What’s the housing outlook in 2025?

Challenges include high interest rates, home prices

Homebuyers and sellers and others associated with the residential sector have found the housing market challenging the past two years.

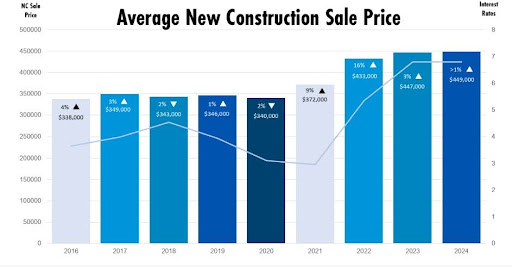

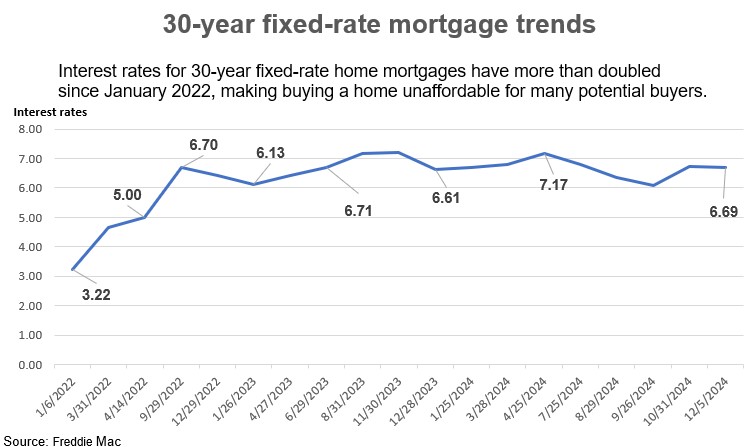

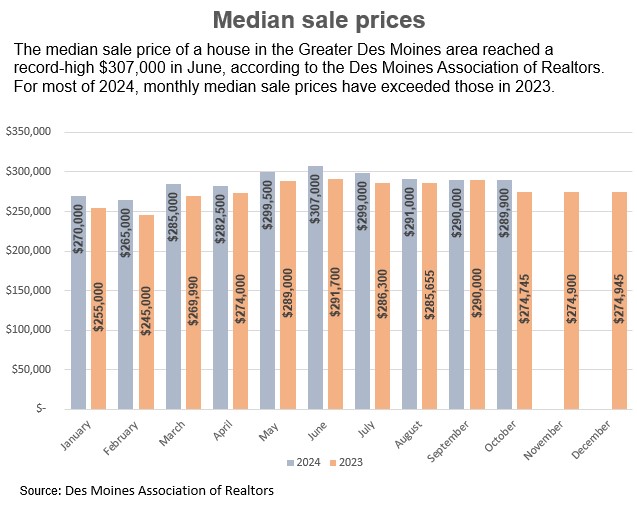

Mortgage rates are more than double what they were two years ago. Costs to build a new home have escalated. The median sale price for a home has jumped 5% from a year ago.

The Business Record recently assembled a group of housing experts to talk about the sector and the housing market’s outlook for 2025.

Participants in the Project515 virtual event included: Rachel Flint, senior vice president, homebuilding operations, Hubbell Realty Co.; Sean Fogarty, partner, Artisan Capital Group; Larry Goodell, retail mortgage manager, U.S. Bank; Lance Henning, CEO, Greater Des Moines Habitat for Humanity; Sara Hopkins, Realtor, Re/Max Precision; and Aaron Mesmer, executive vice president/chief investment officer, Block Real Estate Services.

The following are excerpts from the discussion. Panelists’ comments have been edited for brevity and clarity.

Where are home mortgage rates headed in 2025?

Fannie Mae’s Economic and Strategic Research Group recently revised its mortgage rate forecast for 2025. The group had predicted mortgage rates would drop below 6% in 2025 but now expects rates to stay above 6% well into 2026. Goodell, who agrees with the group’s forecast, said the median interest rate for mortgages in the past 30 years is around 7.25%.

Goodell: Interest rates will “probably stay in that 6% range. I hope that it trends down throughout the year. Mortgage rates tend to move a lot in anticipation of what’s coming, short-term interest rate cuts, that type of thing. When the [Federal Reserve Board] finally did cut rates, mortgage rates went up. … I think that mortgage rates will have some periods of time where they’ll dip down, hopefully closer to that 6% and maybe even in the upper-5% range throughout next year. However, I kind of expect a similar year to what we have this year, where [interest rates range] between 6% and 7%.”

Homebuyers who have been waiting for rates to drop will likely get off the sidelines in 2025, Goodell said. “I think the farther we get from the [interest rates that were] 2%, 3% and 4%, the farther back that is in the rearview mirror. We’re going to have consumers who are going to want to take action. They’re going to want to move to a bigger home; they’re going to want to downsize.”

Number of homes listed for sale

The below-average number of homes listed for sale is a problem cited by many real estate professionals nationwide. Empty nesters are staying put rather than downsizing. Families who would consider moving into a larger home are also staying put, either because of affordability or because they want to stick with their current mortgage rate. In October, there were nearly 4,000 homes listed for sale, 600 more than a year ago, according to the Greater Des Moines Association of Realtors. Hopkins said the number of listings is deceiving. In addition, the low inventory of homes for sale is keeping home prices inflated, she said.

