Rising interest rates, home prices pushing buyers out of housing market

KATHY A. BOLTEN Apr 18, 2022 | 2:45 pm

3 min read time

730 wordsAll Latest News, Housing, Real Estate and Development

Escalating sale prices of houses coupled with rapidly rising interest rates is pushing homeownership out of the reach of some buyers, local housing experts say.

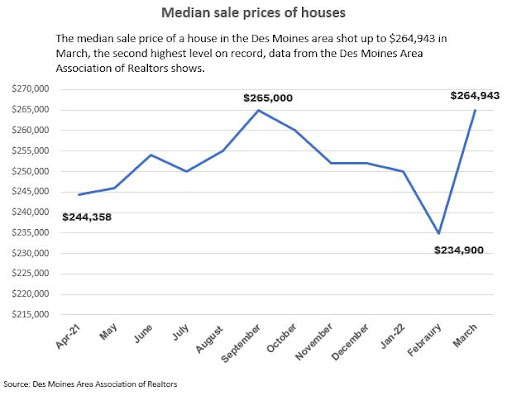

In March, the median sale price of a home in the Greater Des Moines area shot up to $264,943, 13% higher than February’s median sale price of $234,900, data from the Des Moines Area Association of Realtors shows. March’s median sale price was the second highest on record. In September, the median sale price was $265,000.

“Every $1,000 increase in housing prices, prices out 1,900 households in Iowa,” Lance Henning, chief executive officer of Greater Des Moines Habitat for Humanity, said at a recent symposium on affordable housing. “When you think about all of the people that are trying to move into housing out there…[the increases] are pricing out people who are working in our community.”

Last week, the average rate on a 30-year-fixed-rate mortgage was 5%, according to Freddie Mac, the federally chartered mortgage investor. It is the first time in more than a decade that mortgage rates have been as high as 5%.

In early January, the average rate was 3.2%. The jump to an average rate of 5% was the fastest three-month increase since 1987, data from Freddie Mac shows.

The rapid increase in interest rates is adding hundreds of dollars a month to mortgage payments at a time when the cost of food, gasoline and other items are rising. (The Federal Reserve is increasing rates as it tries to quell inflation).

In January, a homebuyers’ monthly mortgage principal and interest payment on a $300,000 house – after a 20% down payment – would have been $1,038, according to consumeradvocate.org. The recent rate hike pushes the payment to $1,288, or $250 more a month.

In the Des Moines area, as well as nationwide, the supply of single-family residences for sale is limited, data from the association shows. In March, just 1,702 residences were listed for sale. By comparison, in March 2020, there were 3,487 listings in the Greater Des Moines area.

Of the 1,702 single-family homes listed for sale in March, about 850 were new construction, said Jen Stanbrough, the association’s president.

“Some of those new construction houses are just at the foundation stage or haven’t even begun construction,” she said. “When you break out those numbers … that really shrinks down that inventory number. … It’s becoming a bit frustrating for buyers.”

Buyers who may have prequalified for a home loan but have had difficulty finding a house to buy may have the interest rate offered for a loan expire. Higher interest rates could affect the size of a home loan for which they qualify, meaning a larger down payment or finding a lower-priced house, real estate experts said.

Rising interest rates “impacts people who are trying to become homeowners,” said Rachel Flint, vice president of Hubbell Homes Inc. “When the rates go up, they may no longer qualify for that home loan because the rates have changed.”

Stanbrough said interest rates for home mortgages are expected to continue to rise through 2022. Still, she said, rates remain below the 30-year averages of 8% and higher seen in 2000 and below the 7% and 6% rates of 2001 through 2004.

“I think we’re going to start seeing some loan products that are in the portfolios of lenders that haven’t been used for quite some time,” she said, citing adjustable-rate mortgages and the buy-down of interest rates. “There are tools in our tool box that we can pull back out and use to help buyers, too.”

Highlights from the association’s reports on home sales in the Greater Des Moines area, which includes Polk, Dallas, Warren, Jasper, Marion, Madison and Guthrie counties, include:

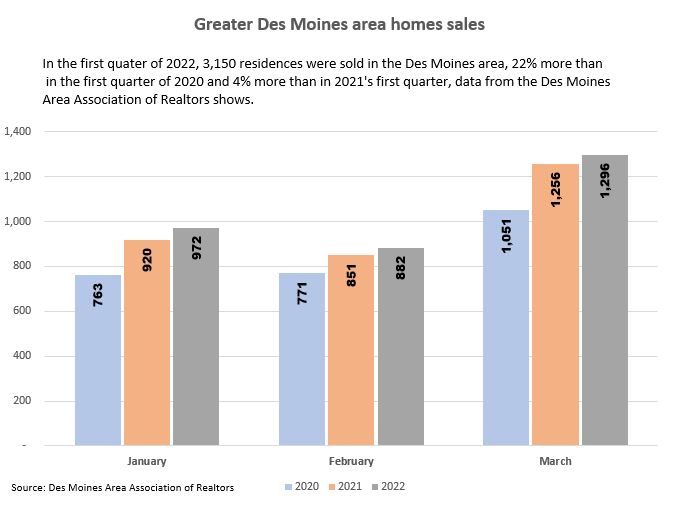

•3,150 residences were sold in January, February and March, 4% more than the 3,027 sold during the same period in 2021.

•Residences sold in an average of 46 days in March. In February, residences sold in an average of 44 days, and in January it was 22 days.

•The average sale price of a house sold in March was $264,943, 13% more than in March 2021 when the average sale price was $234,100.

•22 of the residences sold in January, February and March were priced at $1 million or higher. In 2021, 102 residences were sold for $1 million or more.