Trend of online sales expected to pick up pace in 2024, reshaping business model and need for space

Michael Crumb Dec 22, 2023 | 6:00 am

6 min read time

1,538 wordsBusiness Record Insider, Retail and BusinessThe trend of consumers buying online will only continue to grow, causing some retailers to consider shrinking their brick-and-mortar footprint as fewer customers shop in person.

That’s according to one Des Moines shop owner, who indicated possible plans to downsize his store’s presence in other markets in the coming years.

While the trend of people shopping online and retailers adjusting their footprints may be nothing new, it might pick up pace in 2024, forcing more companies to rethink their business models, said Mike Draper, owner of T-shirt shop Raygun.

Raygun operates stores in nine cities, including its popular East Village location.

Draper said that in 2019, Raygun was a brick-and-mortar store with an online presence — 75% of sales were in-store with 25% online. Now, it’s a 50-50 split and Raygun is more of “an online brand that has brick-and-mortar stores,” he said.

“In 2020 we had to go online, so 2020 was a big inflection point as online skyrocketed,” Draper said. “For brick-and-mortar neighborhoods, the mantra has always been ‘when people return.’ Now, we’re a few years out and we’ve run the data sets, we can see that we’re in a new era of retail and it’s not 100% clear what that is, but it’s not what it was before the pandemic.”

Sekar Raju, the Gary and Margaret Pint Faculty Fellow and chair of the Ivy College of Business marketing department at Iowa State University, said that while consumers have not pulled back on spending, the way they spend has changed.

“As far as retail sales go, if you look at in-store purchases, they are growing but it’s not spectacular,” he said. “They’re just marginally growing. The real growth is on the e-commerce side. That is growing really significantly. That has been going on for some time, and we are not seeing a slowdown in the shift to online shopping.”

While online shopping is growing faster than in-person sales, it still only makes up about 20% of retail sales, he said.

Another growing trend in retail is companies implementing fees to return online purchases, Raju said.

“A large reason for the growth in online shopping has been people could buy and if they didn’t like it, it was a relatively low-friction method of returning it,” he said. “What’s happening in the past few years is a large number of retailers are starting to look at that ask, ‘How can we reduce this?’”

Raju said the trend of companies charging fees for returns to offset losses from returns will continue to grow.

“In the short-term, it seems to be good for retailers because it’s boosting up profits and boosting up the items they’re selling that aren’t coming back,” he said.

But charging return fees likely won’t affect long-term gains, he said, because growth in e-commerce will continue.

“I don’t think customers are going to go back to brick-and-mortar,” Raju said. “What will happen is customers will be shopping around for where the retailer has a better return policy.”

That may also cause consumers to focus on retailers they can trust rather than just randomly buying products online.

“It’s still going to be online, but the convenience of online shopping is not going away,” Raju said.

And that means every business needs to have a strong online presence, he said.

“Data shows a large part of the growth seems to be with small and medium brick-and-mortar stores going online,” Raju said.

Consumers are also beginning to focus more on buying local, if the product they are looking for is offered, he said.

Raju said the trend of shopping malls struggling to keep tenants and shoppers will likely also continue in 2024.

“I don’t think people are seeing a real compelling reason why they should go to a mall,” he said. “There are certain things, like jewelry, for example, where it makes sense, but almost everything at a mall you can get online. What I would expect is that malls will continue to face trouble in terms of attracting people and I think that is a longer trend that is going to continue.”