Hopkins: “What’s actually happening right now is that we’re seeing fewer homes go under contract. About the same number of homes are being listed for sale each week compared to a year ago. The difference is that the homes are remaining on the market, which is bringing that rise in inventory levels up. …The higher median sale price is also a direct result of lower inventory. During COVID, when we had low interest rates combined with a severe shortage of inventory, we saw prices skyrocket. The peak was probably in June 2021. Fast forward to today … and homeowners are not selling. They refinanced at those 2.5% and 3% rates. If they did purchase a new home [at the lower rates] they are golden and not putting their home on the market. The homes that are coming on the market, the [sellers] want to get the same price as their neighbor got back in 2021, meaning home prices are not coming down. We have a shortage of inventory in that $250,000 to $325,000 range. [The shortage] is keeping median prices high.”

Homebuyers pushed to new construction

The shortage of existing homes for sale is pushing buyers to new construction, Flint said. Material prices remain high, prompting builders to find ways to trim costs, she said.

Flint: “There are some pockets of oversupply. You’ll see that in Waukee, particularly with new construction. … Year to date, over 2,000 new homes have been sold; that’s 70 sales ahead of last year, which indicates a healthy and active market. Overall, [the supply of building] lots … in the market is strong, but average lot prices within the metro have increased [to] over $85,000 a lot. It is not cheap within the metro. You’re starting to see more people move to the outskirts of the metro in order to get more affordability. … A lot of builders are looking at lean building. We’ve gone through and figured out, ‘Are we sending too much material to the job site? Are houses being built as efficiently as possible?’ I think home sizes are actually starting to get a little bit smaller in order to be more affordable.”

Converting Ruan II to housing

In fall 2023, Ruan Inc. announced it was forming a joint venture with Block Real Estate Services and Foutch Brothers, both located in the Kansas City, Mo., area, to redevelop the 14-story building Two Ruan Center at 601 Locust St. Mesmer provided an update on the project and explained some pros and cons of building conversions.

Mesmer: “We have our plans completed. We just got turned down [in the latest] round of state historic credits, so our hope is to get the award [in 2025]. We do have our application [for historic tax credits] in with the federal government as well. We have our incentives approved by the city of Des Moines, so we’re pretty much ready to roll. The state tax credit is a pretty vital component of the capital stack. Hopefully we’ll get an allocation next year. … I think there’s a lot of pros in doing these building conversions. You get to reallocate the inventory in a downtown environment to meet the demand. [Right now] we need fewer offices but more residential units. That repurposes those existing buildings and helps revitalize the urban core. [The new residential units] are near employment centers. You get a good draw from folks who want to live near where they work. You can do [renovations and updates] year-round. You’re not building ground up in a frozen environment.”

High interest good for rental market

Artisan Capital Group, with offices in Des Moines and Chicago, entered the Central Iowa market a few years ago. The real estate investment firm’s most recent acquisition in Des Moines was Cityville on 9th, a 312-unit complex in downtown. The group now owns and manages over 2,000 apartment units in the Des Moines area. Higher interest rates for home mortgages has been positive for the rental market, Fogarty said.

Fogarty: “We’re not losing a lot of folks who are buying homes or condos. … I would say, though, that in the past decade, there’s been a shift in folks who are apartment renters by choice versus necessity. There’s a lot of folks, whether they’re just entering the job market or the rental housing market, who want optionality and flexibility. Your younger folks want the ability to move around and don’t want to be stuck with a mortgage. … We’re also seeing more empty nesters in the market in the past decade. They also want flexibility, whether it’s to park their investment somewhere other than a house or they want to spend [part of the year] in Des Moines and the rest of the year someplace else.”

Habitat’s project in Waukee

Greater Des Moines Habitat for Humanity is working with the city of Waukee to develop a workforce housing townhome project near 500 N. Warrior Lane. The project, called Walnut Crossing, will include 48 owner-occupied townhomes, Henning said. Most of the townhomes will include three bedrooms and about 1,300 square feet of space.

Henning: “There will be four-plexes and two-plexes. We’ll be putting the infrastructure in early next year and starting to go vertical in [late 2025]. It’s an exciting project and it’s a great partnership with Waukee that I think can be a model that could work across the metro area. [Waukee officials] realized that they have many people who work in Waukee but cannot afford to live there. …More and more people are getting priced out of the housing market all of the time now. If you look back two decades ago, the lower middle class didn’t have a problem purchasing an existing home. Today, you really need to be in the upper middle class to be able to purchase a home. Decades ago, [families earning] 20% below the median income could buy a house without a problem. Today you need more than 30% of the median income to be able to afford a home. …Folks tend to stay with their employer longer when they live near where they work. They become more engaged in their community. Having the ability to choose to live near where you work is something folks should be able to do.”

Kathy A. Bolten

Kathy A. Bolten is a senior staff writer at Business Record. She covers real estate and development, workforce development, education, banking and finance, and housing.