Values of Polk County’s residential properties expected to jump a record 22%

KATHY A. BOLTEN Jan 10, 2023 | 4:35 pm

3 min read time

714 wordsAll Latest News, Government Policy and LawResidential property owners in Polk County this spring will experience sharp increases in the value of their properties, the county’s assessor said.

The area’s strong residential real estate market, coupled with low interest rates for home mortgages, has fueled the increase in valuations, which are expected to increase an average of 22% countywide, said Randy Ripperger, the county’s assessor.

The expected increase is the largest jump in the past several decades, he said.

“The market has been really, really strong,” Ripperger said. “There’s been a shortage of homes for sale on the supply side. We’ve had strong demand from potential buyers on the demand side. The shortage of homes for sale has driven up prices and we’ve had record low interest rates.”

Iowa law requires the countywide reassessment of properties each odd-numbered year. Around April 1, about 190,000 assessment notices will be mailed to Polk County property owners informing them of the new values of their commercial and residential properties, Ripperger said.

The more than 8,000 residential transactions recorded between Jan. 1 and Nov. 30 last year have provided department officials with enough sales data to forecast 2023’s residential values, Ripperger said. The small number of sales that occurred in December will have little effect on department officials’ expectation that residential property values will increase an average of 22% countywide, he said.

The increase “is more than double anything we’ve ever had,” Ripperger said.

In 2021, residential property values grew an average of 7.4%; in 2019, they increased 8.7%.

Dallas County officials are estimating that the values of residential properties will increase an average of 13%, according to Steve Helm, the county’s assessor.

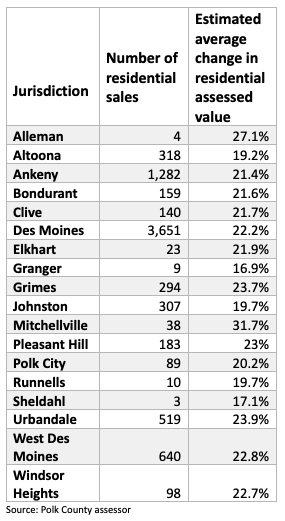

In Polk County, increases in residential property values will likely range from an average of 16.9% in Granger to 31.7% in Mitchellville, according to information provided by the assessor’s office. Residential property owners in Des Moines will likely see the value of their properties increase an average of 22.2%; in West Des Moines, residential property values will likely increase an average of 22.8%, and in Ankeny 21.4% is likely.

Property values are part of the formula used to determine owners’ property tax bills. Even though residential valuations are rising, homeowners’ property tax bills aren’t expected to rise at the same pace, officials said.

Currently, the residential rollback – the percentage of a property’s value that can be taxed – is 56.49%. That means a residential property valued at $100,000 is taxed on $56,490 of its value. The 2023 residential rollback is projected to be between 47% and 48%, said Bryon Tack, chief deputy assessor. That means property valued at $100,000 would be taxed on $47,000 to $48,000 of its value.

“We think homeowners could see about a 3% increase in the portion of their residential property that is taxable,” Tack said.

Taxing bodies such as cities, counties and school districts haven’t yet set their property tax rates for the fiscal year that begin on July 1. Once those rates are set, property owners will have a better idea of what their property tax bills will be in the fiscal year that begins July 1, 2024. (In Iowa, property taxes are paid a year after an assessment year. For instance, in assessment year 2021, property taxes are due in September 2022 and March 2023.)

The record high increases in property values will likely spark a large volume of protests, Ripperger said. “We are anticipating that we’ll have about 10,000 protests, which would be a record.”

In 2021, 5,130 protests were filed, assessor data shows. In 2017 a record 8,797 were filed, and in 2019 there were 7,893.

“We thought there would be more protests in 2021 but our building was still closed because of the pandemic,” Ripperger said. “I think that’s part of why we didn’t have as many protests.”

Property owners will have until April 30 to appeal their assessments.

The assessed value of residential property in Polk County is expected to increase a record 22% in 2023, Polk County Assessor Randy Ripperger said. Assessments for individual properties are expected to be mailed to property owners by April 1. The chart shows the number of residential sales in each community through Nov. 30, 2022, and the average expected change in residential property values.