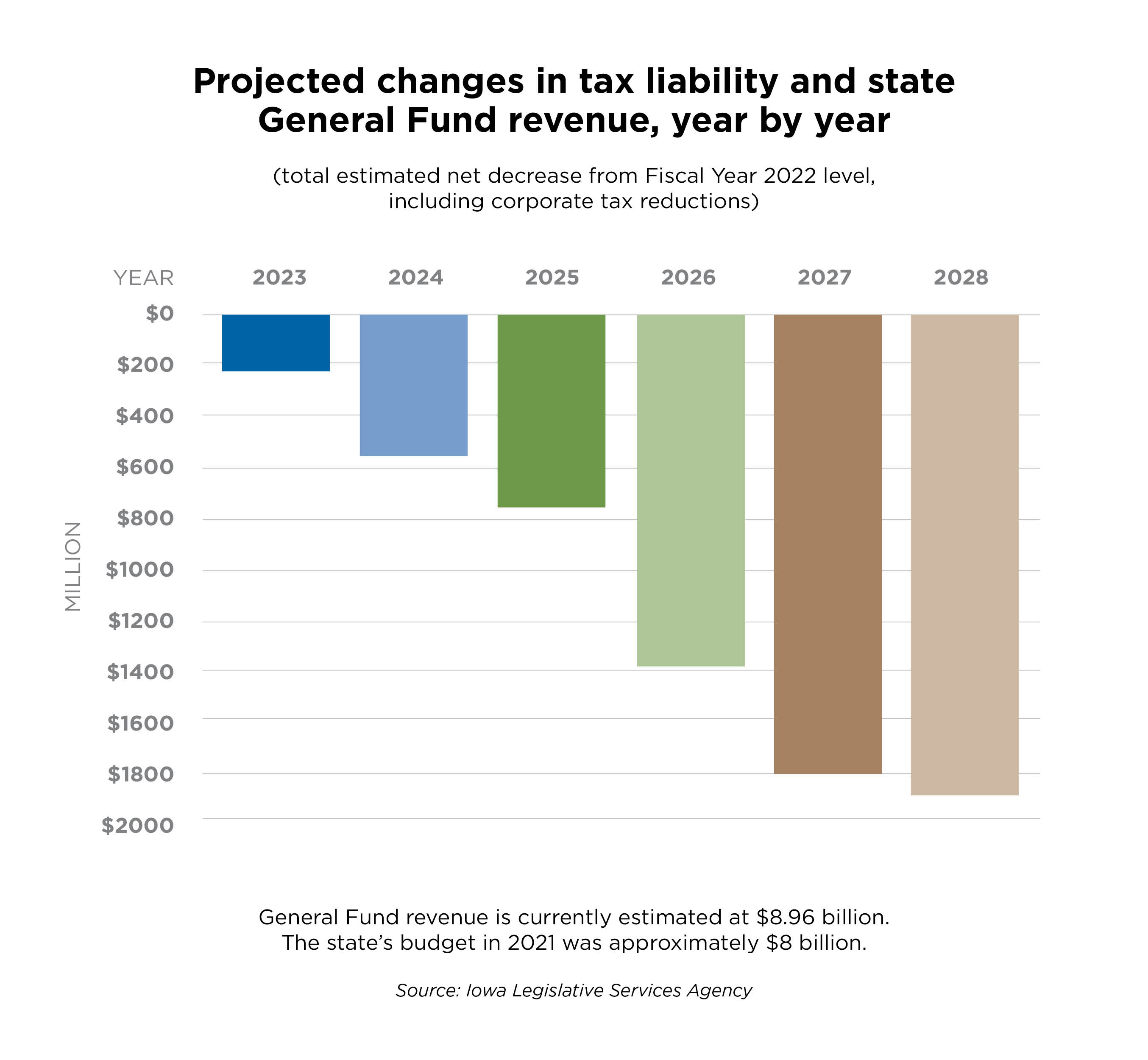

The legislation also establishes revenue triggers that, if met, will begin ratcheting down Iowa’s corporate tax rate beginning as early as next year. The bill’s goal is to reach a flat rate of 5.5% on all corporate income, to be phased in over several years. The trigger: If the annual corporate tax collected exceeds $700 million, the percentage by which that amount is exceeded will be used to determine a percentage to lower the top tax rate, until the tax rate is lowered to a single rate of 5.5%.

If the corporate tax cut goes into effect next year, it will trim an estimated $19.6 million in corporate income from taxation in 2023, with that amount increasing each year. By fiscal year 2028, the annual reduction in corporate income tax collected is estimated at $229.4 million less than the amount to be collected this fiscal year — which is projected to total $780 million. On a percentage basis, that means Iowa corporations could be paying 30% less in taxes in 2028 than they are currently paying.

If the corporate tax cut goes into effect next year, it will trim an estimated $19.6 million in corporate income from taxation in 2023, with that amount increasing each year. By fiscal year 2028, the annual reduction in corporate income tax collected is estimated at $229.4 million less than the amount to be collected this fiscal year — which is projected to total $780 million. On a percentage basis, that means Iowa corporations could be paying 30% less in taxes in 2028 than they are currently paying.

According to the fiscal note prepared by the Legislative Services Agency on the tax legislation, the retirement exemption will exclude nearly $180 million of retirees’ income from state tax next year, a figure that will increase to more than $350 million in 2024 and then increase gradually through 2028.

Additionally, all income that retired Iowa farmers who are 55-plus receive from leasing their farmland becomes tax-exempt, beginning next year. The Iowa Department of Revenue estimates that 1,295 returns will qualify each year for the new exemption each year, with combined annual farm lease income of $37.8 million, or about $29,157 annually in nontaxable income to those retired farmers.

