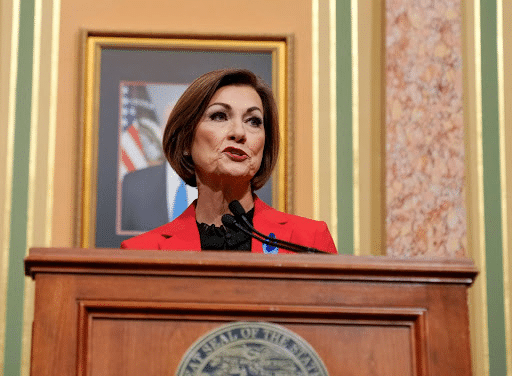

Reynolds calls for more tax cuts, teacher pay increase in Condition of the State address

Iowa governor also wants to see drop in business contributions to state unemployment insurance system

Mike Mendenhall Jan 10, 2024 | 11:12 am

5 min read time

1,269 wordsAll Latest News, Government Policy and Law

Iowa Gov. Kim Reynolds is urging state lawmakers to enact more income tax cuts this year, reduce unemployment insurance payments for business, and increase teacher starting pay by 50%.

Reynolds made her latest policy pitches Tuesday night during her annual Condition of the State address to members of the General Assembly at the State Capitol building.

The governor is calling for legislation that would lower the state’s personal income tax rate to a flat 3.65% to go into effect this year and further reduce the rate to 3.5% in 2025.

Reynolds’ proposal accelerates and goes further than a bill enacted in 2022 that will simplify the state’s income tax brackets from nine to one and institute a flat 3.9% rate by 2026, a drop from the previous maximum rate of 8.9%.

In her speech, Reynolds said, “When the world descends on our state over the next week” for the 2024 presidential Iowa caucuses, “they’re going to see one of the most livable, most affordable states in the country.”

“They’re going to see what it’s like to be in a state that saves more than it spends; cuts taxes; and rewards economic growth and innovation; that orients its educational system to students, parents and teachers; where life is protected, family comes first and community runs deep,” Reynolds said.

According to Reynolds, the latest tax bill would cut about $3.8 billion in taxes over the next five years. Under her proposal, the initial cut to 3.65% would be retroactive to Jan. 1, with the deeper cut to 3.5% happening next year.

The governor touted a $1.83 billion state surplus at the end of 2023 with $900 million in reserve funds.

Iowa’s current tax law would drop the state’s tax revenue by $1.9 billion per year when fully implemented, according to an analysis by the nonpartisan Legislative Services Agency.

The latest estimate for the state’s 2024 tax receipts from the Revenue Estimating Conference shows total expected general fund revenue after transfers is $9.59 billion, down 1.3% from 2023. Personal income tax revenue is estimated to decline 6.7% from 2023, or by $80.8 million, according to the report.

The Revenue Estimating Conference is expected to release another forecast near the end of the 2024 session.

House Speaker Pat Grassley, R-New Hartford, told the Business Record in a Jan. 4 interview before the governor’s address that he was “pretty confident” the GOP majorities in the House and Senate would take more action on taxes this year.

“I think we’re in a position through our budgeting and through our Taxpayer Relief Fund … the House would be in a position where we want to look at speeding up those tax cuts to get money back in the hands of Iowans,” Grassley said.

In the Democratic response to Reynolds’ address in an interview with Radio Iowa News Director O. Kay Henderson and Cedar Rapids Gazette Des Moines Bureau Chief Erin Murphy, the House Minority Leader Jennifer Konfrst said many Iowa taxpayers would see no benefit from the cuts.

“They are facing challenges with the economy, they’re also facing budget challenges. What are we going to do for them?” Konfrst said. “And so we want to make sure that we’re also addressing the 500,000 Iowans who are being left behind with what the governor proposed tonight. And so we’re going to be asking about them. We’re going to be asking what are we going to do to lower costs for those folks?”

Konfrst criticized Reynolds for not proposing in her speech legislative efforts on affordable housing, child care or utility costs, which many Iowa business groups and nonprofits have included in their 2024 legislative priorities as workforce development issues.

Unemployment insurance payments

Reynolds also called for decreasing the amount of money Iowa businesses pay into the state’s unemployment insurance system per employee by half. According to the governor, her plan would reduce payments from employers by $800 million over five years.

“Instead of paying money into the government, these businesses can create more jobs, increase salaries or reinvest into their communities,” Reynolds said.

Reynolds pointed to Iowa’s low unemployment rate – currently 3.3%, according to Iowa Workforce Development – and the labor force participation rate, which sits at 68.1% of the state’s total working-age population as rationale for the reduction.

“We have the sixth-highest labor force participation rate in the country, and Iowans are now spending on average less than 10 weeks on unemployment. That’s the lowest rate in 56 years — turns out, good things happen when we promote work,” Reynolds said.

“Because so many Iowans are drawing a paycheck instead of a government check, our unemployment trust fund is full,” she said.

Teacher pay

Reynolds also pushed a $96 million proposal to increase starting pay for teachers in Iowa to $50,000 annually and to set a minimum salary of $62,000 per year for teachers with at least 12 years of experience.

Reynolds said the plan would call for “new money,” with the governor allocating an additional $10 million to a merit-based grant program that will “reward teachers who have gone above and beyond to help students succeed,” she said.

“We want younger Iowans to see the teaching profession as something to aspire to. It’s one of the highest callings one can have, so let’s make sure that teacher pay sends that message,” Reynolds said.

“These investments will put Iowa in the top-five states for starting pay and help recruit more of the best and brightest to join the teaching profession,” she said.

Reynolds’ push for more teacher pay appeared to get bipartisan applause from the legislators in the House chamber Tuesday night, but Konfrst said Democrats want to see the details of the plan.

Konfrst noted that Iowa Democrats have pushed for teacher pay increases in previous sessions. The minority leader said she’ll be looking for how the proposal could affect paraprofessionals, some of whom she said make $10 an hour, and other school workers.

“It’s new money, but where’s that money coming from, and what strings are attached? And so we think it’s a great idea. It’s a great headline to want [a] teacher pay increase. We want to know, what else are we going to do to help teachers and who’s all going to benefit from this bill?” she said. “We got to see the details. We love paying teachers more. We’re big fans of it, but let’s respect them for the professionals that they are and leave them alone to do their jobs as well.”

Reynolds’ education proposals also include a major reform to the state’s nine Area Education Agencies, which handle school special education funding.

The governor’s plan would end all other services other than special education support from the AEAs.

It would also give school districts the option to use AEA services or contract out to private providers. Schools would also receive state special education funding directly, according to Reynolds.

Outside land purchases and Medicaid postpartum funding

The governor also said Tuesday that she’s developed legislation with Iowa Secretary of Agriculture Mike Naig this session to enhance reporting and enforcement, increase penalties and “provide more transparency” for land in Iowa that has been purchased for foreign buyers.

Reynolds also voiced her support for legislation introduced Monday that would allow pregnant women covered by Medicaid to keep coverage for 12 months after the end of pregnancy, an increase from the 60 days currently allowed by Iowa law.

Watch the full Condition of the State Address on IowaPBS.org

Mike Mendenhall

Mike Mendenhall is associate editor at Business Record. He covers economic development, government policy and law.