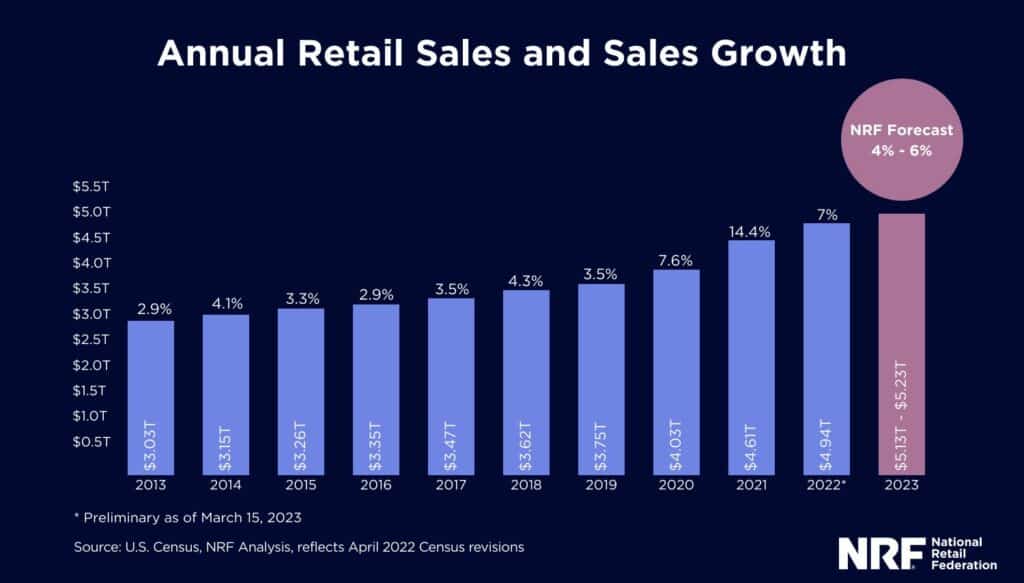

The National Retail Federation won’t release its forecast for 2024 until next spring, but in its forecast for 2023, it projected growth of 4 to 6% for the current year, totaling as high as $5.23 trillion nationwide.

“In just the last three years, the retail industry has experienced growth that would normally take almost a decade by pre-pandemic standards,” Matthew Shaw, the organization’s president and CEO, said in the report.

“While we expect growth to moderate in the year ahead, it will remain positive as retail sales stabilize to more historical levels,” he said.

Those numbers were down from 7% growth seen in 2022, but higher than pre-pandemic growth of 3.6%, the report showed.

According to the report, non-store and online sales, which are included in the total figure, were forecast to increase 10% to 12% year over year in 2023 to as much as $1.43 trillion.

And what are people buying online?

According to a Pew Research report in November, online sales in 2022 were up at general merchandise stores, food and beverage stores and health and personal care stores, while online sales for electronics, appliances, motor vehicle parts and furniture declined.

The businesses getting the highest portion of online sales tended to be those without a physical presence, the Pew report showed.

Riley Hogan, senior vice president of CBRE, said there is strong demand for retail space around Jordan Creek Town Center in West Des Moines. And the mall is 100% occupied, he said.

Attempts to reach officials with the mall before the deadline for this story were unsuccessful.

“While some retailers may be downsizing or need less bricks and mortar, we’re seeing a demand for the areas that we call ‘A-plus areas,’ the demand has never been greater,” Hogan said.

According to Hogan, some other retail centers that have lost their anchor stores are working to reposition themselves. He cited work being done at Merle Hay Mall to build an ice arena and the construction of indoor pickleball courts.

Another trend, he said, is an increase in demand by retail to be near the sports complexes that are going up around the metro.

“We’re seeing a lot of development and retailers wanting to be in and around areas like that that draw in youth sports and the dollars being created in and around those areas,” Hogan said. “I’m excited about that trend. and it’s something the retail industry is embracing.”

He said he believes downtown businesses will also see a strong 2024 with more employees returning to work in the office, citing the decision by Principal Financial Group to require employees to work from the office three days a week, and with others considering similar moves.

“I would say those numbers are trending up,” Hogan said. “There’s been a tug-of-war of remote working, and [Principal’s] decision is already having a positive impact on businesses downtown, both restaurants and retailers, so I think that’s a positive trend.”

Draper, Raygun’s owner, said losses in in-store purchases have been made up through the growth in online sales. But there has also been a surge in foot traffic into his stores by customers who are picking up items purchased online, he said.

“In-store pickups are double this year from what they were last year,” he said.

Raygun’s brick-and-mortar footprint

For Raygun, the push by consumers to shop online means that the holiday shopping season can be less busy in-store than other times of the year, Draper said.

“So stores, wildly enough, are less busy in December than they are in July,” he said. “I think the holiday season for a neighborhood shop has changed a lot. If you’re in the East Village, the summer is almost now more important season than December because people are out about, they’re shopping.”

Draper said while no changes are planned for the Des Moines store, stores in Omaha, Neb., Chicago and Cedar Rapids are oversized for the company’s model and could be reduced in size. Raygun’s model is to have space of less than 1,900 square feet.

He said he expects more turnover in neighborhood retail districts, including the East Village.

“I think something major has shifted, and we are only at the beginning,” Draper said. “I think it’s going to be harder to lease brick-and-mortar street level retail. I think more street level retailers will be going out of business if they don’t have alternate streams of income or an online presence.”

“We almost have to look at this as like, [the] startup phase all over again,” he said.

He said what worked a decade ago won’t work now, and new approaches are needed to ensure the viability of neighborhood retail businesses.

“All options have to be on the table,” Draper said. “The playbook from 10 years ago is not going to cut it this time around. So much has changed. It’s a giant fundamental shift in how people behave.”

He said he thinks that what happens in 2024 will set the tone for the years to come in the retail sector.

“Next year will be a harbinger for an entirely new dynamic for retail in America,” he said.

Michael Crumb

Michael Crumb is a senior staff writer at Business Record. He covers real estate and development and transportation.