UpLift basic income pilot prepares for community conversations as checks are delivered

Michael Crumb Jul 18, 2023 | 3:20 pm

4 min read time

900 wordsAll Latest News, Economic Development, Government Policy and Law

Researchers behind the UpLift basic income pilot project are planning community conversations for later this year to gather information to present to community and business leaders to create the next steps in addressing the needs of low-income families.

The program, launched in February, provides $500 a month for 24 months to 110 people in Polk, Dallas and Warren counties whose family income is 60% or less of the area’s median income. To qualify, a household income for a family of four cannot exceed $59,100. For a family of three, the annual income cannot be more than $53,190, and $47,280 for a family of two.

The 110 participants were chosen from a field of more than 6,000 applicants. They received their first checks in May.

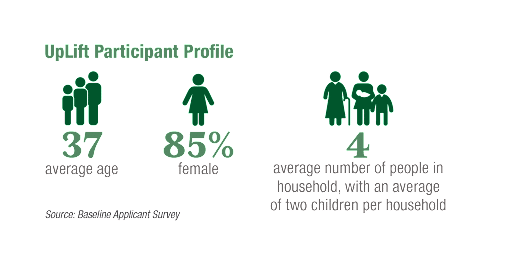

An infographic created by UpLift researchers shows that the average age of participants is 37, with 85% being female. The average family size is four, with the average annual income being $24,542. The infographic also shows that the average amount a participant spends on rent or housing is 44% of their income. More than 30% is considered housing burdened.

When the program was launched, researchers said providing a basic income gives people more flexibility to meet essential needs, reduces month-to-month fluctuations in income, increases the ability to find full-time work, boosts physical and mental health and improves the ability to respond to unexpected emergencies.

Researchers will track how participants use the stipend each month. They will compare various outcomes with those of 140 people who don’t receive the monthly payment. Findings will be shared with the community to explore the effects that a sustained, unrestricted income augmentation has on low-income residents.

The UpLift study will be evaluated by a team from the Center for Guaranteed Income at the University of Pennsylvania in collaboration with Des Moines University’s Department of Public Health.

In all, 11 local governments and organizations invested a total of $2.5 million, with 70% coming from private funds for the program. Those groups include the Mid-Iowa Health Foundation, Principal Foundation, Wells Fargo Foundation, the cities of Des Moines, Urbandale and Windsor Heights, Polk County, Bank of America, the Directors Council in Des Moines, Telligen Community Initiative and the United Way of Central Iowa.

The Harkin Institute for Public Policy and Civic Engagement at Drake University is implementing the program.

Ashley Ezzio, senior project coordinator at the Harkin Institute, said the project is entering its next phase of community engagement and education.

“As we get our participants settled into their new lives with this extra income, we’re going to go out into the community asking, ‘What do you think of basic income? Here’s how we define it. What are your thoughts and how do we collectively, as a community, come together and package that along with our research to present to decision-makers?’” she said.

That package will include data from the research, along with what is learned during the community conversations, Ezzio said.

“We’ll have this nice package to deliver to community decision makers, policymakers, perhaps and say, here’s what we learned in the last three years of doing this. What do we see?” she said. “And then we can start to make some evidence-based decisions about what is in the best interest of central Iowans.”

The dates for the community input sessions will be announced at a later date, but the sessions likely won’t happen until later this summer and fall.

How information from the research and community input sessions will be used by the community will be up to the community, said Michael Berger, project coordinator at the Harkin Institute.

“We want to see if this basic income model is a good fit for Central Iowa,” he said. “If it is, then we want to share all this information with the community. We want people to use it for whatever programs they may have or explore other opportunities. I don’t think it’s really defined at this moment.”

Berger said the hope is to bring stakeholders together who are doing work on issues such as safe and affordable housing, child care and food insecurity to get their expertise and give them a platform to voice their opinions.

“You don’t have a healthy workforce if you can’t put food on the table, or if you know child care is inaccessible or they can’t get someone to watch their child,” he said. “That is all going to impact how people enter the workforce and what kind of work they can do.”

According to Ezzio, the concept of basic income can make a difference for low-income Iowans and make them better workers.

“It allows folks to use it toward rent or transportation to get to work,” she said. “Stable housing is a prerequisite for being able to secure employment. Having a basic income and having that little bit of cushion or savings can give you leverage in the workforce and choose a job that best fits what your family needs and what your skillset is. Whereas without that breathing room, folks get kind of shoehorned into low-wage jobs that can create cycles where they have no economic mobility.”

“I think employers can appreciate this kind of model, too,” Ezzio said. “Employers want healthy, thriving employees. They want employees that have reliable transportation to get to work … so giving people the ability to choose the employment that works best for them: I think it benefits our community overall.”

Michael Crumb

Michael Crumb is a senior staff writer at Business Record. He covers real estate and development and transportation.