Considering the new retiree and farmer exemptions, the tax package removes from the tax rolls approximately 295,000 Iowans who now will pay no state income tax on those income sources, Paulsen said.

The legislation also sweetens the tax exemption provisions for farmers on capital gains of farm property as well as capital-gains exemptions on the sale of livestock. The department projects that an additional 948 farmers will benefit annually from the new property capital gains exemption, giving them a total of $113 million in annual tax-exempt income (an average of $119,198 per farm), while the livestock gains exemption will benefit 230 more farmers to the tune of $25.7 million annually.

For Iowans who are employee-owners in qualified corporations, the new law also phases in an exemption of capital gains earned through the sale or exchange of their stock that they acquired while working for the company. Beginning next year, one-third of qualified capital gains will be exempt from individual income tax, increasing to two-thirds in 2024 and then fully exempt beginning in 2025.

There are also changes in eligibility for the Research Activities Credit and other state tax credits that collectively will raise new revenue by creating new limitations on credits. Together, those changes are expected to begin adding new revenue of approximately $13.5 million to the state’s coffers in fiscal 2024, increasing to about $50 million more revenue by fiscal 2028.

More carve-outs, shrinking tax base

Looked at from a fairness perspective, Kristan, the tax partner with Eide Bailly, said he would have favored reducing the overall tax rate further by eliminating many of the “carve-out” provisions that are part of the state tax law. Instead, the legislation kept most of the existing carve-outs and expanded some of them, the largest being the new exemptions for retirement income and for expanded farmer exclusions.

“If you look at the numbers, retired people have higher net worth than young working people,” Kristan said, noting that his comments represent his personal views, not those of his firm.

“From my own kids, I know what young people are making coming out of school, and how hard it is,” he said. “It’s hard to argue that in general, retired people should have a special preference of all their income being excluded. People might say, ‘Well, this encourages retirees to stay in the state,’ but lower rates do that too. And then you can lower everybody’s rates more. You didn’t have to carve that out.

“But now that [the legislature has] done it, I can’t imagine politically that they’ll ever be able to get that [revenue] back. And that means that someday in the future when the state needs to raise taxes for some reason, it’s going to hit the people who are left in the tax system harder because you’ve carved out this big chunk of people.”

Kristan said that overall, he’s very much in favor of the lower rates.

“I think low rates cure a lot of sins, and that even if some taxpayers are unfairly favored, low rates reduce the unfairness because people who don’t get the special breaks are screwed a little less,” he said. “But it would still be better to bring rates down more and tax everybody more equitably.”

Kristan said the legislation provides a terrific incentive for people to increase their retirement savings, because the nontaxability of retirement income means that state income tax on those retirement savings isn’t just deferred — it’s eliminated. “So that’s probably the most immediate thing — it’s a lot easier now to talk somebody into an IRA or a SEP contribution or setting up a pension plan than it would have been before this,” he said.

Will tax-cut savings leave the state?

Michael Lipsman, the former state tax research manager, outlined numerous concerns about the legislation to the Business Record.

In 2004, Lipsman conducted a study while working for the Iowa Department of Revenue that evaluated the effects of tax cuts enacted by the Legislature in 1997-98. He noted that his research found that the tax cuts did not stimulate economic growth in the state, but instead appeared to have reduced the rate of nonfarm personal income in the state by 3.6% by 2002, which before the tax cuts had been consistently growing in line with national income trends.

Among the reasons for the past tax cuts not generating the expected economic growth, Lipsman said, was that high-income Iowans received the bulk of the benefits of the capital gains and pension income exclusions that were enacted, with much of that in turn likely invested outside of Iowa. Also, state and local government employment in Iowa decreased by 16% in that period, which likely depressed personal income growth because most state and personal income spending occurs within the state.

Lipsman said a critical factor being ignored with the newly enacted tax cuts is “the likelihood that much of the tax savings from the proposed individual and corporate income tax cuts will flow out of Iowa.”

While the Department of Revenue estimates that 9% of the individual income tax cuts will go to nonresidents, a much larger percentage may actually leave the states if high-income households invest their tax savings outside of Iowa. Also, Lipsman contends that about 75% of the corporate tax cuts will benefit large national companies, many of which have relatively small portions of their sales in Iowa.

In response to those arguments, Paulsen acknowledged that leakage out of state is occurring, but said that it’s happening due to Iowa’s high corporate tax rate. Currently, Iowa has the sixth-highest corporate tax rate among all the states, he said.

“So if you are a corporation that operates in multiple states, and you have the ability to legitimately and legally source your income in one state or another, there are only [five] states that you chose Iowa ahead of, and once we get to 5.5%, we’re in like the top 15,” he said. “And so, I think that leakage is going to go down significantly.”

What about the sustainability of these cuts? Will Iowa continue to have sufficient revenue as it transitions into a flat tax?

Paulsen said he is confident from extensive modeling conducted by his department that the annual budget carryover, plus future revenue surpluses and money from the Taxpayer Relief Fund, will enable the plan to comfortably cash flow.

“If you look at the assumptions we have right now, there’s the ending balance that’s carried forward also from year to year, so that will take care of any potential shortfalls that exist between now and a handful of years – 3, 4 or 5 – and then maybe [the Taxpayer Relief Fund] starts getting reached into,” he said. “It just depends on the assumptions you build and what’s going forward, but unquestionably, it works.”

A related Business Record article on this topic by Joe Gardyasz can be found at this link.

Graphs by Lauren Burt